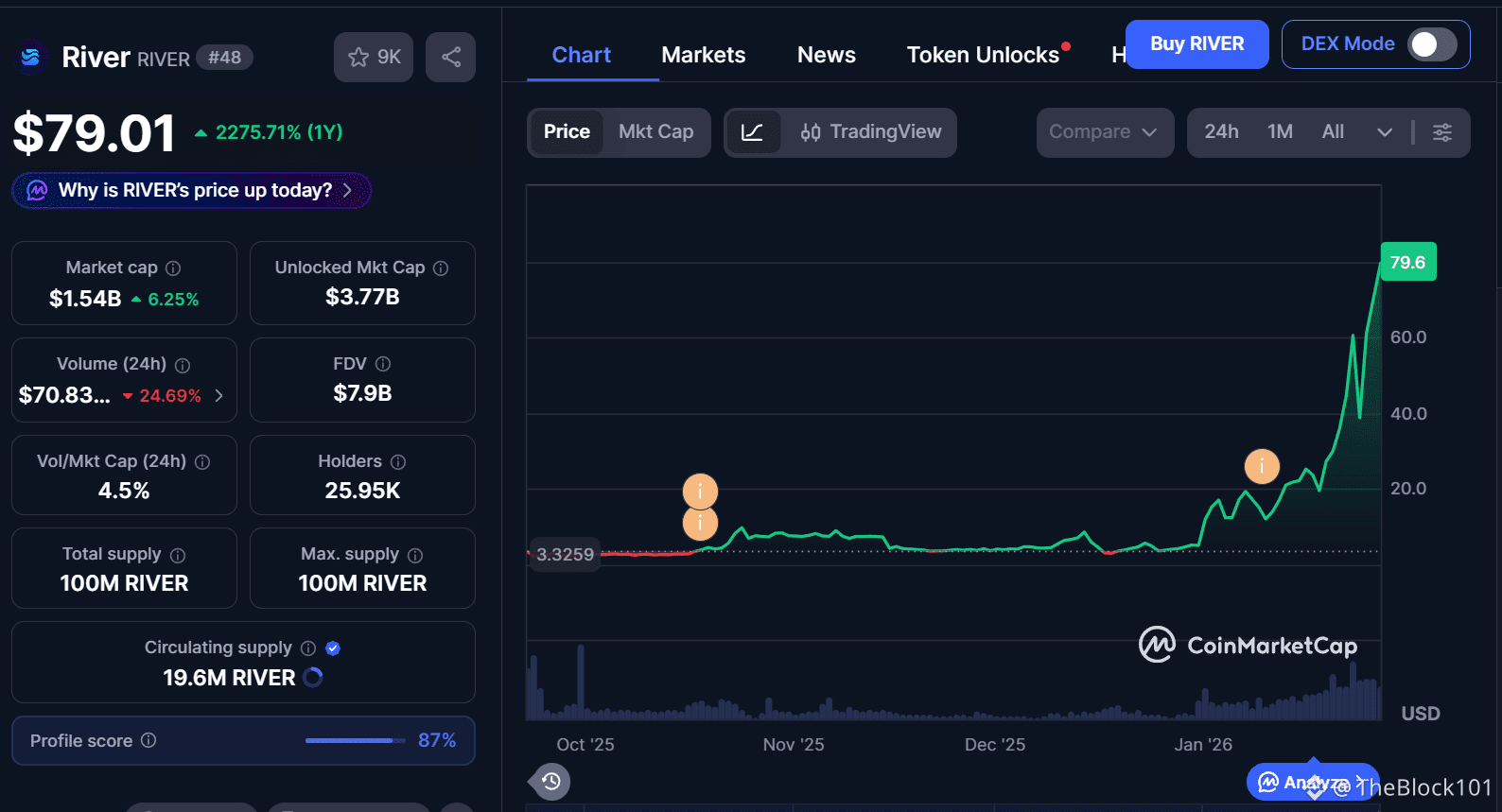

River $RIVER ran from $3 to $80 since early January, a clean 27x that caught most of the market off guard.

If you missed it, here’s a concise breakdown of what actually pushed River into its latest moon leg.

At the core, this rally is driven by three things: institutional backing, a differentiated chain abstraction stablecoin model, and an airdrop design that rewards patience instead of fast selling.

1. River closed a $12M strategic round from Tron DAO, Justin Sun, Maelstrom Fund (Arthur Hayes), Spartan Group, plus Nasdaq-listed companies and institutions.

2. River is a chain abstraction stablecoin system that connects assets to opportunities across chains. Their stablecoin (satUSD) works without bridges, deposit on one chain, use on another.

The most interesting part, though, is the airdrop mechanics.

River rewards users for waiting. You earn River Points, which can later be converted into $RIVER . The longer you hold before converting, the more tokens you receive. After Day 90, the multiplier doubles, directly discouraging early exits.

Right now, River has processed $6B in trading volume, ranks #4 globally, and is #1 trending on both Binance and CoinGecko.

There’s also a visible arbitrage gap between River Points and $RIVER, highlighted in the latest Alea Research report.

NFA. DYOR.