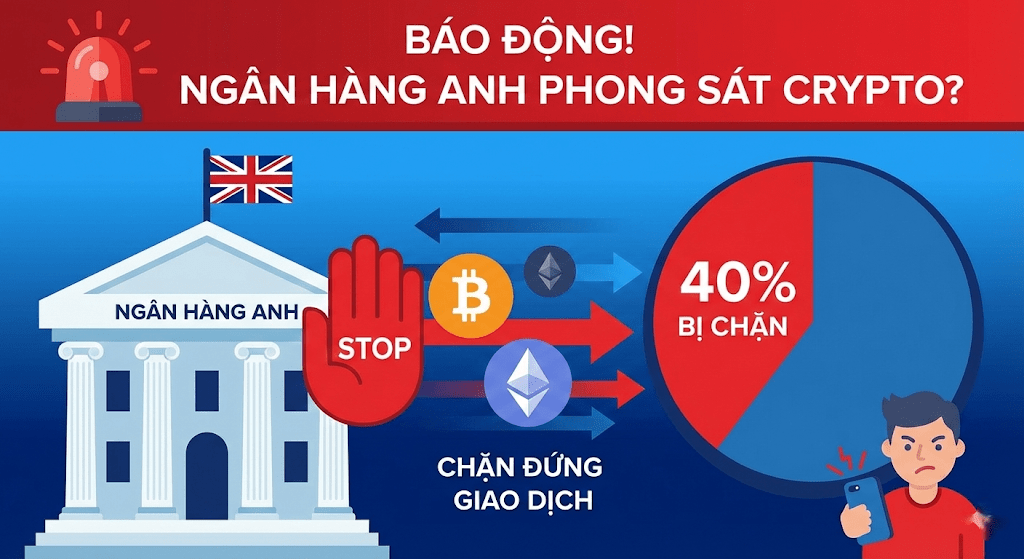

The door to the cryptocurrency market for British investors is narrower than ever. A shocking report released today has exposed the organized debanking situation occurring in the UK.

🔷 The latest survey from UKCBC shows that commercial banks in the UK are erecting extremely complex technical barriers:

Currently, it is estimated that up to 40% of efforts to transfer money from bank accounts to Crypto exchanges are completely blocked or delayed for long periods.

This ban is not only aimed at strange exchanges but also applies to transactions with exchanges that are licensed and legally managed by the UK's Financial Conduct Authority.

🔶 A survey with 10 leading centralized exchanges in the UK has painted a grim picture:

80% of exchanges confirm that banks have increased their obstruction or restrictions on customers' money transfers over the past year.

Alarmingly, there are currently no exchanges reporting any improvement or loosening from the banks.

🔷 The measures adopted by banks are becoming increasingly drastic and encircling:

Imposing extremely strict quota limits on the amount of money transferred.

Completely blocking credit card payments and transfers to exchange wallets.

Currently, 100% of the exchanges surveyed reported that banks often block transactions without providing any specific reason, leaving users in a completely passive position.

While the UK once aspired to become a global cryptocurrency hub, the actual actions of its banking system are completely contrary to those previous ambitions.

The extreme blocking of fiat money is strangling the liquidity and financial freedom of millions of investors in the land of fog.

This article is for reference only and is not investment advice. Please read and consider carefully before making a decision.