When I started my journey with cryptocurrencies (it's not overly long), having an account on KRAKEN, I chose the crypto that had the largest staking at that time. To earn the most. The choice fell on $SCRT . It was not a conscious choice; it was nice to look at the numbers. Then I had a reflection. What is this SCRT? Who stands behind it? I invite you to read.

During the preparation, I tried to exercise due diligence. I apologize in advance for any possible errors or misunderstandings.

If you like my content, give a thumbs up, share, or as it was with Andrzej Sapkowski: 'Give a coin to the Witcher'.

I. The institution behind SCRT

Behind the SCRT token is an ecosystem developed by Secret Network, whose organizational core is formed by the Secret Foundation (non-profit foundation) and the development company SCRT Labs.

This is a hybrid model:

foundation → governance, grants, ecosystem development

commercial company → development core, enterprise, partnerships

Very similar to: #DFINITY / #EthereumFundation / #Web3Foundation , only with a sharp focus on privacy-by-design.

II. What was the idea behind SCRT?

SCRT was not created as a 'privacy coin' in the style of Monero.

The idea was more 'institutional' and long-term:

🔐 Enable smart contracts that can process data privately,

but without breaking regulatory compliance.

Key assumption:

blockchain = public and verifiable

data in the smart contract = encrypted

This was a response to a real barrier to blockchain adoption:

'We cannot use DeFi, DAO, and tokenization if all data is public.'

III. What exactly does Secret Network deal with?

Core competence:

Privacy-Preserving Smart Contracts

Technologically:

Trusted Execution Environments (TEE – Intel SGX)

data encryption at the contract level

the ability for selective disclosure (e.g., to the regulator)

Practically:

DeFi with hidden positions

DAO with secret voting

NFTs with private metadata

AI + sensitive data

tokenization of assets with confidential ownership structure

This is not retail-privacy, but:

privacy for institutions, companies, and compliance-heavy use cases

IV. Where does the funding come from?

a) Historical funding

private VC rounds (including the Cosmos ecosystem)

ecosystem grants

early community support

b) Current model

inflation of SCRT (staking / validators)

ecosystem funds (Secret Foundation)

developer grants

technological partnerships

👉 No aggressive VC-overhang in the style of 'token unlock tsunami'.

V. How are they perceived in the market?

🔹 Among devs:

'technically legit'

'difficult stack, but unique'

'privacy done right'

🔹 Among institutions:

niche, but serious

perceived as compliance-friendly privacy

no 'dark darknet' narrative

🔹 Among Big Tech / Web2:

rather an experimental partner

no open regulatory war

zero status of 'toxic project'

This is important:

SCRT has never been a target for regulators, unlike typical privacy coins.

VI. Is SCRT the only project?

Secret Network is a platform, not a single-token bet.

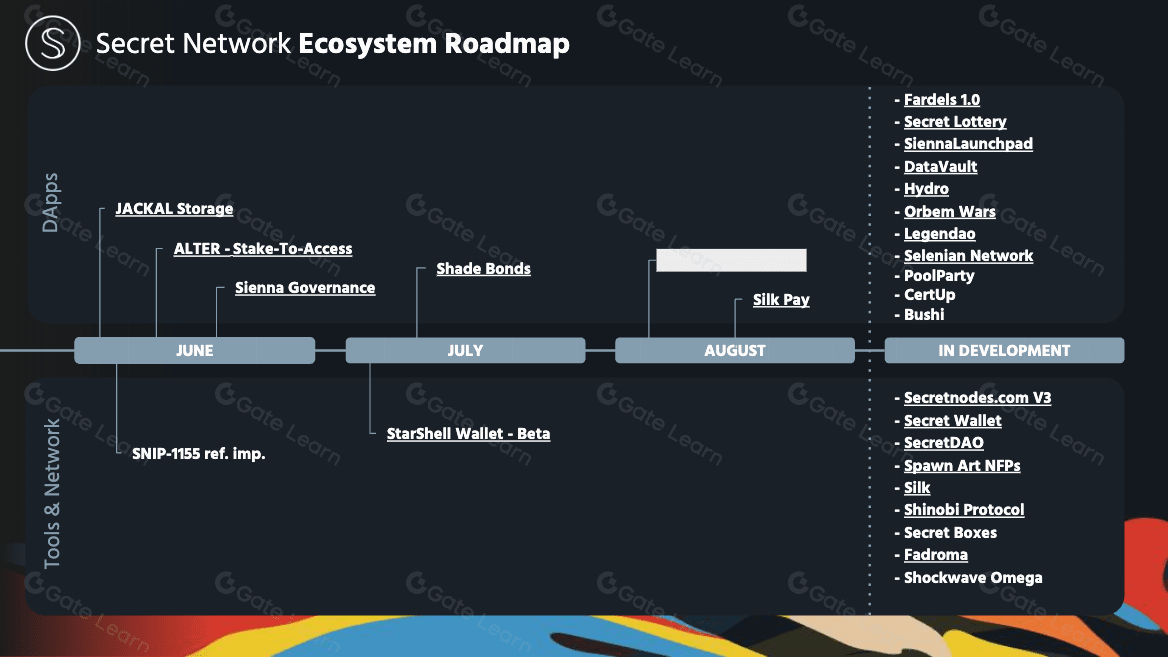

In the ecosystem:

Shade Protocol (privacy DeFi)

Secret NFTs

Secret AI use-cases

cross-chain privacy (Cosmos IBC)

The institution actively incubates projects, not just 'maintains the chain'.

VII. Proceedings, legal risks

As of today:

❌ no known legal proceedings

❌ no regulatory charges

❌ no conflicts with SEC / CFTC / ESMA

Why?

SCRT does not promise absolute anonymity

the technology enables audit and compliance

the narrative 'privacy ≠ hiding crimes'

This is conscious legal positioning.

VIII. Key People

Most frequently mentioned in history and development:

Guy Zyskind – co-creator of the idea of private smart contracts

Tor Bair – CEO SCRT Labs (strategy, communication, ecosystem)

Assaf Morami – co-founder (architecture)

Characteristic:

no celebrities

no 'crypto-influencer CEOs'

technocratic leadership

IX. How to read this institutionally?

SCRT is:

❌ not a hype coin

❌ not a meme

❌ not retail privacy

This:

✅ infrastructure for tokenization + AI + sensitive data

✅ blockchain that does not compromise compliance

✅ a project that can 'be quiet' for a long time and then suddenly be needed

X. Assessment of SCRT in a portfolio next to ICP / $0G / BANK

a) Starting point: what do you already have in your portfolio?

I analyze holding SCRT in terms of what I have in my portfolio and what I previously described. It is a very coherent, 'infrastructural' basket:

ICP → compute + web3 cloud (on-chain execution, hosting, backend)

0G → data availability + AI data layer

BANK → AI-DeFi / institutional capital optimization

These are not L1 'for payments', but elements of the future financial-technological stack.

The question is:

👉 does SCRT bring a new, non-overlapping function?

b) The role of SCRT in this arrangement

SCRT = logical privacy layer

No:

transaction privacy (like Monero),

not 'hiding everything'.

Only:

privacy of data and business logic at the smart contract level

This is exactly the gap that:

ICP does not directly address (on-chain compute is public),

0G does not solve (storage ≠ processing),

BANK assumes but does not implement it on L1.

c) How does SCRT realistically complement the others?

🔹 SCRT + ICP

ICP → executes the application

SCRT → hides sensitive logic / data

effect: enterprise-grade dApps that will not burn out on audit

SCRT acts as a privacy-coprocessor for the world of ICP

🔹 SCRT + 0G

0G → data availability (AI, models, embeddings)

SCRT → access control and confidentiality of processing

effect: AI/ML on the blockchain without data leakage

This is critical when:

financial data,

scoring,

customer data (RODO / GDPR).

🔹 SCRT + BANK

BANK → AI-DeFi, strategies, capital automation

SCRT → hidden parameters of strategies, positions, conditions

effect: DeFi that is not front-run

Institutionally: huge value

d) Institutional assessment (cold, without emotions)

✅ Arguments FOR SCRT in this portfolio

adds a unique function (privacy logic)

compliance-friendly (this is key!)

no narrative conflict with regulators

low technological overlap

fits into the narrative of tokenization + AI + institutions

⚠️ Risks

niche → free adoption

difficult technology (TEE, SGX = higher entry threshold)

lack of retail hype (i.e.: silence… sometimes very long)

But these are exactly the same risks that once had:

AWS before the boom,

Docker,

Kubernetes.

XI. Comparison of SCRT vs DUSK strictly under compliance

The coin that has recently been ruling among many users and in the market in terms of growth is $DUSK . A brief comparison of these two tokens.

Meta-difference in approach:

SCRT = privacy throughTEE (Intel SGX) and 'confidential compute' (fast, general-purpose). (docs.scrt.network)

DUSK = privacy designed forregulated finance, strongly exposingselective disclosure and standards for the tokenization of securities. (dusk.network)

a) 'Can the regulator legally peek into the data?' (selective disclosure)

DUSK

Directly position themselves asprivacy + compliance for finance and talk aboutselective disclosure as a mechanism for reconciling privacy with audit requirements. (dusk.network)

Compliance impression: 'designed for the regulated market'.

SCRT

Secret Network offersconfidential smart contracts, where state/inputs/outputs are private thanks to TEE. (docs.scrt.network)

Compliance impression: 'technical tool', not 'regulatory framework' – it can work, but often requires re-designing the disclosure process through the application.

Compliance-point: DUSK's advantage in 'narrative and compliance construct', SCRT's advantage in 'practical private execution of logic'.

b) KYC/AML, whitelisting, transaction control (typical for RWA/securities)

DUSK

From their materials, it appears they target tokenization and financial use cases as well as 'regulatory requirements'. (dusk.network)

The ecosystem also circulates the concept of a standard for security tokenization (e.g., XSC) – this is 'compliance by design' for issuance/trading. (Note: some descriptions of XSC circulate in side studies and articles, so I would treat it as a direction, not a sole pillar.) (simpleswap.io)

SCRT

KYC gating/whitelisting can be done at the application level, but the chain itself is not branded as 'securities-first'. It's rather 'confidential dApps', which can be fintech-friendly.

Compliance-point: if you think about RWA / bonds / stocks / regulated DeFi, DUSK has a more 'institutional framework'.

c) Auditability and 'proof in case of dispute'

DUSK

ZK-approach (in theory) gives better 'cryptographic elegance' for audit: you prove compliance without revealing data. (Note: as always, the devil is in the implementation and audit standards). (dusk.network)

SCRT

In TEE, you have very practical, fast 'confidential compute', but compliance will ask about trust assumptions for hardware/attestation and the history of vulnerability mitigations. Secret has directly published a security update regarding SGX and mitigation mechanisms. (scrt.network)

TEE class risks (side-channel / hardware vulnerabilities) are widely discussed in the industry. (tee.fail)

Compliance-point: for the DUSK auditor, it often 'sounds cleaner'; SCRT can be 'more debatable' because TEE = additional vector of questions.

d) Regulatory risk 'privacy stigma' (Monero syndrome)

DUSK

They build the message: 'privacy meets compliance' and target the financial market, so the stigma of 'privacy coin' is smaller. (dusk.network)

SCRT

They are also not positioned as 'anonymous cash'; more like confidential contracts. However, the use of SGX/TEE itself does not solve the image issue of privacy – it depends on the application.

Compliance-point: DUSK has a clearly 'sold out' PR/reg narrative to institutions.

e) When is which better 'for compliance'?

Choose DUSK if:

Your investment theses are about RWA / regulated finance / tokenization of securities

you want a project that from the start 'speaks the language of the regulator': compliance, control, selective disclosure. (dusk.network)

Choose SCRT if:

the priority is practical business logic privacy (e.g., strategies, scoring, customer data, AI) and speed of execution,

you accept that compliance due diligence must include TEE risk management (mitigations, procedures, threat model). (docs.scrt.network)

f) 'compliance only' opinion for a basket holding ICP / 0G / BANK

If you think of the portfolio as an institutional stack, then under compliance DUSK is more 'plug-and-sell' to regulated finance. (dusk.network)

SCRT is more 'tooling-first': great for private logic/data AI, but in compliance, a long set of questions about TEE and hardware security will often arise. (tee.fail)