Here’s one more data point worth respecting not because it’s flashy, but because it’s consistent.

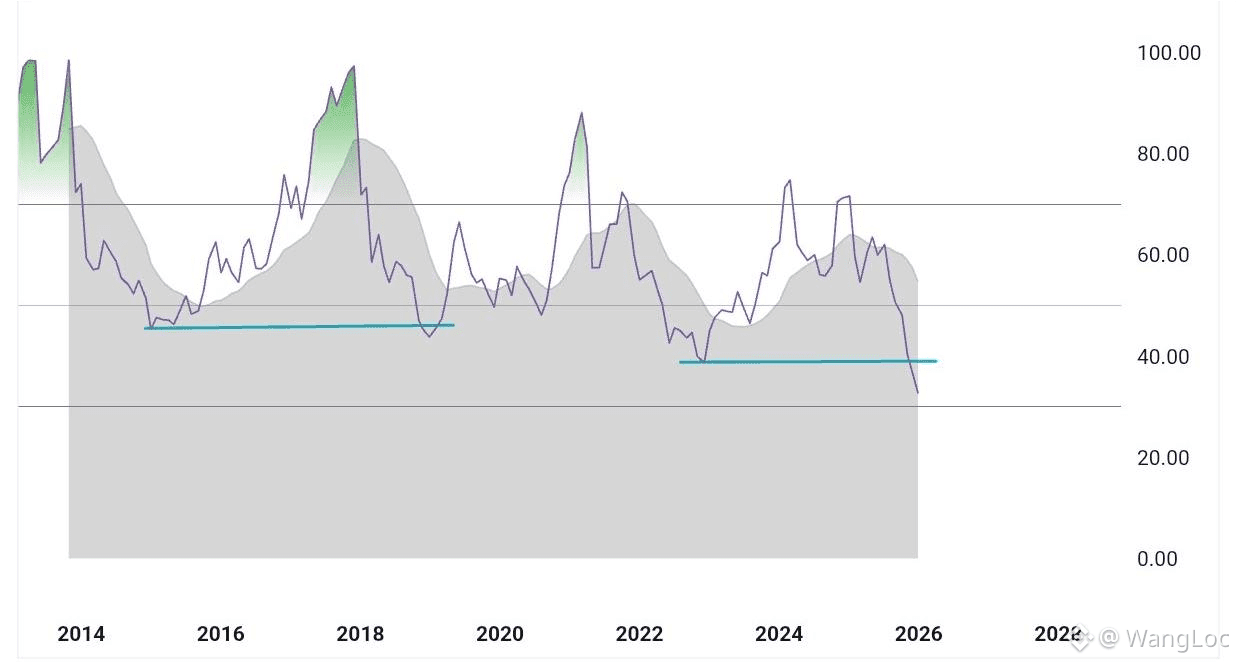

The Bitcoin / Silver ratio has a habit.

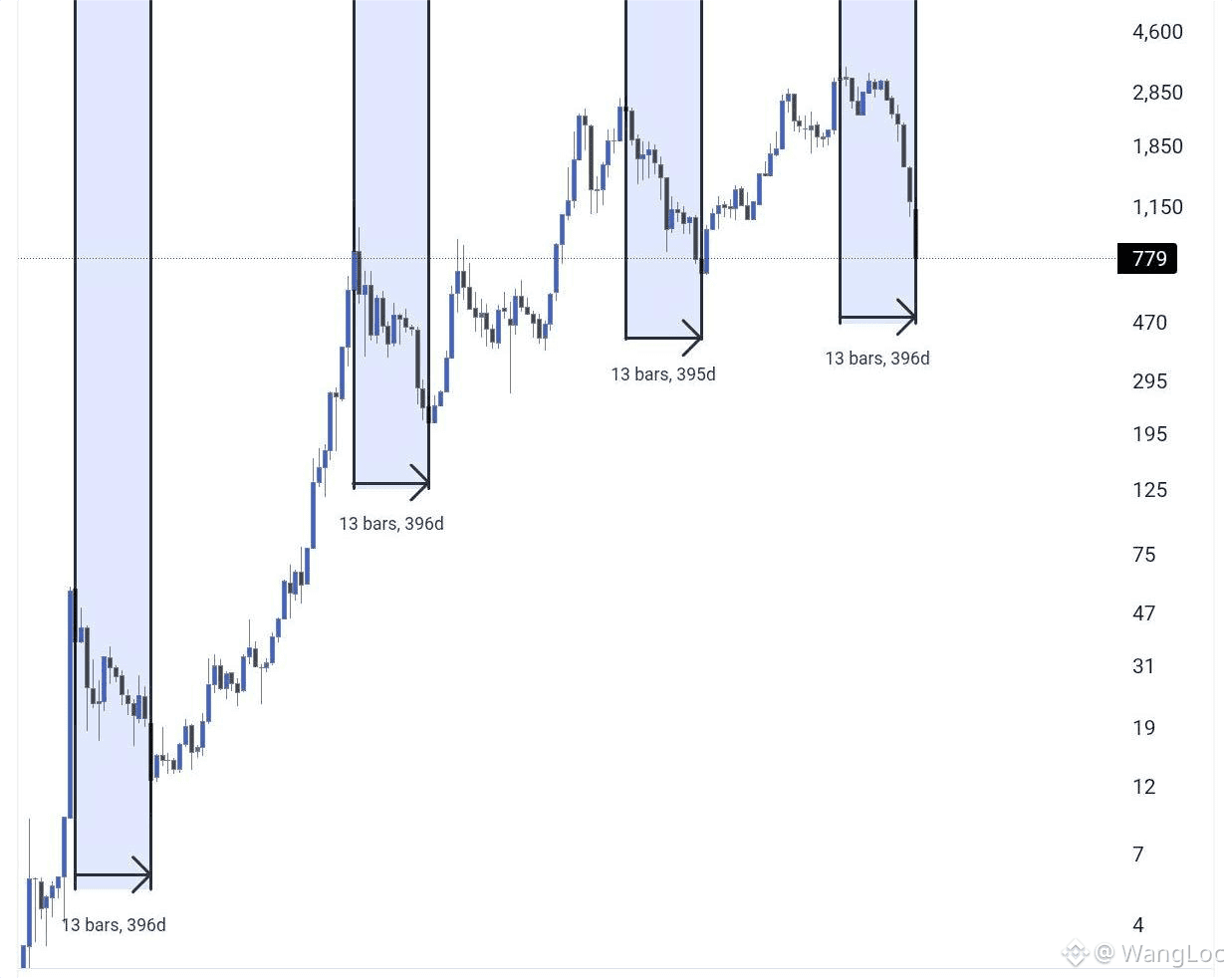

In past cycles, its downtrend has bottomed after ~13 months.

Not 6. Not 9. Not “whenever sentiment feels bad enough.”

13 months.

And right now?

We’re sitting at month 13 again.

That doesn’t mean Bitcoin explodes tomorrow. It doesn’t mean risk is gone.

But it does mean something important: this ratio is reaching the point where historically, downside momentum runs out.

Silver usually outperforms BTC during stress phases when liquidity tightens and risk appetite fades.

When that relative strength stalls, it often signals that macro fear has already done its damage.

This is how bottoms usually form:

Not with optimism

Not with headlines

But with timing signals lining up while sentiment stays heavy

BTC vs Gold.

BTC vs Silver.

Cycle-duration metrics all clustering.

None of these are “buy now” alarms on their own.

Together, they suggest the same thing: The downside window is getting crowded, not wide open.

If you’re waiting for comfort, you’ll get it later at higher prices.

If you’re managing risk, this is when you start paying closer attention.

Bottom in? Maybe.

Bottom closer than most think? Increasingly hard to ignore.

Do you still see this as an early-cycle drawdown or are you starting to treat it like a late-stage correction?