The thin liquidity of the Altcoin market has just revealed a fatal weakness as a Market Dump from insiders is enough to cause token prices to plummet uncontrollably.

An address related to an investor or project team has just executed a liquidation of all assets, putting 1INCH on red alert.

Join the Web3 Binance wallet with me to optimize 30% fees!

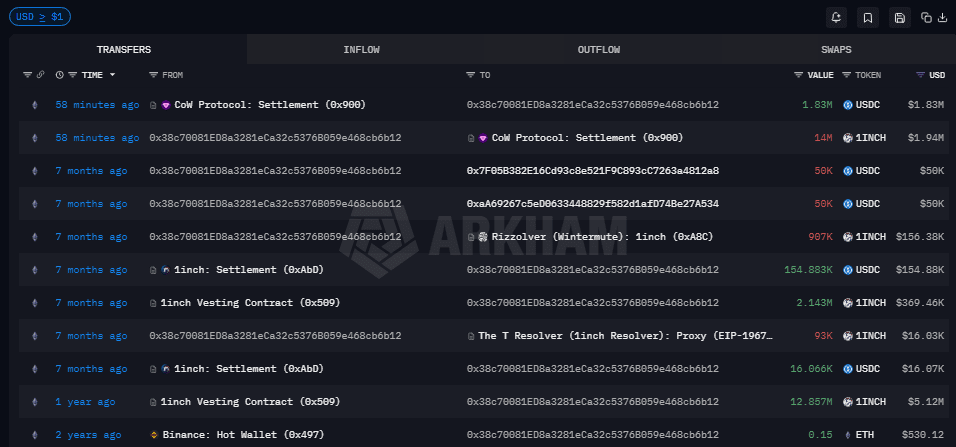

🔷 On-chain data records a massive sell order just executed directly on the chain:

The selling volume reached 14 million tokens. The value obtained was approximately 1.83 million USD.

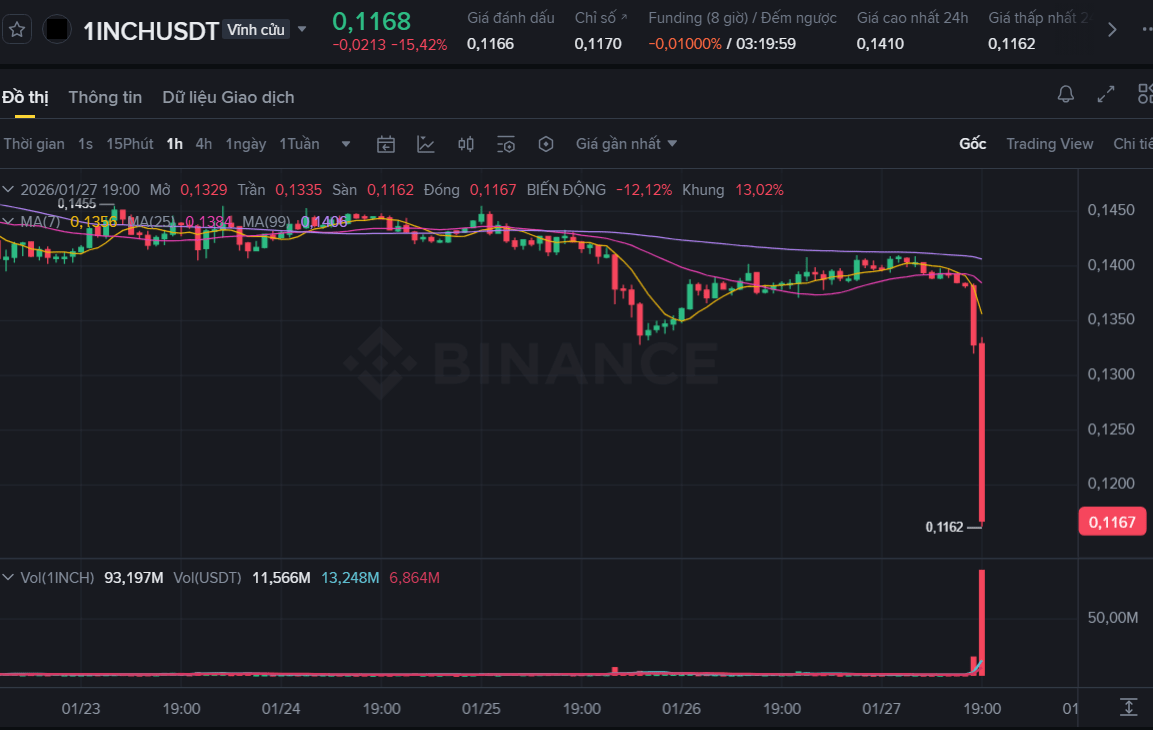

This massive sell order swept away the Buy wall liquidity, causing the price $1INCH to drop sharply by -7% in an instant from $0.1385 down to $0.129.

🔶 This amount of tokens is not accumulated from the market, but comes from the Vesting contract for insiders:

This wallet received 15 million 1INCH through the vesting reward from a year ago.

Dump history:

Round 1: Sold a trial of 1 million tokens at a fairly good price of $0.17.

Round 2: Decided to completely cut ties, sold all remaining 14 million tokens at a low price of $0.13.

🔷 The fact that an early investor or team member accepts to sell off at the bottom price indicates a loss of confidence in the project's short-term recovery potential.

This decisive action of cutting ties often creates a domino psychological effect on other small holders.

This event serves as a reminder of the concentration risk in tokenomics.

When a large amount of tokens is in the hands of a few individuals and they decide to sell off, the price chart will be broken regardless of technical analysis.

This article is for reference only and is not investment advice. Please read and consider carefully before making a decision.