What stands out to me right now isn’t where Bitcoin is trading, but how it’s behaving. After a series of sharp, uncomfortable sell-offs, Bitcoin — alongside Ether, XRP, and SOL — is doing something unexpected: staying composed.

There’s no rush to chase upside, but there’s also no urgency to exit. That balance matters. It suggests a market that’s waiting, not reacting.

As I went through today’s notes, one recurring theme kept surfacing: speculation around potential yen intervention. It’s not dominating headlines, but it’s quietly influencing how risk assets are being approached — crypto included. When macro uncertainty lingers in the background, price action tends to slow, not accelerate.

Positioning Feels Defensive, Not Fearful

Early in the session, sentiment across major crypto assets felt neutral to slightly cautious. Short positions edged out longs, but not aggressively. It looked less like conviction and more like hesitation.

What caught my attention was how thin the liquidation data looked. Despite some short liquidations — oddly enough driven by tokenized silver rather than crypto itself — overall volume remains subdued. That usually tells me participation is low, not stress levels high.

Positioning data reinforces that view. Long exposure has slipped to just under half of open interest, a subtle but clear lean toward caution. This isn’t capitulation. It’s restraint.

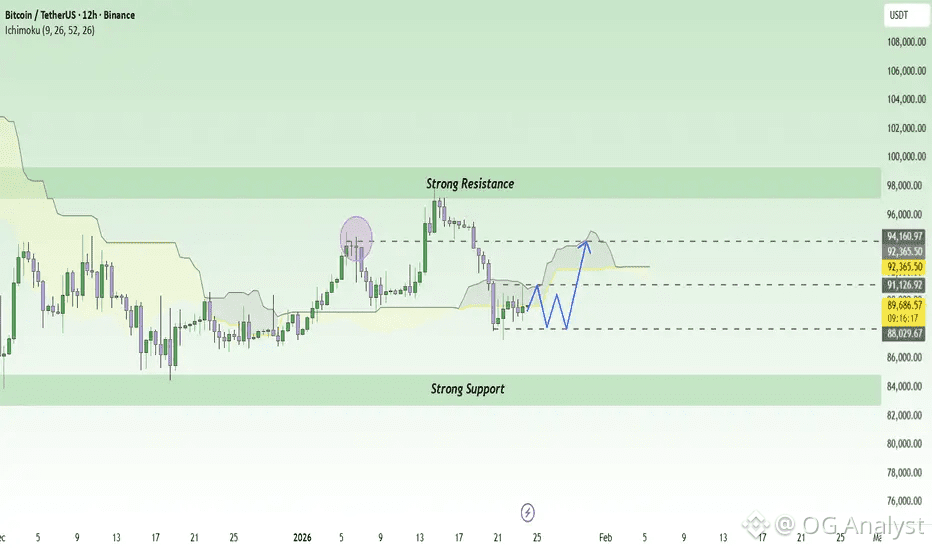

Bitcoin at Support: A Technical Pause, Not a Breakdown

Bitcoin hovering around the $88,400 area feels deliberate. This zone has become a checkpoint rather than a launchpad.

The level I’m watching most closely is the monthly open near $87,500. If that gives way, the chart naturally opens toward the $86,300 region, which aligns neatly with recent local lows. There’s nothing dramatic about that path — it’s simply how the structure is laid out.

Importantly, price hasn’t rushed toward those levels. That hesitation suggests sellers aren’t pressing their advantage.

Upside Liquidity Remains Crowded

On the upside, the picture is clearer but less forgiving. The $89,800 to $90,500 range continues to act like a congested corridor. Liquidity is stacked there, and historically, those zones don’t resolve quietly.

A rejection from that area wouldn’t be surprising and could easily trigger another short squeeze attempt. On the flip side, a clean acceptance above it would reopen the path toward $91,400. The key word here is clean. Anything less risks another fade.

Structurally, Bitcoin still looks intact. The trend isn’t broken — it just shows signs of wear.

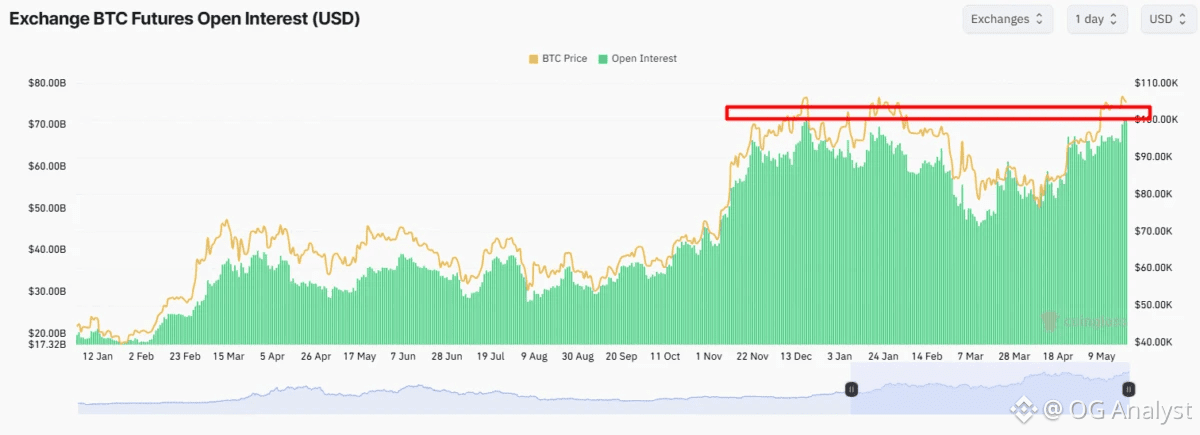

ETF Flows Add a Note of Caution

One factor that’s harder to ignore is the recent stretch of spot ETF outflows. More than a billion dollars has exited over the past five days, which doesn’t scream confidence.

At the same time, these flows haven’t translated into disorderly price action. That disconnect is important. It suggests that while marginal demand has softened, underlying supply remains controlled.

In other words, pressure exists — but it’s being absorbed.

Closing Thought: Waiting Is a Position Too

Right now, Bitcoin doesn’t feel bullish or bearish. It feels patient.

The market is absorbing macro uncertainty, thin volume, and shifting positioning without losing its structural footing. That kind of behavior usually precedes resolution — not necessarily upward, but decisively.

Until then, I’m treating this phase less as a call to act and more as a reminder: sometimes the most informative signal is how little the market reacts.