@Plasma The rise of stablecoins has been one of the most practical advancements in blockchain adoption. While much of the industry has gone through speculative narratives, stablecoins have quietly demonstrated their value by solving real financial problems: price stability, global transferability, and on-chain liquidity. Plasma $XPL is based on the recognition that this success is not accidental, and that stablecoins are no longer peripheral assets, but fundamental financial instruments that deserve an infrastructure specifically designed for their scale and importance.

What makes Plasma XPL particularly attractive is its clarity of purpose. Instead of trying to be everything at once, the project focuses on a clearly defined economic role: to become a reliable, efficient, and scalable environment for stablecoin-based activity. This approach reflects a maturing industry, where specialization is replacing experimentation and where real-world utility is becoming the primary measure of success.

Stablecoins operate under different requirements than volatile crypto assets. They demand predictable fees, quick settlement, deep liquidity, and regulatory compliance. #Plasma XPL aligns its architecture around these needs, creating conditions where stablecoins can function as true digital cash instead of speculative instruments. This alignment is especially important for businesses, fintech platforms, and institutions that require consistency and transparency to operate at scale.

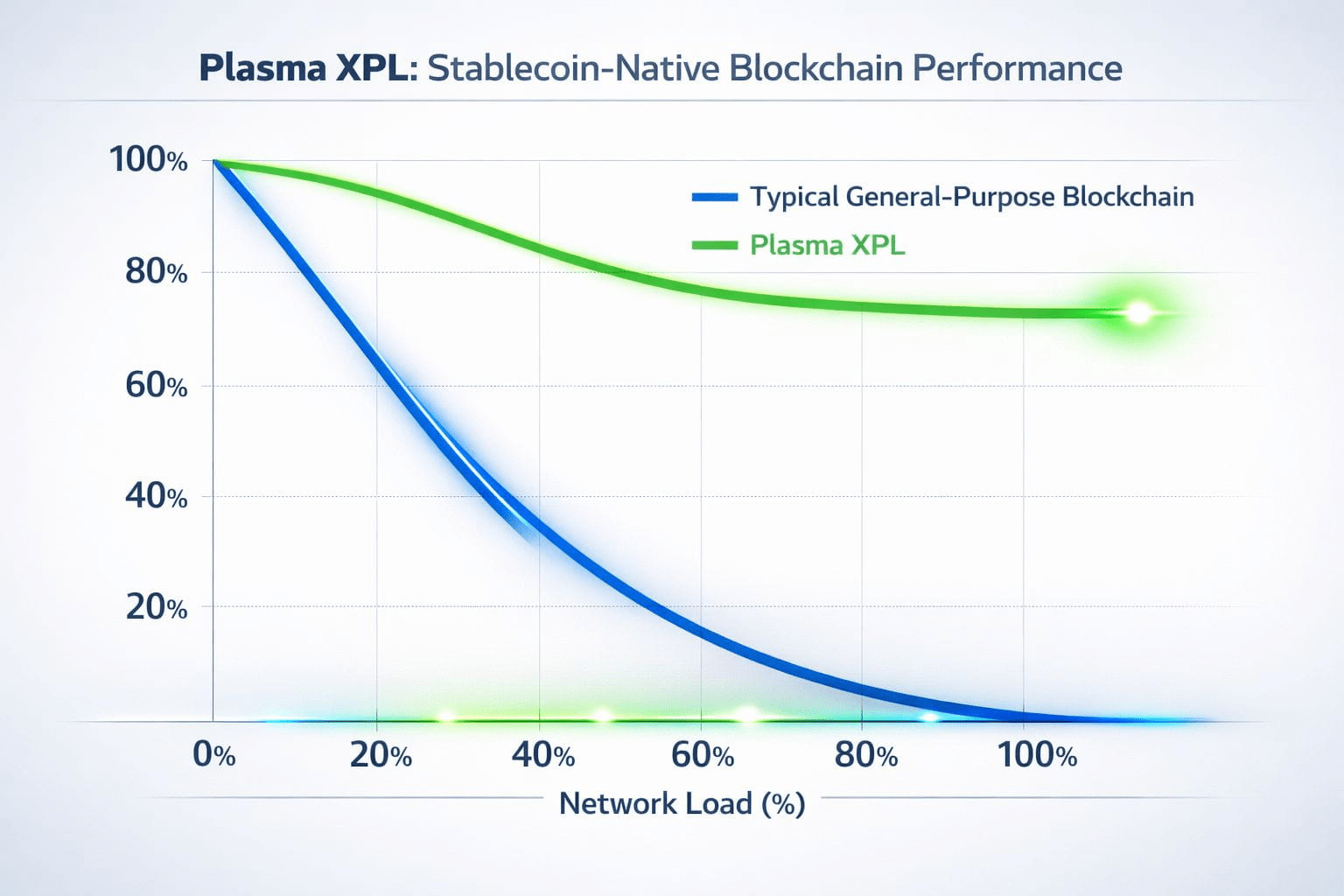

From a broader perspective of the ecosystem, #Plasma XPL strengthens the overall blockchain landscape instead of fragmenting it. Acting as a native stablecoin layer, it reduces congestion on general-purpose chains and allows for more efficient capital flows across the ecosystem. This type of specialization enables different networks to excel at what they do best, enhancing the resilience and functionality of the entire industry.

The project's approach to compliance further reinforces its long-term viability. Plasma XPL recognizes that stablecoins exist at the intersection of decentralized technology and regulated finance. Rather than positioning regulation as a hurdle, it treats compliance as an architectural consideration. This mindset makes the network more accessible for institutional participants while preserving the key benefits of blockchain-based settlement.

Equally important is Plasma XPL's support for developers and builders. By removing unnecessary friction from infrastructure, the project allows teams to focus on true innovation: payment systems, settlement platforms, treasury automation, and embedded finance solutions.

Plasma XPL also represents a shift in how value creation in Web3 is approached. Instead of relying on hype cycles or speculative token mechanics, it positions itself around transaction volume, liquidity efficiency, and actual economic use. This model aligns more closely with the evolution of financial infrastructure in traditional markets, where durability and reliability matter more than rapid experimentation.

In a market increasingly shaped by scrutiny, regulation, and user expectations, Plasma XPL offers a grounded and realistic vision. It supports the idea that blockchain adoption will not come solely from abstract innovation, but from infrastructure that works seamlessly with the real economy. By committing to a native stablecoin design, the project signals a long-term strategy rather than a temporary narrative.

Ultimately, Plasma XPL supports a broader transition in digital finance. Stablecoins are becoming the default medium for value transfer on-chain, and the infrastructure behind them must evolve accordingly. Plasma XPL contributes to this evolution by providing a network built around stability, efficiency, and trust. As the blockchain industry continues to mature, projects with this level of focus and alignment are likely to play a significant role in shaping its future.