@Vanarchain When people call Vanar Chain “the chain that thinks,” I don’t hear a brag. I hear a promise with sharp edges. Thinking, in the real world, is what you do when the inputs are messy, the clock is loud, and the cost of being wrong lands on someone’s desk as a missed payment, a broken reconciliation, or a compliance question that can’t be hand-waved away. Vanar’s recent messaging has leaned into that responsibility: it describes itself as built to serve AI agents, onchain finance, and tokenized real-world infrastructure, but the deeper point is that it’s trying to move computation and memory closer to the place where trust is enforced. Not trust as a mood. Trust as something you can re-check when pressure rises and nobody has time for a “just believe us.”

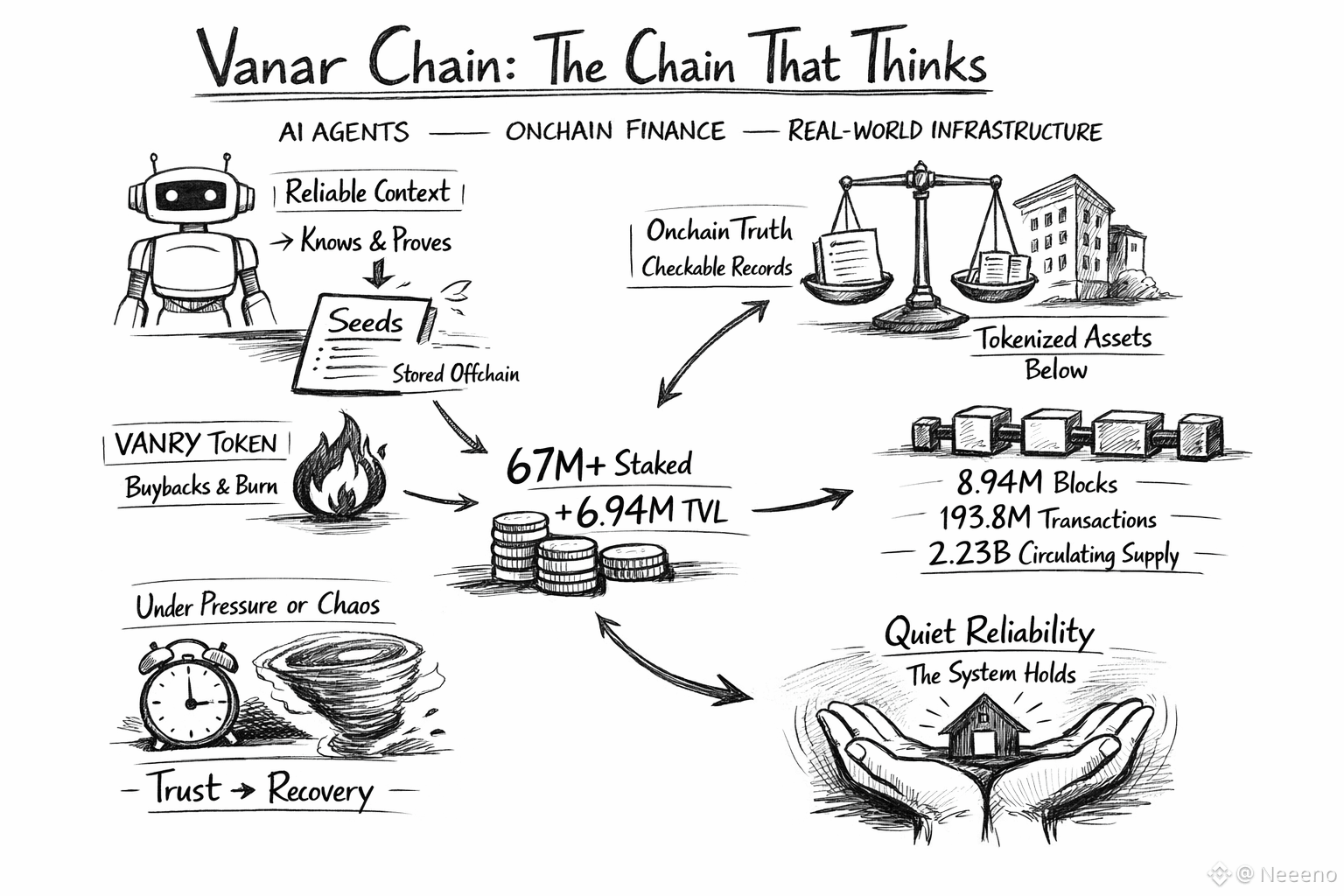

The easiest way to misunderstand Vanar is to think it’s only about speed or convenience. The more interesting ambition is about turning information into something the chain can actually hold onto without choking on it, and then making that information usable when the system is stressed. Their documentation frames this as breaking messy sources into compact “Seeds,” stored offchain by default for practical performance, with the option to anchor integrity and ownership onchain when it matters. That design choice isn’t cosmetic. It’s an admission that reality is too big to fit neatly on a ledger, and also too important to leave floating as unverifiable screenshots and dead links. When you’ve lived through a dispute—two parties showing two versions of “the same” document—you start to appreciate how much emotional safety comes from being able to point to one timeline that doesn’t argue back.

There’s a specific kind of fear that shows up in AI-driven workflows, and it isn’t the sci-fi fear. It’s the fear of silent drift: the assistant that “knows” something today and forgets it tomorrow, or worse, remembers it incorrectly and speaks with confidence. Vanar’s recent product direction has tried to address that with a more unified approach to accounts, storage, and memory, including an update they shared about putting account, Seeds, and storage controls “in one place,” with the ability to switch between cloud storage and blockchain anchoring. That sounds like UX, but it’s actually governance over your own context. In practice, this is what determines whether an AI agent can be trusted in a finance setting: not whether it can talk, but whether it can prove what it relied on, and whether you can revoke, audit, or re-anchor that reliance when the stakes change.

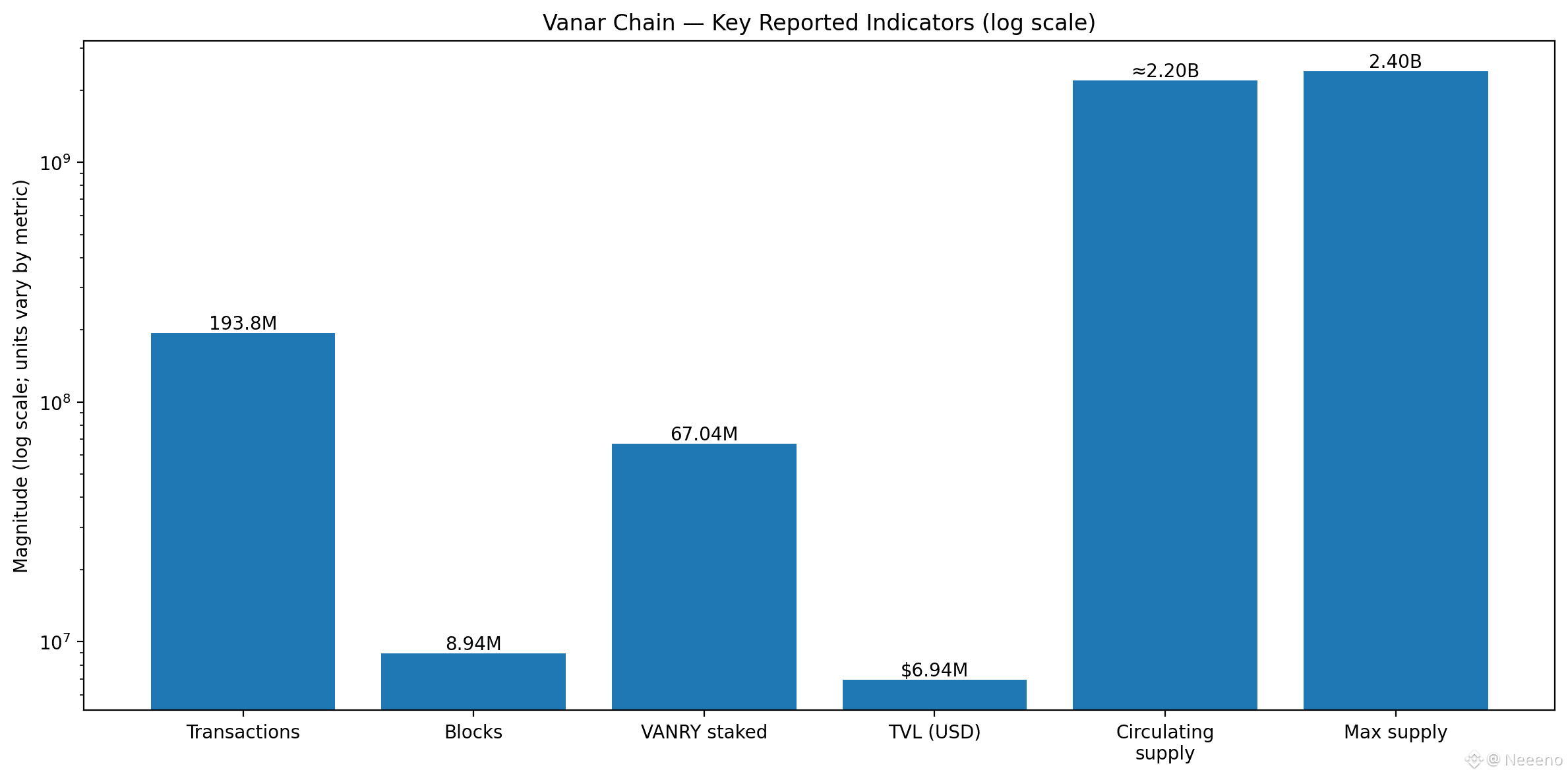

The “data points” people quote about Vanar—blocks, transactions, addresses—can sound like scoreboard talk until you place them in the right frame. On Vanar’s mainnet explorer, the chain publicly surfaces totals like roughly 193.8 million transactions and about 8.94 million blocks, alongside wallet address counts shown on the explorer interface. Those numbers don’t prove meaning by themselves, but they do hint at something operational: a network that has had to keep producing blocks through ordinary chaos, not just during a perfect demo window. Reliability isn’t a headline; it’s repetition under boredom and under stress. The moment the chain stops being “new” is the moment the real work begins, because that’s when people assume it will still be there tomorrow.

Where Vanar gets more emotionally interesting is when you look at how it’s trying to align incentives around that reliability. The token, VANRY, isn’t just positioned as a fee unit; it’s being tied into a loop where usage converts into market action. In an official post about buybacks and burns, the team describes subscriptions flowing into conversions to VANRY and triggering buy events, framing it as a revenue flywheel that is meant to connect product demand to token demand. I’m careful with language here because these mechanisms can be misunderstood as spectacle, but the intent matters: if you want “thinking infrastructure,” you need economics that reward keeping the lights on, not just shipping announcements. A chain that wants to serve finance and real-world assets can’t afford incentives that only work when sentiment is euphoric.

Recent ecosystem updates also show Vanar trying to ground participation in measurable commitment. In a 2025 weekly recap on their blog, they reported more than 67.04 million VANRY staked and cited a TVL figure of about $6.94 million, describing it as momentum built quickly. People like to debate what staking “means,” but in lived terms it’s a collective bet on continuity: validators and delegators choosing to lock attention and capital into the network’s ongoing health. When markets get jumpy, that choice becomes psychological infrastructure. It’s the difference between a community that vanishes at the first drawdown and one that stays present enough to fix what breaks.

Token history matters here because it’s part of how trust is inherited. Vanar’s shift from TVK to VANRY wasn’t just a rename; it was a coordinated migration across major venues, publicly documented by exchanges. Binance’s support announcement and completion notice both specify a 1:1 swap ratio, and other venues echoed the same. That kind of operational coordination is unglamorous, but it’s one of the first times many users experience a project’s competence under constraints: deadlines, custody systems, address formats, and the simple fact that mistakes in migrations hurt real people. Vanar also shared the key swap details in public, like the 1:1 swap ratio and the new ERC-20 contract address. These may not sound exciting, but they’re the kind of facts that make users feel secure—or make them feel at risk. Even token supply numbers, which people often ignore, can change the mood and trust around the project.. Market trackers and exchange pages generally present VANRY with a maximum supply of 2.4 billion, and they show circulating supply figures around the ~2.0–2.23 billion range depending on venue and timing. You can treat that as trivia, or you can treat it as the boundary conditions for governance and liquidity, the constraints within which “infrastructure” has to fund itself. When Vanar links token demand to product subscriptions and staking participation, it’s implicitly admitting that long-term trust can’t be sustained on narrative alone. It has to be sustained on flows that are legible enough that a cautious operator can explain them to a team without feeling embarrassed.

What I keep coming back to is how Vanar talks about “truth” in a way that is less philosophical than practical. Their docs describe a hybrid world where the useful work—organizing documents, turning scattered records into structured units—can happen offchain for speed, while verification and ownership can be anchored onchain when the context demands it. Their public pages also make bold claims about compressing large inputs into small, verifiable units. Whether every promise lands perfectly is almost secondary to the direction: it’s an attempt to make the chain a place where disagreements can be reduced to checkable artifacts instead of endless argument. That is exactly what tokenized real-world infrastructure needs. The real world is full of “almost true” records: mismatched invoices, conflicting timestamps, documents that were edited without a clean trail. A thinking system isn’t one that never faces that mess. It’s one that’s designed to keep functioning when the mess arrives.

If you want a calm conclusion, it has to be honest about what’s hard. Building for AI agents, finance, and real-world assets means you’re building for the moments when someone is tired, money is moving, and certainty is demanded on short notice. It means designing so that errors don’t cascade into panic, and so that truth can be reconstructed after the fact without begging a third party for mercy. Vanar’s recent updates—unifying how users manage memory and storage choices, tying subscriptions to token buybacks and burns, reporting staking growth, and maintaining a chain history visible through its explorer—are all, in their own way, attempts to take responsibility for the boring parts.

Because in the end, the most serious infrastructure is the kind that doesn’t demand attention. It doesn’t need applause to keep producing blocks. It doesn’t need hype to keep records consistent. It shows up when people are stressed, when data conflicts, when incentives are tested, and it quietly gives them a way back to clarity. That’s the quiet responsibility Vanar is signing up for with “the chain that thinks.” If it succeeds, the reward won’t be noise. The reward will be a strange kind of peace: the feeling that the system holds, even when everything else is loud.