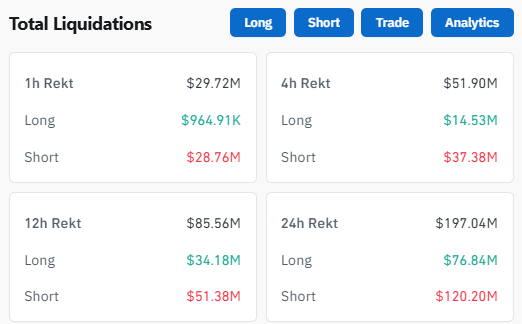

After yesterday's stormy day, the total liquidation in the market today has decreased to 197 million USD.

However, don't let the total number deceive you, as the focal point of the cash flow is shifting very strongly from Crypto to Derivatives commodities.

🔷 The shock named Silver $XAG The New King of Lethal Strikes

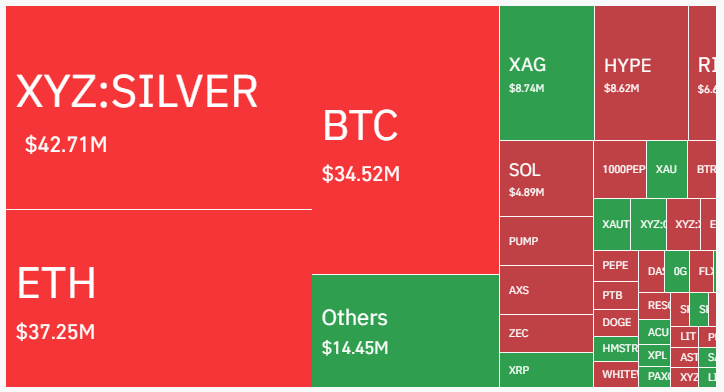

Top 1 Liquidation: XYZ:SILVER is at the top of the rankings with $42.71 million USD being blown away.

Citi raising the target to $150 and the ETF cash flow of 40 billion USD pouring in yesterday has made the Short Silver faction the main victim.

The crowd trying to stop Silver at the peak has been crushed by an aggressive buying force.

This is evidence that Silver is currently the most volatile and attractive asset for capital.

🔶 Cryptocurrency has retreated: $ETH surpassing $BTC in terms of Damage.

ETH: Ranked 2nd with $37.25M liquidation. Fidelity's strong accumulation of ETH has caused price spikes that caught the Short ETH side off guard.

BTC: Only ranked 3rd with $34.52M. Today's Bit is quite sluggish, mainly sideways, so the level of damage is lower compared to the two mentioned younger siblings.

🔷 24h statistics show a clear difference:

Short Rekt: $120.32 Million USD Accounts for 61%.

Long Rekt: $76.80 Million USD.

The market is in a very strong short-term Uptrend. The Short side is trying to block at resistance levels but is continuously getting killed.

The fact that Silver has climbed to the Top 1 liquidation is an extremely rare signal. It shows that speculative money is crazily concentrated here.

Brothers trading Silver or Crypto at this time absolutely MUST NOT SHORT THE TRAIN. Once Silver runs, it will run to the most unreasonable extent possible!

This article is for reference only and is not investment advice. Please read and consider carefully before making a decision.