Altcoin Season? Maybe.

But it's not for the majority – and it definitely doesn't resemble what everyone is dreaming of.

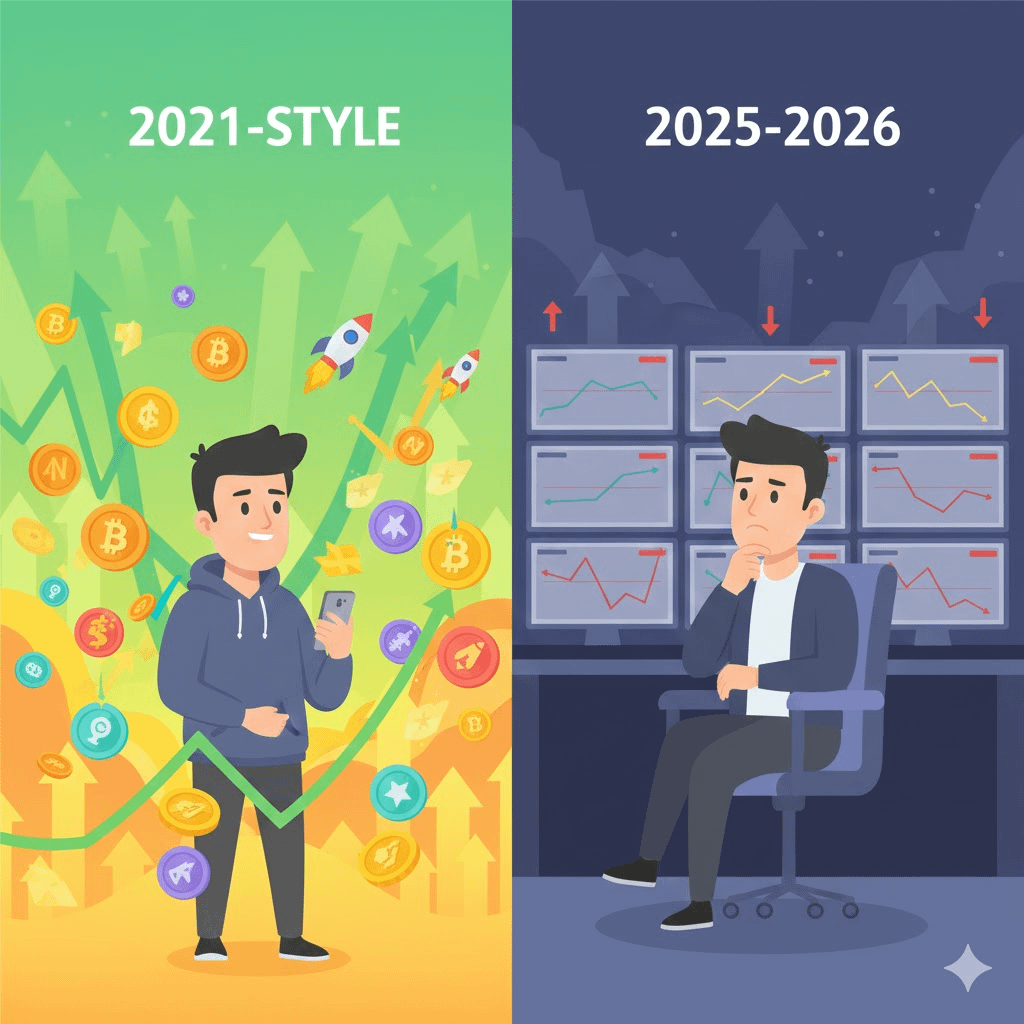

If you are still waiting for an Altcoin Season like 2021 – where almost every coin rises, and everything is profitable – then I will say bluntly: the chances are high that you are looking at the market wrong.

Not because crypto has lost its potential.

But because the current structure of the altcoin market is completely different.

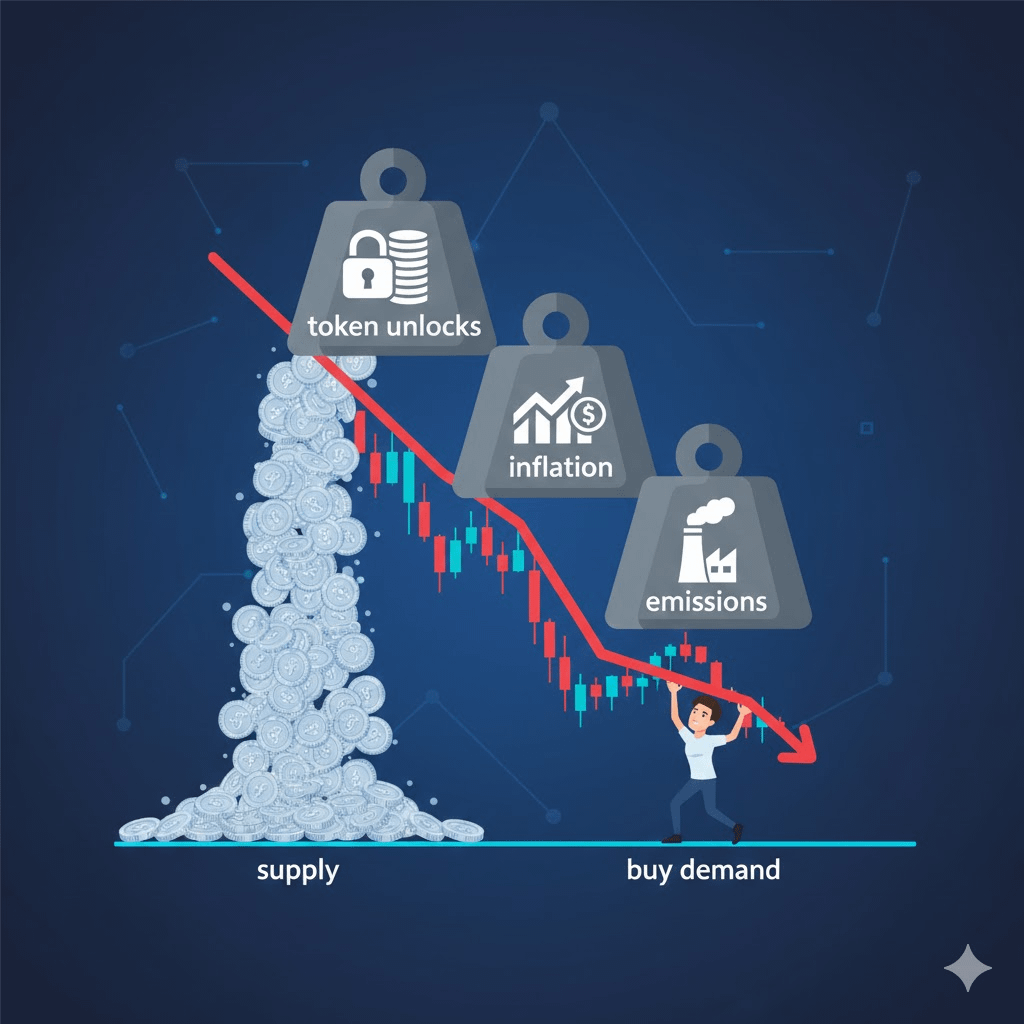

1. Altcoins are not 'weak' – they are being choked by supply

Looking at the on-chain and tokenomics of most altcoins today, there is a very clear common point:

• Circulating supply is increasing steadily every day

• Token unlocks are happening continuously

• Incentives, liquidity mining, airdrops… all create real selling pressure

Meanwhile:

• Net inflow of stablecoins into altcoins is not increasing

• Spot volume mainly comes from short-term traders, not long-term holders

• Positive funding but thin open interest → just a slight shake is enough to cascade

In other words:

supply increases – demand does not increase, so what drives the price up?

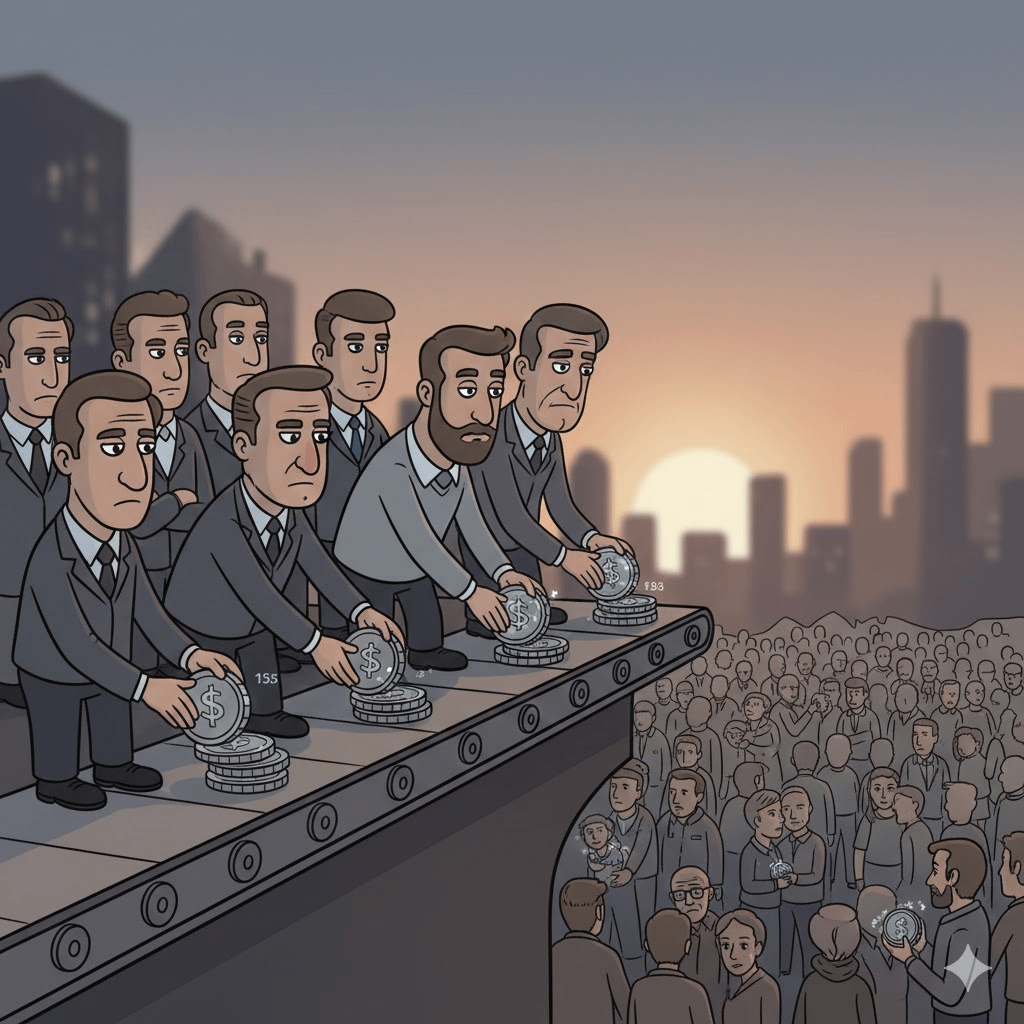

2. Trust has been 're-priced' by the market

The market is not foolish.

After too many projects:

• Beautiful roadmap

• Good narrative

• Strong KOL shills

… but in the end, the token is just an exit tool, investors are starting to understand one thing:

Not every project that builds needs a token.

And not every token deserves long-term value.

On-chain, this is very clearly shown:

• The number of long-term holding wallets is decreasing

• Holders are gradually distributing at high price areas

• Tokens after TGE often lose value benchmarks faster than previous cycles

This is not panic.

This is an adjustment of expectations.

3. Cash flow is choosing places with 'reasons to stay'

While altcoins are struggling to maintain prices, big cash flow is prioritizing:

• Stocks & Real Estate: assets that generate cash flow, valued based on profits.

• Gold & Silver: safe havens against geopolitical risks and inflation.

• Traditional ETFs: yields are not too high, but transparent and have protective legal frameworks.

Compared to holding a token:

• No cash flow

• No ownership rights

• Price depends entirely on liquidity

… then the fact that cash is leaving altcoins is a very normal reflex.

4. Narratives are no longer enough to pull the entire market

L2, AI Crypto, DePIN, RWA… are not wrong narratives.

But the problem is:

• Too many similar projects

• Real users are much fewer than farming users

• Actual revenue is not enough to offset the amount of tokens issued

On-chain shows:

• TVL is increasing but revenue is not increasing proportionally

• Active addresses cannot be maintained after the incentive

• Most liquidity only circulates among projects with the same narrative

This is not a growth ecosystem.

This is the liquidity being chopped up.

5. If there is an Altcoin Season, it will be very different

Altcoin Season (if any) will not be:

• Buying a basket of coins randomly

• Holding and waiting for the market to pull

But it will be:

• Only a very few projects attract real cash flow

• Has Real Yield, not just APR on paper

• Has products being used, not just existing to 'decorate the ecosystem'

The rest will fall into the state:

Tokens are still trading

Charts are still running

But no longer have long-term investment value

The final "Close" for everyone 🔥

Altcoins are not dead.

But the easy period is over.

In the current context, without risk management, not understanding tokenomics, and not looking on-chain – while still dreaming of 'Altcoin Season saving accounts' – it is very easy to become liquidity for others to exit.

This market no longer rewards naivety.

It only rewards those who understand what game they are playing.