January 2026 is exposing something MASSIVE about asset behavior and the divergence between precious metals and Bitcoin is telling us exactly where smart money is positioning.

Gold: Absolute Dominance

Gold just crushed through $5,163per ounce - a new ALL-TIME HIGH. Not a retest. Not consolidation. Pure price discovery into uncharted territory.

Honestly, this is institutional capital flowing into the ultimate safe haven as macro uncertainty intensifies. Gold breaking ATHs while everything else consolidates is SCREAMING something.

Silver: The Sleeper That Woke Up

Silver absolutely EXPLODED tripling from its 2025 lows to trade near $120 per ounce by late January.

3x move. In months. While most assets consolidated.

Silver’s industrial demand + monetary premium + supply constraints = the most underrated asymmetric play in markets. When silver moves, it MOVES.

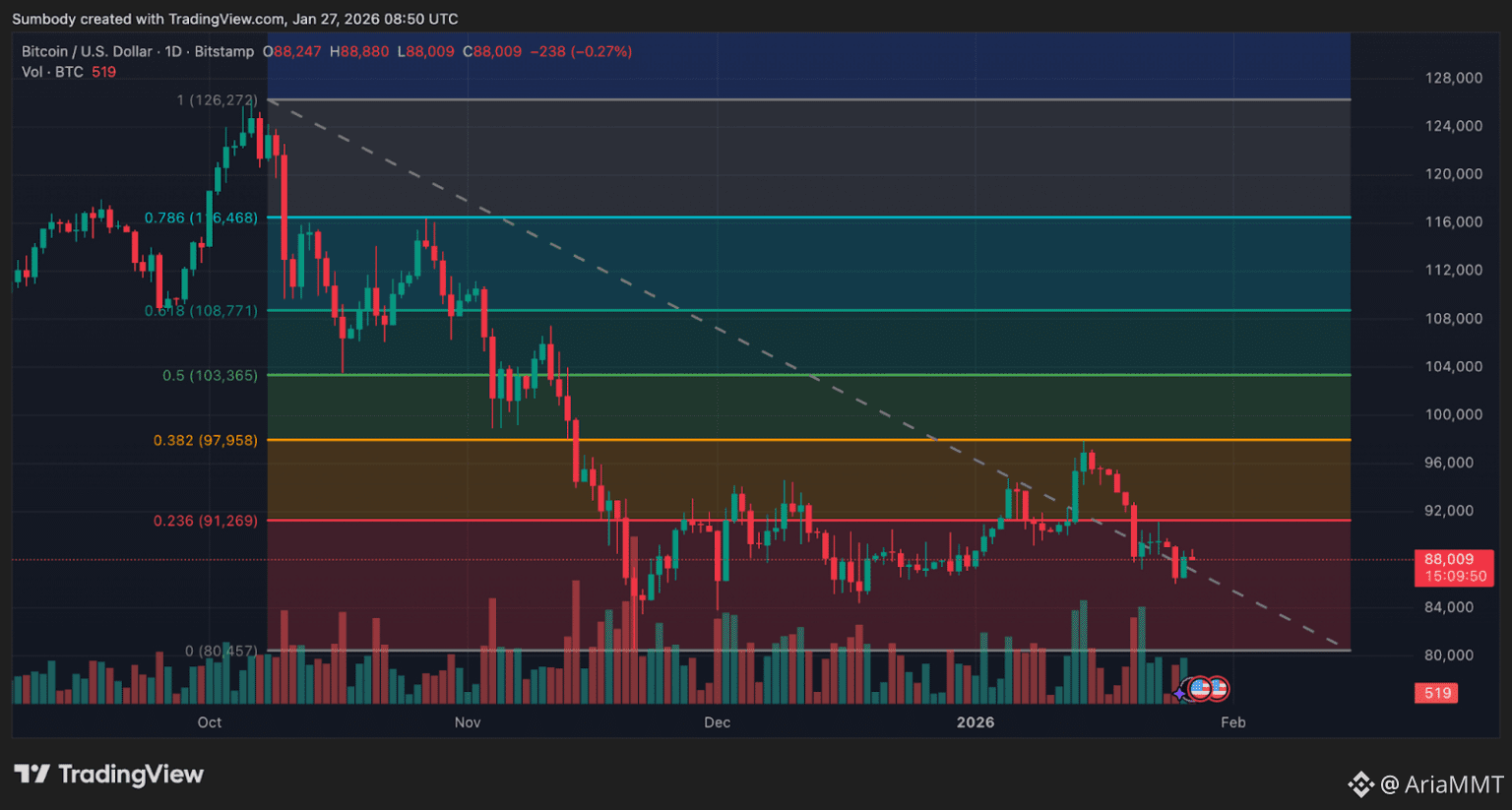

Bitcoin: Healthy Consolidation or Warning Sign?

Bitcoin struggled to reclaim $100K after hitting $126K in 2025. Currently consolidating, digesting gains, working through profit-taking.

But here’s the thing: #bitcoin Bitcoin at $100K IS the new base. The fact that six figures is now “consolidation range” and not “euphoric top” shows how far we’ve come.

What This Divergence Means

Each asset is responding to different forces:

Gold = $5,150 ATH → Macro fear, inflation hedging, central bank buying, geopolitical instability

Silver = 3x from lows → Industrial demand surge, solar/EV adoption, monetary demand awakening

Bitcoin = $100K consolidation → Profit-taking after 2025 run, institutional accumulation, waiting for next catalyst

The Bullish Thesis

This isn’t bearish divergence - it’s SECTOR ROTATION.

<<Gold hitting ATHs = confirmation that inflation/macro concerns are REAL

<<Silver tripling = confirmation that precious metals bull market is EARLY

<<Bitcoin consolidating at $100K = healthy base-building for next leg up

When gold makes new ATHs, it validates the entire hard money thesis. Bitcoin consolidating while #GOLD runs doesn’t mean Bitcoin is done - it means Bitcoin is LOADING for the next move.

What Smart Money Sees

Gold at $5,150 isn’t competing with Bitcoin at $100K. They’re complementary.

<<Gold = proven store of value, 5,000 year track record, central bank buying

<<Silver = industrial + monetary demand, most undervalued metal

<<Bitcoin = digital scarcity, tech adoption, generational wealth transfer

All three can win. All three ARE winning.

The Setup

Gold breaking ATHs while Bitcoin consolidates is EXACTLY what happened in early 2020 before Bitcoin’s massive 2020-2021 run.

Precious metals lead → Bitcoin follows → Altcoins explode.

We’re in the “precious metals lead” phase right now.

Bottom Line

<<Gold: $5,150 ATH = macro thesis confirmed

<<Silver: 3x move = precious metals bull market validated

<<Bitcoin: $100K base = next leg loading

Imo, this is sector rotation signaling STRENGTH across hard assets.

The real question isn’t “why isn’t Bitcoin at ATH?”

It’s “are you positioned for when Bitcoin catches up to gold’s momentum?”

Because when BTC breaks out of this $100K consolidation with gold already at $5,150…

That’s when things get REALLY interesting.