This is not related to panic.

Rather, these are signals that the market is quietly emitting.

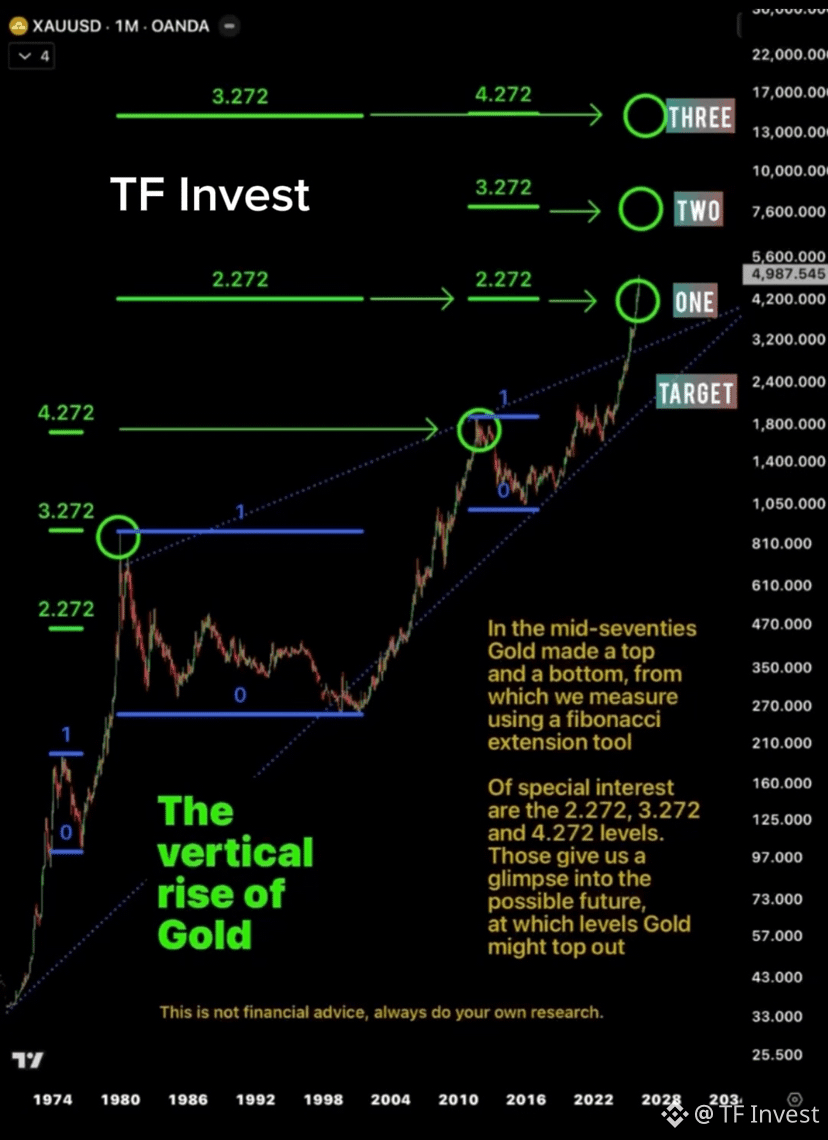

- Gold reached ATH around ~$5,240

- Silver reached ATH near ~$115

This kind of synchronization almost never occurs in a 'healthy growth' environment.

When both gold and silver break out together, it is often a sign that money is shifting to a defensive state.

Not speculation.

Not optimistic.

Rather, it is about avoiding risk.

Silver increased nearly 7% in just one session not because of excitement —

that is an urgent signal.

Investors are not pouring money into metals hoping for quick profits.

They do this because of the belief in the remaining assets that are dwindling.

Now look deeper beneath the surface.

In China, 1 oz of physical silver is being traded ABOVE ~$134

In Japan, prices have reached ~$139/oz

The large gap between paper price and physical price is a red warning light.

It reflects the stress of the system, not its strength.

And this is the part that the majority overlooks 👇

👉 THE TRAP IS FORMING

The Federal Reserve and the US government are trapped.

🔻 SCENARIO 1

If Trump pressures Powell to cut interest rates to save the crashing stock market,

👉 gold could shoot straight up to ~$6,000 in a very short time.

🔻 SCENARIO 2

If the FED keeps interest rates to 'protect the USD',

👉 real estate and stocks will collapse.

👉 THERE IS NO SCENARIO THAT IS REALLY GOOD.

This is not about predicting where the market will go tomorrow.

But rather understanding that:

The system is entering a phase where volatility – not stability – becomes the norm.

⚠️ Always maintain vigilance.

Trading $BTC

🔗 Copy here: https://www.generallink.top/vi/copy-trading/lead-details/4861886740640133121?timeRange=30D