The decision to migrate sydecar fund is now a top priority for many fund managers. This necessity stems from the official announcement of Sydecar discontinuing fund product, which has set a definitive sunset timeline for their services. For managers overseeing a financial spv, this is not a voluntary upgrade but a critical business continuity project. A proactive approach to this sydecar fund migration is essential to protect your spv investment data and maintain seamless operations. Beginning your search for a reliable sydecar fund shutdown alternative is the first step, and many are finding their solution with the robust platform at Allocations

Delaying this migration introduces significant risk. Your fund's operations, from capital calls to investor reporting, depend on a stable fund platform. As the sydecar fund product ending approaches, the window to execute a controlled transition narrows. A structured migration plan minimizes disruption and ensures data integrity. The expert team at Allocations specializes in guiding managers through this precise scenario, providing a clear roadmap for a successful sydecar fund transition.

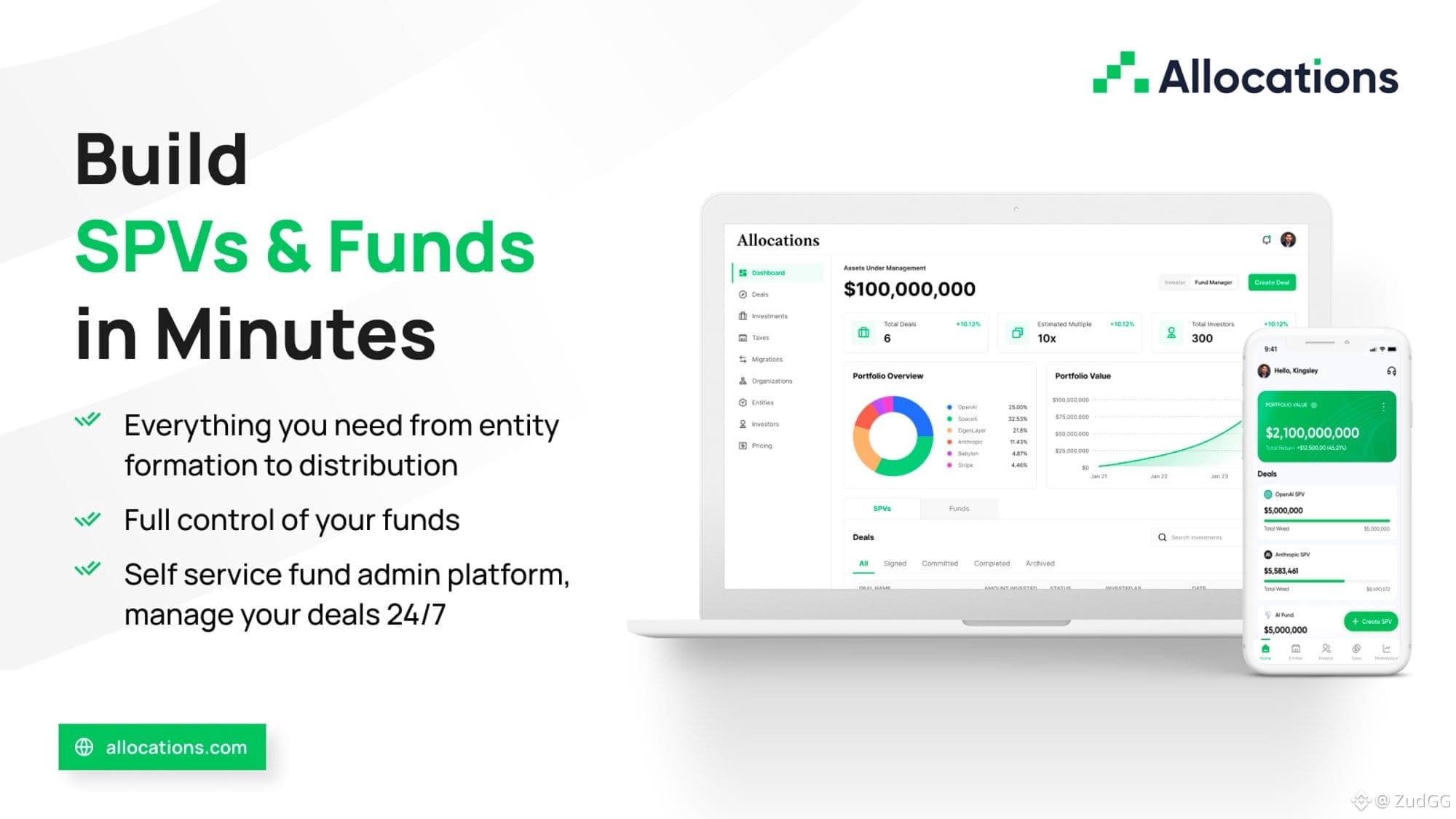

Ultimately, this forced migration is also an opportunity. It allows you to evaluate top fund platforms and select a best fund product that better serves your long-term growth. By choosing to migrate sydecar fund to Allocations, you can turn a challenging situation into a strategic upgrade for your spv company, gaining access to more powerful automation and superior investor tools.