In the hustle and bustle of the crypto market in 2026, we witnessed countless Layer 1s, boasting 'high performance', fall into the same trap: when a meme goes viral or a wave of NFTs arrives, public chains that originally advocated for inclusive finance instantly become a game for the rich, with gas fees skyrocketing to a desperate level.

However, @Plasma has taken a completely different path. It adopts an almost 'stubborn' philosophy of subtraction: not trying to be everything, but born for the flow of stablecoins.

This transformation from 'amusement park' to 'payment infrastructure' is the key to Web3's true move towards mass adoption.

1️⃣ Reconstruction of logic: Why is 'boring' the ultimate realm of finance?

Most Layer 1s pursue 'maximization of use cases', while Plasma pursues 'minimization of interference'.

Physical isolation from interference: In the world of Plasma, there are no meme traffic that blocks blocks, nor sudden NFT minting trends that push Gas fees to unpredictable highs.

Consistency of expectations: For global remittances or merchant payments, reliability is far more important than novelty. Only when the transfer process becomes mundane, predictable, and fast can traditional business power dare to enter on a large scale.

Sub-second settlement hard requirement: The sub-second settlement achieved by Plasma is a lifeline for remittances and merchant checkouts. This performance makes it more like a dedicated digital financial line rather than a crowded public road.

2️⃣ Restraint of consensus: The 'defensive' design of PlasmaBFT's consensus mechanism is the culmination of its philosophy of restraint.

Low-latency pipeline design: The PlasmaBFT pipeline minimizes network latency by restricting the logic of block production.

Functional self-restraint: It deliberately limits the complexity of logic that can run on-chain, with a very clear purpose—ensuring that the flow of stablecoins is never overwhelmed by irrelevant activities.

Balanced evolution: In the adjustments at the end of 2025, the network expanded throughput limits, but this was not to experiment with new features; rather, it was to allow higher daily transaction volumes while maintaining predictability.

3️⃣ The warmth of payment: Gasless is not a gimmick.

To thoroughly implement its infrastructure positioning, Plasma has introduced a highly practical payment mechanism: Sponsoring USDT transfers: The payment system eliminates the psychological barrier for ordinary users to buy Gas coins before transferring by sponsoring the basic USDT transfer Gas fees.

Precise upper limit management: To prevent the system from being maliciously abused, this sponsorship is capped and controlled, and this 'limited freedom' precisely reflects the consistency of the system.

The anchor point of real value: Data does not lie; ConfirmoPay has a transaction volume of about $80 million per month on Plasma. Although there is no so-called 'hype din', it represents real usage demand rather than speculative book fluctuations.

📉 January 28: 'Value return' under the fog of the market

After analyzing the hardcore logic of Plasma, we must return to today’s market situation.

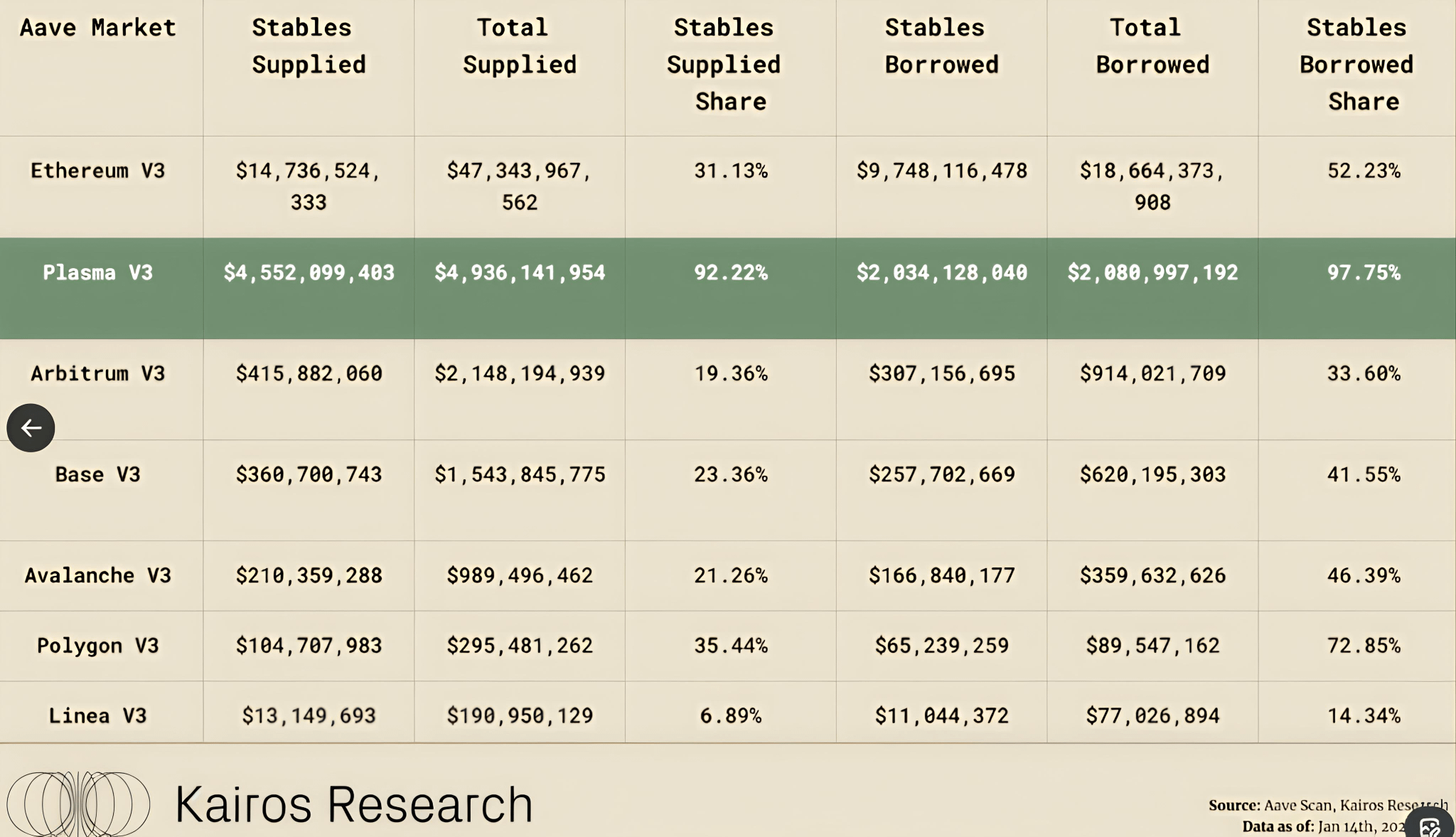

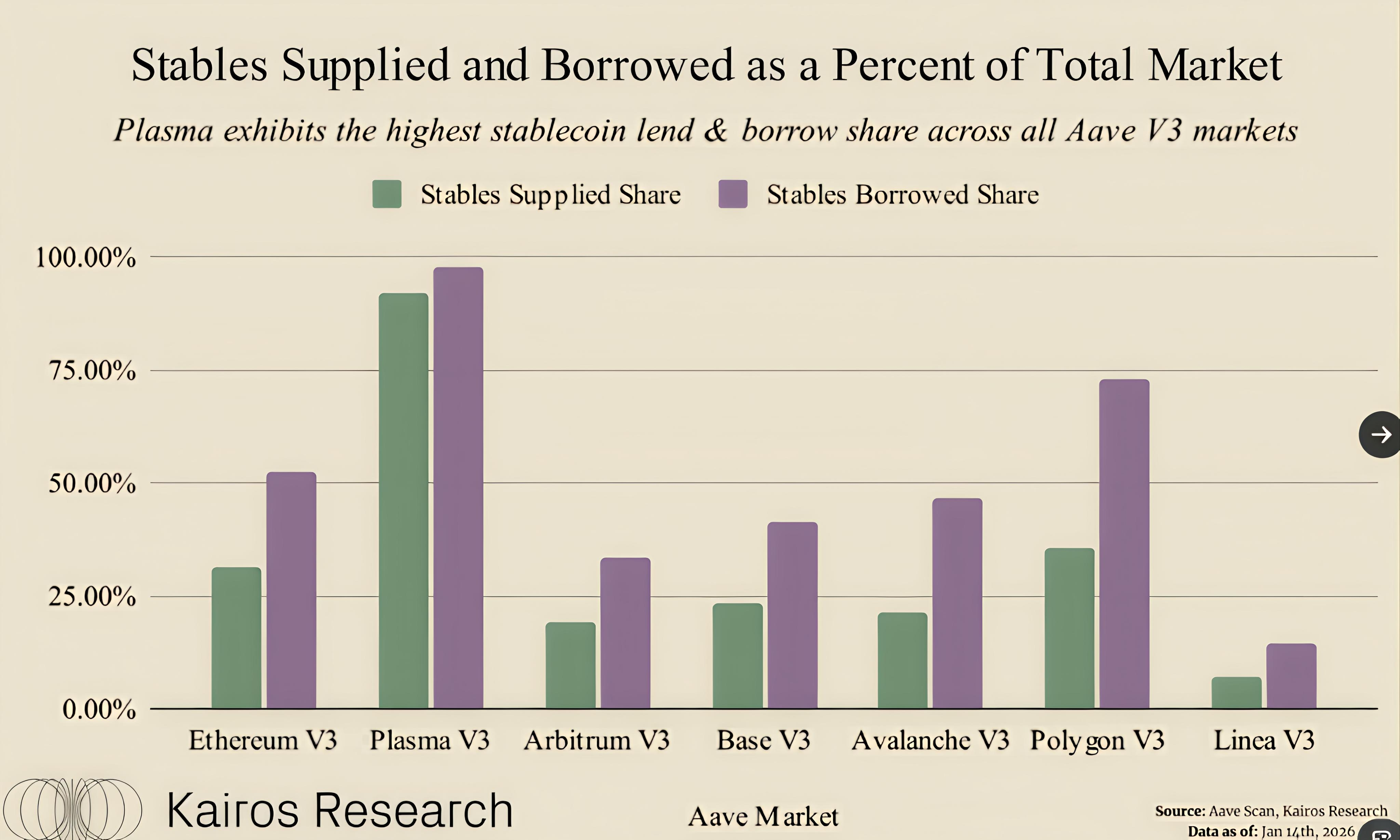

Liquidation data: The 'late spring chill' for longs. According to Coinglass monitoring, the total liquidation amount across the network in the past 24 hours is nearly $300 million, with long positions accounting for about $68.5 million. This typical 'de-leveraging' behavior illustrates the instability caused by excessive speculation. In contrast, Plasma’s pursuit of 'consistency' demonstrates on-chain lending resilience (Aave V3 stablecoin loan proportion 97.75%) during volatile markets, making it even more precious.