Bitcoin has been extremely volatile this week, fluctuating between 88,900 – 86,000. Let’s break down the main reasons and factors behind this movement:

1️⃣ Gold and Metals News 🪙

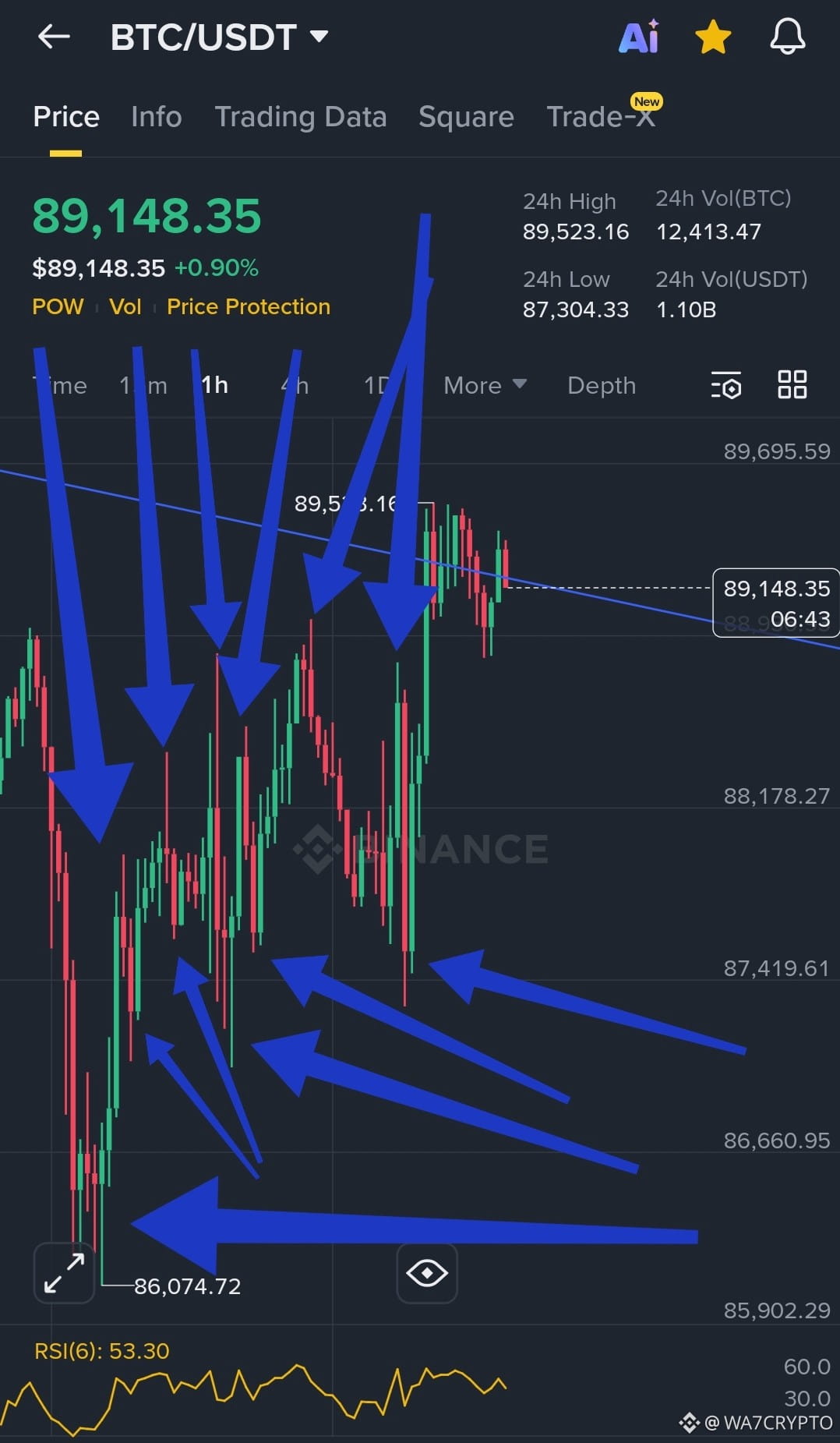

🔵 Recently, there has been strong liquidity pressure

🟢 Liquidity has shifted from the crypto market to gold and metals

🔵 This shift caused unusual market movements

🟢 As a result, Bitcoin dropped slightly but noticeably

2️⃣ U.S. News and Political Factors 🌍

🔵 Potential war with Iran

🟢 U.S. government shutdown

🔵 Statements by Donald Trump

🟢 U.S. economic data and results

🔵 Tariff announcements

🟢 Political tensions between Europe and the U.S.

🔵 Whenever Trump announced tariff increases:

🟢 We observed immediate market drops

🔵 This factor is somewhat negative for Bitcoin

3️⃣ ETFs and Liquidity 💼

🔵 Lack of strong liquidity inflows into ETFs

🟢 This includes BTC, Ethereum, and other crypto funds

🔵 U.S. news and political tension created pressure on investors

🟢 Preventing them from entering the funds

🔵 Therefore, in most recent days, we saw liquidity outflows

🟢 Everyone remembers the effect of ETFs before the rise to 124,000, and how the market behaved back then

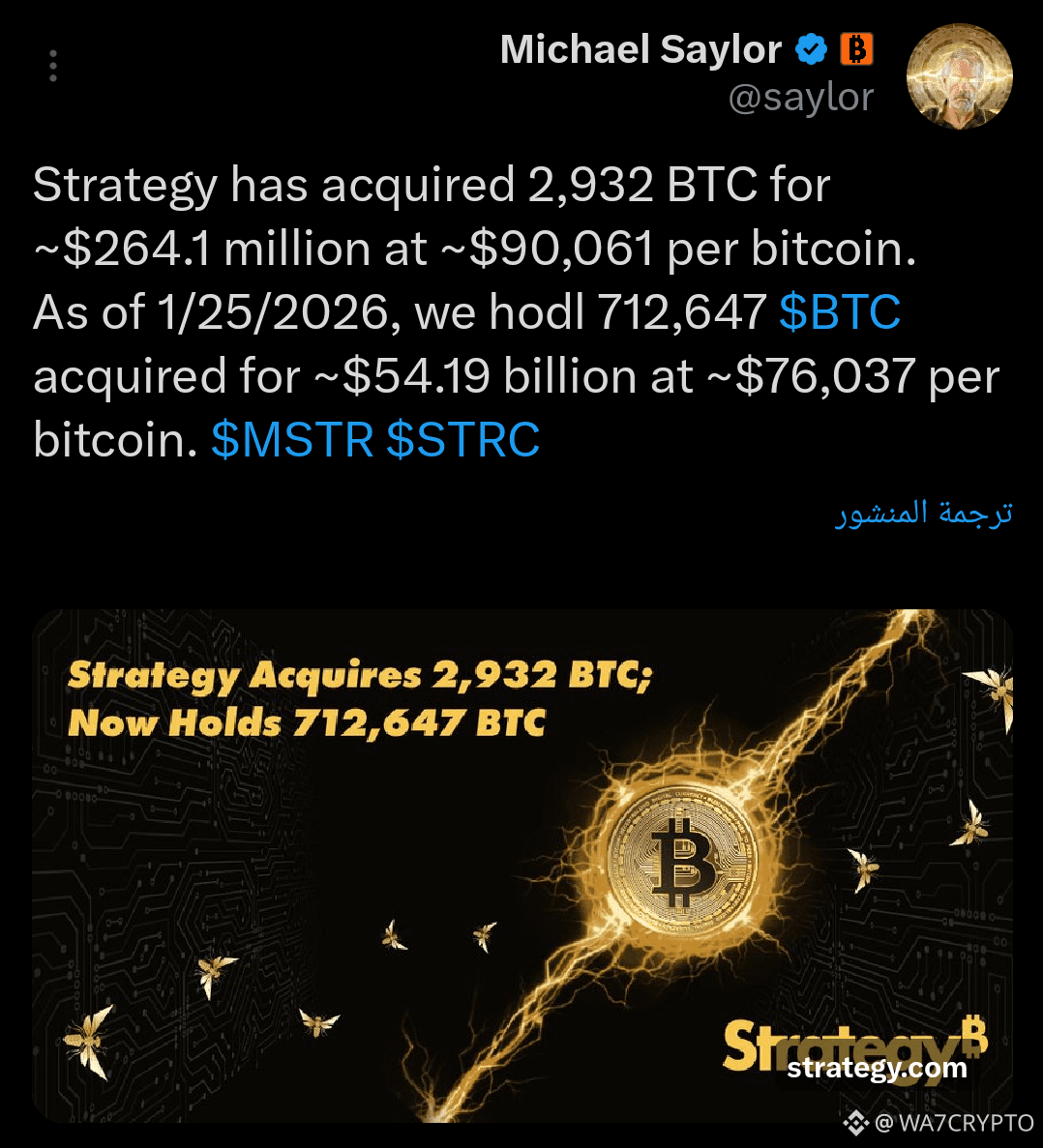

4️⃣ Michael Saylor News 📰

🔵 News about Michael Saylor buying Bitcoin often spreads

🟢 The market expects a price increase after the news

🔵 But when the purchase is announced, Bitcoin often drops

🟢 The price Bitcoin drops from is not the same as the price Saylor bought at

🔵 Example:

5️⃣ Miners ⛏️

🔵 Most Bitcoin miners hold their coins

🟢 Some wait for price increases before selling

🔵 Others sell right after mining

🟢 Reasons for selling often include electricity bills and operational costs

🔵 This behavior is normal

🟢 Especially since the next halving is far away (around 2 years and 10 months)

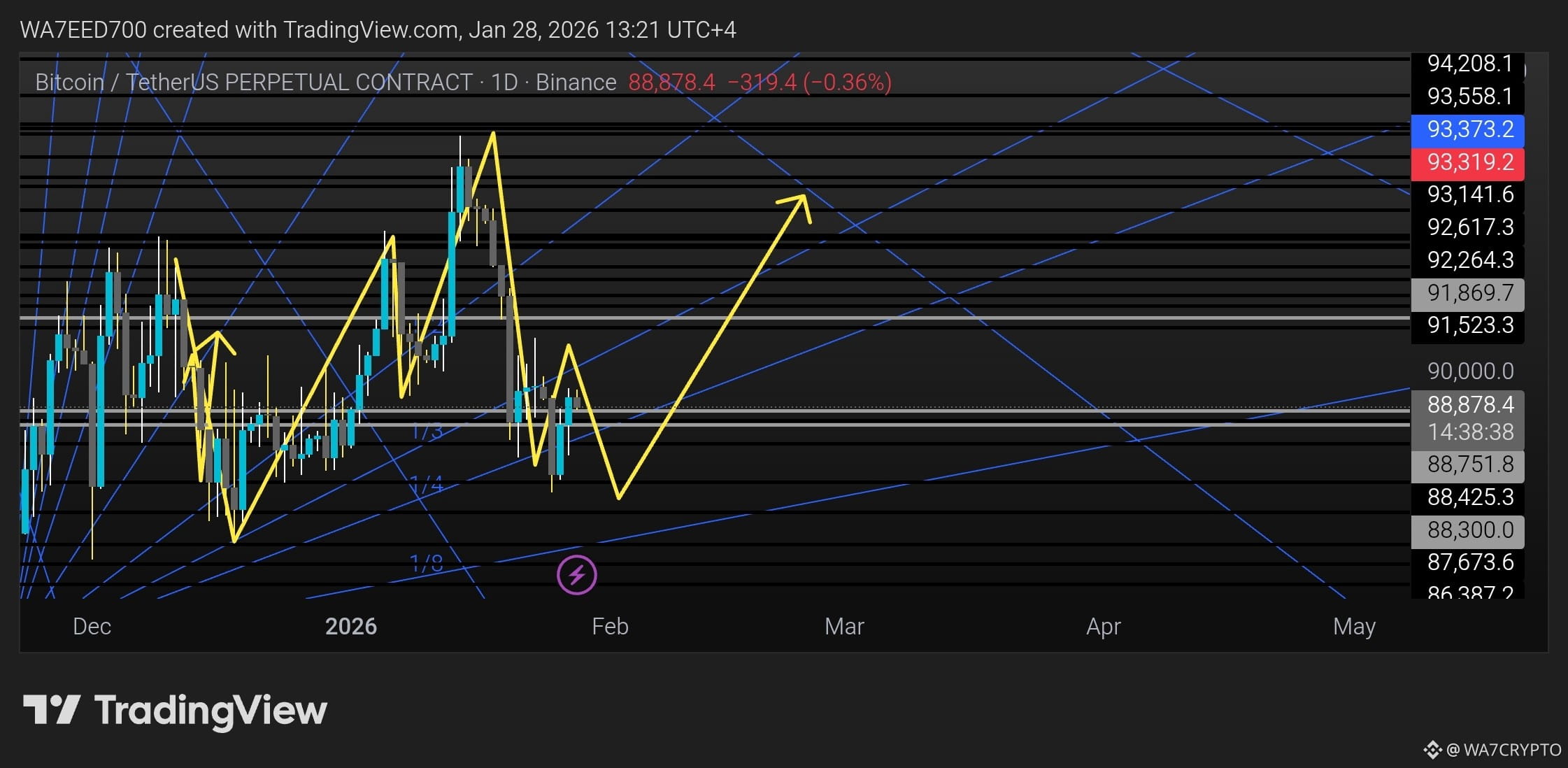

6️⃣ Technical Analysis 📊

🔵 Bitcoin dropped 6 times and rebounded 6 times

🟢 This confirms that economic news, gold, metals, and other factors had a very strong impact

🔵 However, despite this pressure, Bitcoin rebounded after every drop

🔵 A few days ago, I predicted that the movement would be: drop first, then rise

🟢 I expected the drop to be the first phase and the rise the second

🔵 This is what happened so far

🟢 Although with high volatility

🔵 I predicted a negative day with a slightly bearish close and a red candle

🟢 This occurred exactly as expected

🔵 Then a red candle appeared

🟢 Followed by sideways rebound and a 1D green daily close

Before: (initial drop on the same day)

After: (rebound on the same day)

7️⃣ Indicators I Use 🔧

🔵 RSI

🟢 Gann Fan (Trend Gann)

🔵 MACD

🟢 Volume

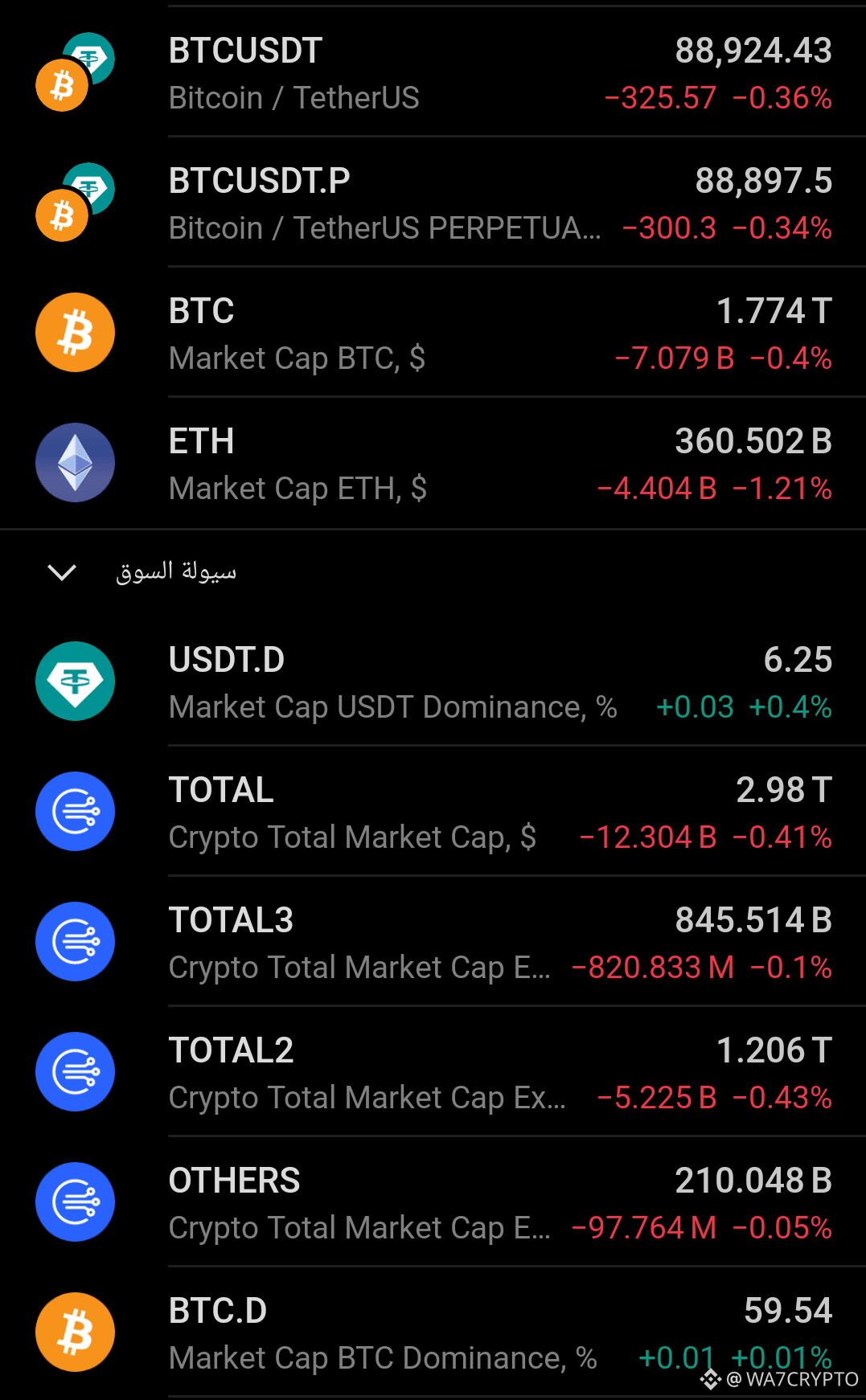

8️⃣ Top 3 Important Market Indicators 📌

USDT.D

🔵 Shows liquidity inflows or outflows

🟢 Rising = outflow / Falling = inflow

TOTAL

🔵 Shows overall liquidity movement across all crypto assets

🟢 Even Bitcoin is correlated with it

BTC

🔵 Bitcoin-specific indicator

🟢 Shows total market capitalization

🔵 Moves similar to Bitcoin price

🟢 But tracks market cap value

🔵 Very useful to monitor Bitcoin movements

These are the key points that will help you better understand Bitcoin’s price movements ✅

#FedWatch #VIRBNB #TokenizedSilverSurge #TSLALinkedPerpsOnBinance #StrategyBTCPurchase