Plasma is building a Layer 1 that treats stablecoins as the main product, not just another token you can move around. The whole idea is to make stablecoin payments feel instant, low friction, and predictable even when volume gets heavy, while still staying fully EVM compatible so builders can deploy familiar contracts and tooling without learning a new execution environment.

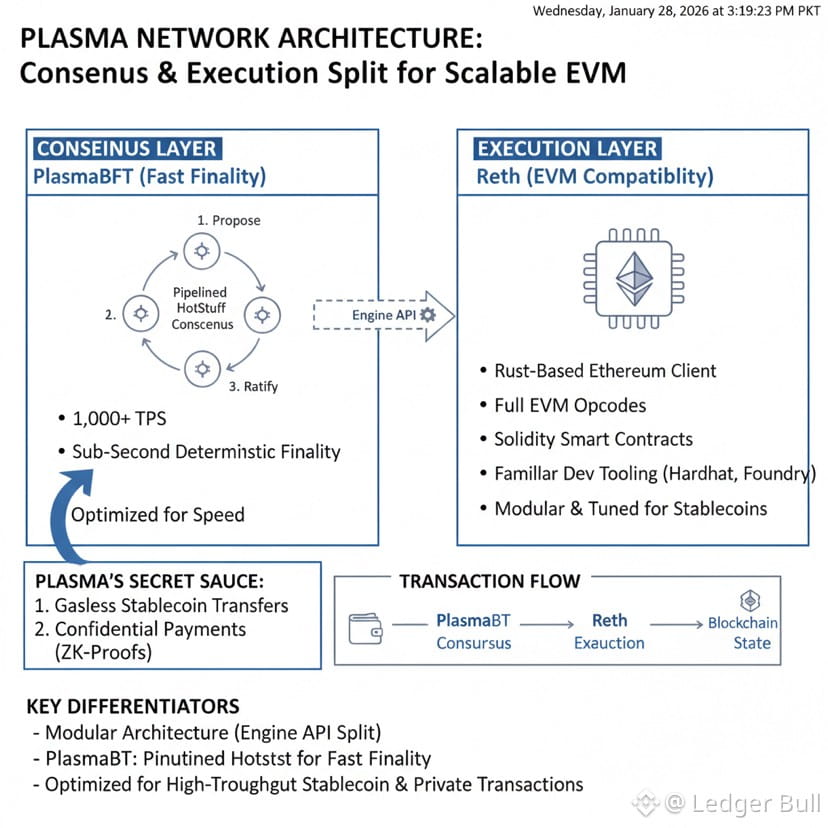

Plasma is structured like a clean split between fast consensus and Ethereum style execution. PlasmaBFT handles sequencing and quick finality, while Reth powers the EVM execution path through the same general engine style approach used in modern Ethereum architecture. That matters because it lets Plasma optimize speed and settlement behavior without breaking the developer expectations that come with EVM compatibility.

Plasma really leans into its identity is stablecoin native infrastructure. Instead of pushing stablecoin user experience into wallets and third party relayers, the docs describe protocol level modules that the chain operates. The headline example is gasless USDt transfers, designed so simple USDt sends can happen without the user paying a fee each time, with controls aimed at preventing abuse and keeping the mechanism sustainable.

Plasma also talks about stablecoin first gas through a custom gas token approach, where users can pay fees in whitelisted assets such as stablecoins rather than needing to hold the native token just to transact. This is presented as an active development area, and it fits the same philosophy as gasless transfers, reduce the extra steps that make stablecoin payments feel like a crypto workflow instead of a normal payment flow.

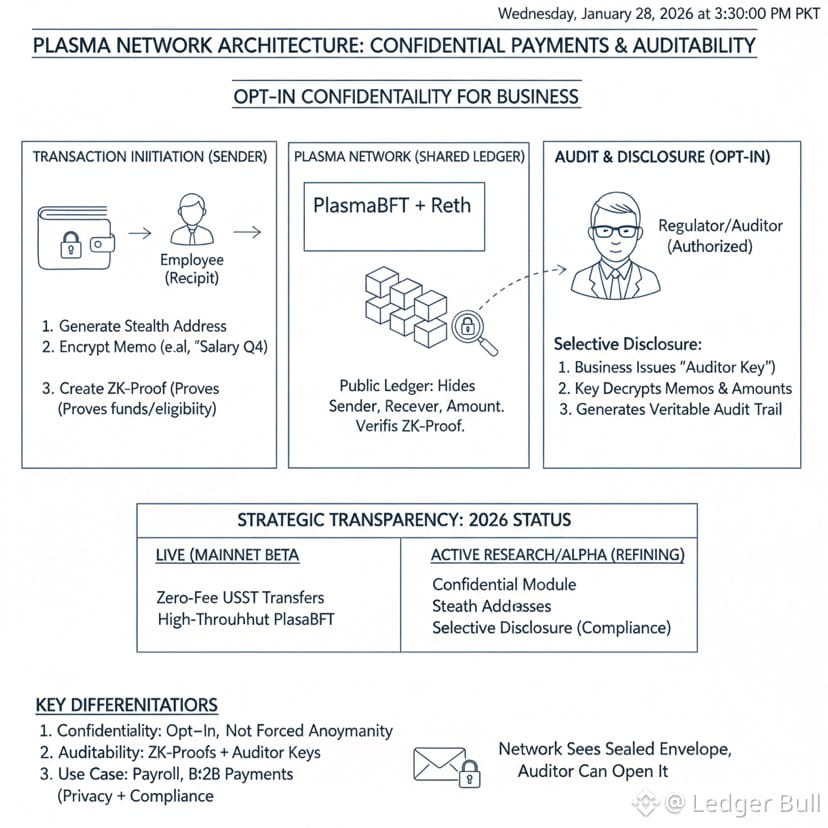

Another part of the design is confidential payments, positioned as an opt in module focused on real payment and settlement situations like payroll or business transfers where privacy is useful but auditability still matters. Plasma is direct that this is not a full anonymity system, and that details are still evolving, which is important because it sets expectations around what is live today versus what is being researched and refined.

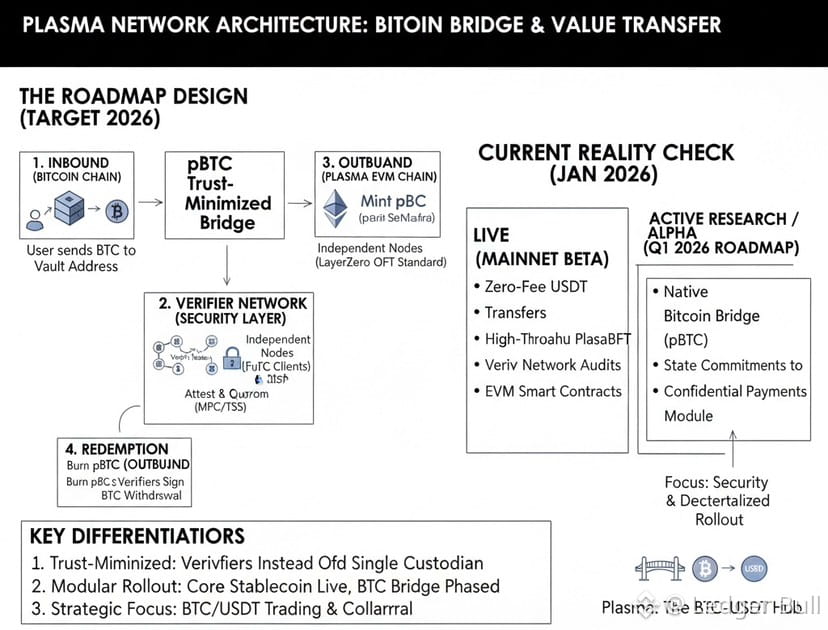

Plasma documents a bridge architecture aimed at bringing Bitcoin backed value into its EVM environment in a more trust minimized way over time. The key reality check is that the bridge is described as under active development and not live at mainnet beta, so it is better to treat it as a roadmap pillar rather than a current feature.

It shared the stablecoin first thesis and the PlasmaBFT plus Reth direction earlier, then pushed into testnet, and later announced mainnet beta with a staged rollout approach for zero fee USDt transfers. Plasma also states that not all features are available at day one and that rollout happens progressively.

XPL is the native token tied to network economics and security, while Plasma tries to remove the need for users to hold XPL for simple stablecoin transfers. The tokenomics page describes a 10 billion initial supply at mainnet beta, defined allocations with unlock schedules, an EIP 1559 style base fee burn model, and validator rewards that only activate when external validators and delegation go live. The intention is clear, stablecoin payments can be simplified at the surface while the chain still preserves incentive alignment for validators and long term security.

Plasmas can is actively reporting the last 24 hour network window with live moving totals. As of the latest snapshot captured today, it shows roughly 399,288 transactions over 24 hours, around 3,742 new addresses, about 229 contracts deployed, and about 935.98 XPL in total transaction fees for that same 24 hour period.