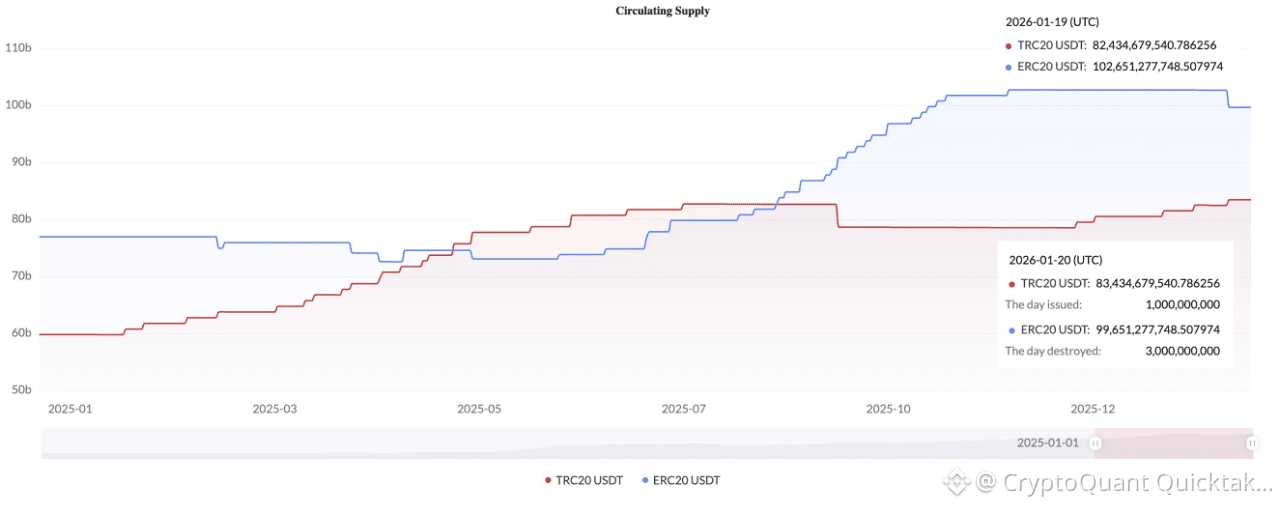

A drop in ERC-20 stablecoin supply is often framed as “liquidity leaving crypto.” The numbers tell a different story: Liquidity is moving across networks.

What happened (with dates)

USDT (TRC-20, Tron)

• Jan 19, 2026: 82,434,679,540

• Jan 20, 2026: 83,434,679,540

• Change: +1.0B USDT in one day

This was a direct mint on Tron.

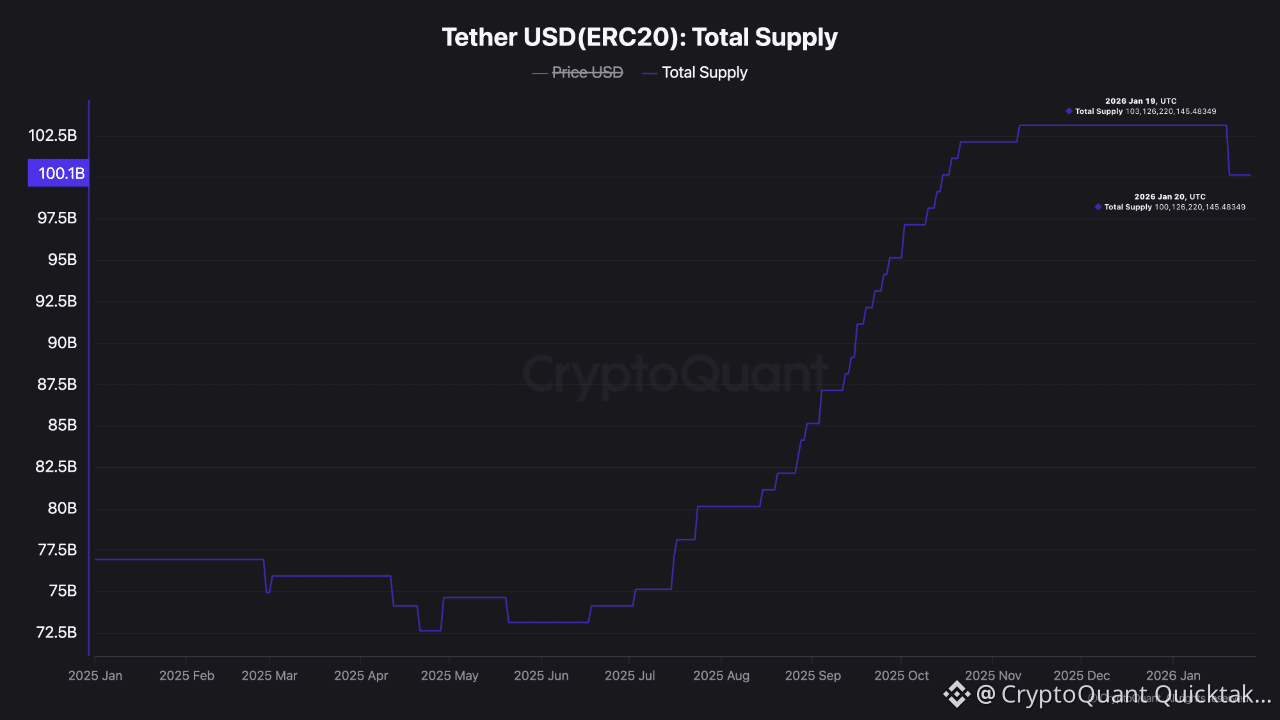

Ethereum (ERC-20)

• USDT ERC-20: -3.0B

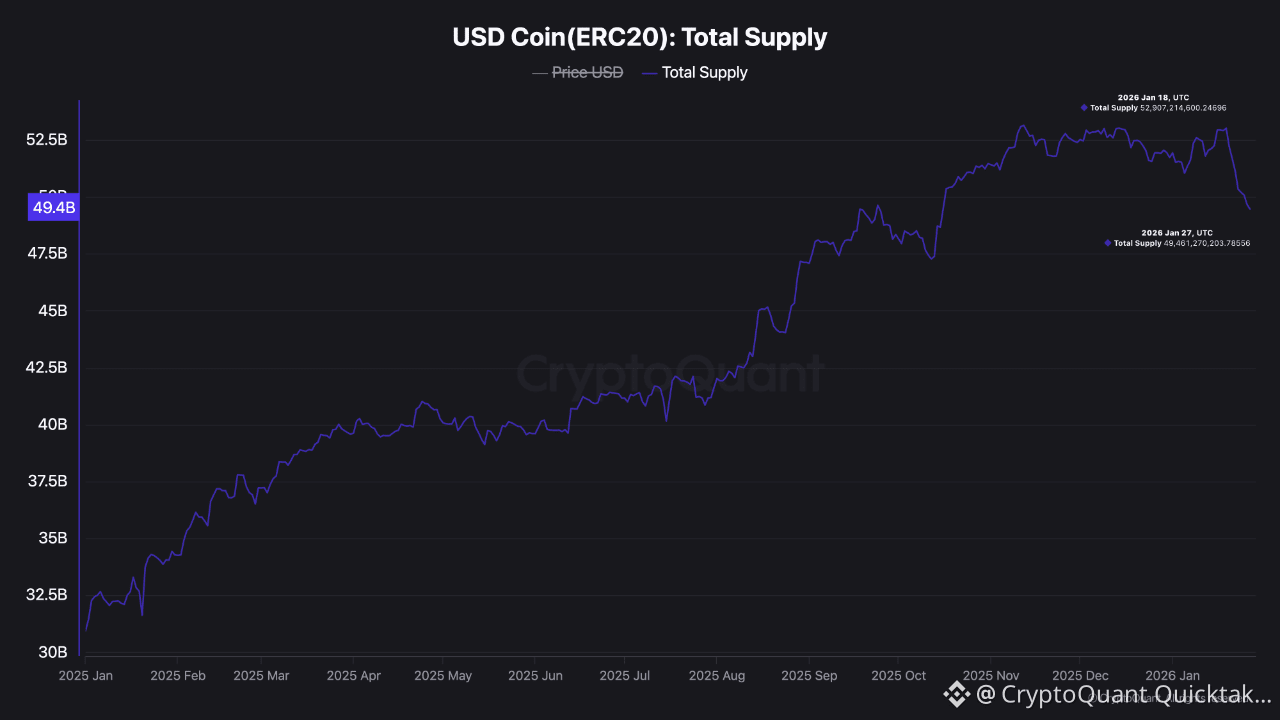

• USDC ERC-20: -3.55B

• Total: ≈ -6.5B stablecoins removed from Ethereum

Timing matters: The TRC-20 increase came right after the ERC-20 contraction.

What it means:

This isn’t a clean “exit to fiat.” It’s a shift in where liquidity sits and how it’s used.

• USDT mainly supports derivatives, OTC settlement, and tactical liquidity - and it regularly migrates to cheaper rails

• USDC is more tied to spot activity and on-chain settlement, making it a cleaner proxy for spot-demand conditions

When USDT + USDC shrink on Ethereum while USDT expands on Tron, the simplest read is: Liquidity is changing rails, not disappearing.

Interpretation:

• Liquidity remains inside the crypto system

• Demand for Ethereum-based settlement has been softening over time

• Positioning looks more defensive, with a preference for derivatives and parked liquidity over spot accumulation

So falling ERC-20 stablecoin supply is:

• Bearish for Ethereum on-chain activity

• Neutral-to-bearish for spot-driven risk

• Not evidence of capital leaving crypto entirely

Bottom line: Stablecoins didn’t vanish - they moved rails 🧸 DYOR

Written by TeddyVision