When I first started paying attention to payment chains, it was not because of throughput charts. It was because of the moments nobody screenshotted. A transfer that “should have” landed, but did not. A merchant staring at a loading spinner. A fee estimate that looked fine, then quietly jumped right as someone pressed confirm. The pattern was boring in the worst way: the fastest rails were often the least dependable when it mattered.

That mismatch is easier to see right now, because the market has its old texture back. Bitcoin is sitting around $89,322 and still swinging intraday by more than a thousand dollars, and ETH is around $3,021 with similarly sharp daily ranges. In that kind of environment, stablecoins become the steady middle layer, not because they are exciting, but because they let people step out of the noise without exiting the system.

You can see it in the numbers. Multiple trackers and market reports have the global stablecoin market around the low $310 billions to $317 billions in early January, an all time high zone, and the framing across those reports is consistent: traders shelter in stables when volatility rises, and that liquidity becomes the foundation everything else leans on. Tether alone is described by Reuters as having about $187 billion USDT in circulation. If you accept that stablecoins are the cash layer of crypto, then the quality of the rail starts to matter more than the raw speed of the chain.

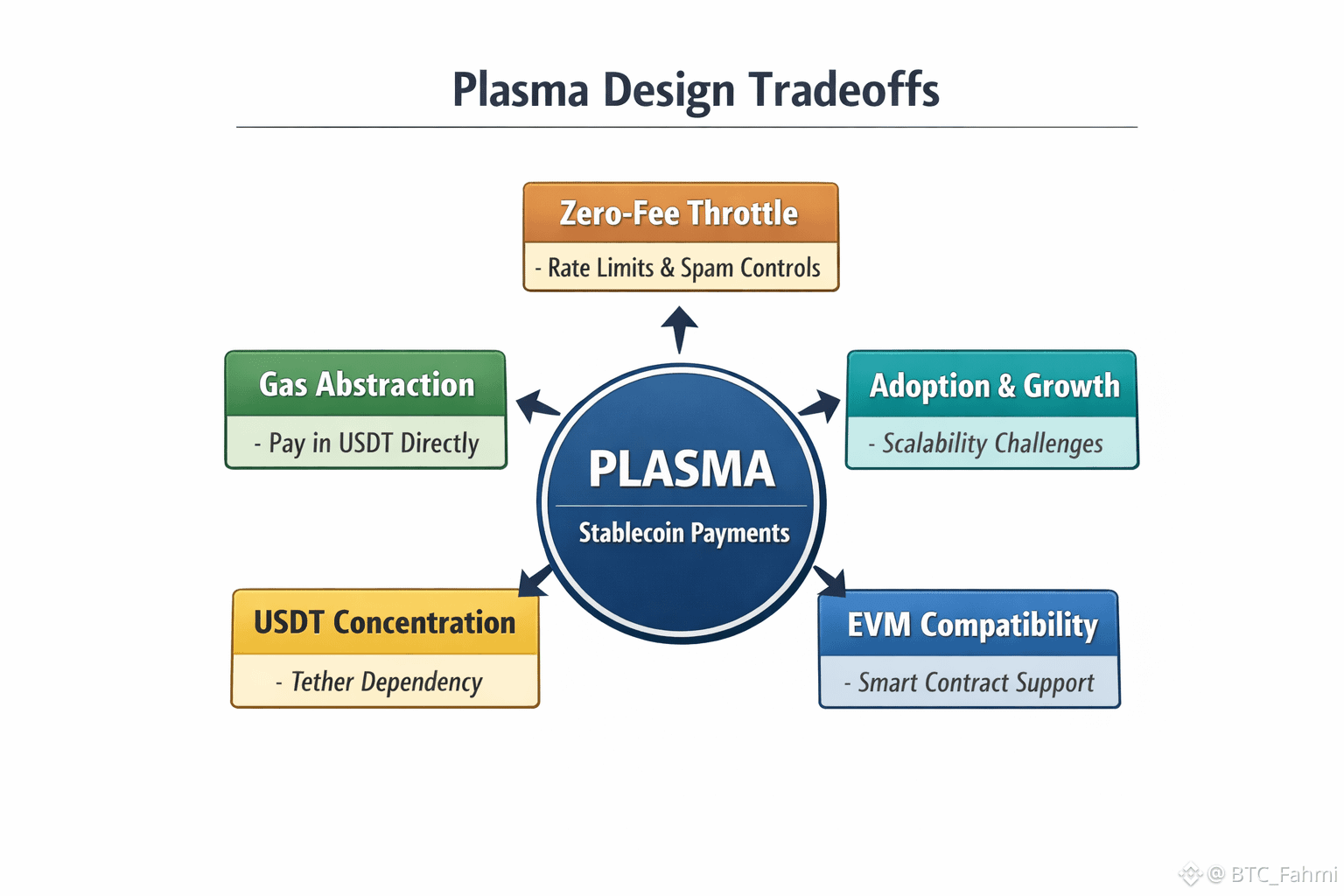

That is where Plasma gets interesting, and not for the reason people usually lead with. Plasma describes itself as a Layer 1 purpose built for USDT payments, with near instant transfers, low or zero fees for USDT, and EVM compatibility so existing tooling can come along for the ride. The obvious headline is speed and cost. The quieter thesis underneath is reliability, meaning the user experience of money that behaves the same way twice.

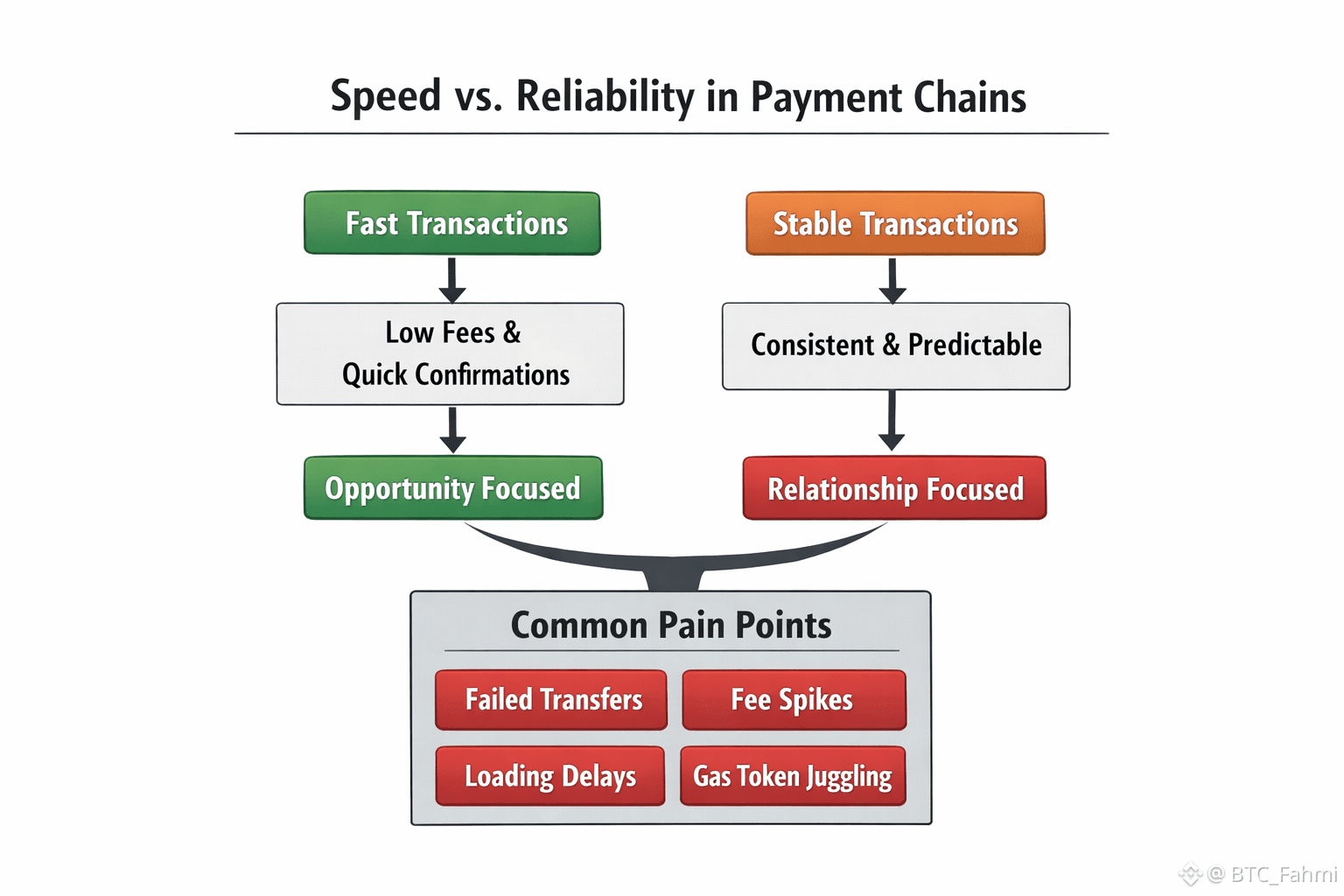

It helps to say what reliability actually means in payments, because people confuse it with latency. Speed is how fast a single transfer confirms under ideal conditions. Reliability is whether the system keeps its promises when conditions are not ideal, during congestion, during partial outages, during fee spikes, during wallet mistakes, during adversarial activity. Payments have a different definition of “works” than trading. In trading, a failed action is a missed opportunity. In payments, a failed action is a broken relationship.

The funny thing is that most major chains are already “fast enough” for a lot of consumer moments. Ethereum fees, for example, have been unusually low lately by several public metrics, with average transaction fee figures hovering well under a dollar and in some datasets around a few tenths of a dollar. Low fees are real relief, but they do not automatically become predictable fees, because averages hide the lived experience. A user does not pay the average, they pay whatever the network demands at the exact minute they hit confirm, and what they remember is the one time it surprised them.

Plasma’s pitch is that you can design around that memory. On the surface, the product claim is simple: USDT transfers can be zero fee, and the network is optimized for stablecoin settlement rather than being a general arena where payments compete with everything else. Underneath, that implies a different set of priorities: the chain is trying to control the variables that create friction, like fee volatility, gas token juggling, and inconsistent confirmation behavior, even if that means narrowing what the chain is for.

That narrowing matters because “raw speed” is often a proxy for “we built a fast database.” Payments are not a database problem. They are a coordination problem across humans, businesses, compliance constraints, and timing. If a merchant has to keep an extra token balance just to pay gas, that is not a technical footnote, it is a support ticket factory. If a chain is fast but frequently requires users to guess fees, that is not efficiency, it is anxiety disguised as flexibility.

Plasma also leans into gas abstraction ideas, where the user experience can be closer to “pay in the asset you are sending” instead of “hold the native coin or fail,” which is one of the most common points where normal people fall off the cliff. Binance’s research summary explicitly describes stablecoin first gas, including fees in USDT via autoswap, plus sub second finality and Bitcoin anchored security as part of its design story. You can argue about the tradeoffs, but you cannot pretend those details are cosmetic. They are the difference between a rail that feels earned and one that feels like a demo.

The other piece people miss is that “zero fee” is not only an incentive, it is a control mechanism. If you remove per transfer pricing, you remove one source of unpredictability for the sender, but you also create new risks: spam pressure, denial of service games, and the need for the network to enforce limits in other ways. The fee is not just revenue, it is a throttle. So the real question becomes where Plasma puts the throttle instead, and how transparent that throttle remains as usage grows. Early signs suggest teams reach for rate limits, priority lanes, or application level gating. If this holds, it can feel smooth. If it does not, it can create a new kind of unpredictability where the fee is zero but the transfer sometimes stalls for reasons users cannot see.

There is also a structural concentration risk that comes from building “for USDT.” The upside is obvious: USDT is the dominant stablecoin by scale, and the market is currently treating stablecoins as the safe harbor asset class inside crypto. The risk is that you are tying the rail to a single issuer’s regulatory and operational reality. Even if the chain is technically reliable, the asset on top of it carries its own dependencies, from reserve management narratives to jurisdictional pressure. That does not invalidate the approach, it just means the foundation is partly off chain.

Zoom out and you can see why the timing is not random. Visa’s head of crypto has been publicly talking about stablecoin settlement as a competitive priority, and Reuters reports Visa’s stablecoin settlement flows are at an annual run rate of about $4.5 billion, while Visa’s overall payments volume is about $14.2 trillion. That gap is the story. Stablecoins are already huge as instruments, but still small as integrated merchant settlement, and the bottleneck is not awareness, it is dependable plumbing that merchants can trust without thinking about it.

This is where Plasma’s angle, when taken seriously, is less about beating Ethereum or Solana on a speed chart and more about narrowing the surface area where things can go wrong. Payments rails win by being quiet. They win when nobody tweets about them, when the system absorbs load without drama, when the user forgets there was a blockchain involved. Plasma is explicitly trying to make the “stablecoin transfer” a first class product rather than a side effect of general purpose execution.

The obvious counterargument is that general purpose chains are improving, and the data supports that in moments like today’s low fee regime. If fees stay low and L2 adoption keeps growing, maybe “payment specific” chains do not get a large enough advantage to justify new liquidity islands and new bridges. That is real. The other counterargument is composability, meaning that the more specialized you get, the more you risk being a cul de sac instead of a city. If a payment chain cannot plug into the wider credit and trading ecosystem, it can feel clean but constrained.

Plasma’s response, implied more than declared, is that specialization is not isolation if you keep the right compatibility layers. EVM support reduces developer friction. A payment first chain can still host lending, card settlement logic, and merchant tooling, it just tries to make the stablecoin transfer path the most stable thing in the room. The question is whether that stability remains true when usage stops being early adopter volume and starts being repetitive, boring, payroll like flow.

What this reveals, to me, is a broader shift in crypto’s center of gravity. In the last cycle, speed was a story people told to other crypto people. This cycle, the pressure is coming from outside, from payments companies, from merchants, from compliance teams, from anyone who does not care about block times but cares deeply about predictable outcomes. The market is already saying stablecoins are the preferred unit of account in volatile weeks, and the next fight is about rails that feel steady enough to carry real obligations.

If Plasma succeeds, it will not be because it was the fastest. It will be because it made reliability feel normal, and made speed fade into the background where it belongs. The sharp observation that sticks for me is simple: in payments, the winning chain is the one that makes you stop checking.