$BTC and spot ETFs have been moving in lockstep.

And there’s one line that separates a nasty correction from a deeper bear phase. ⚠️

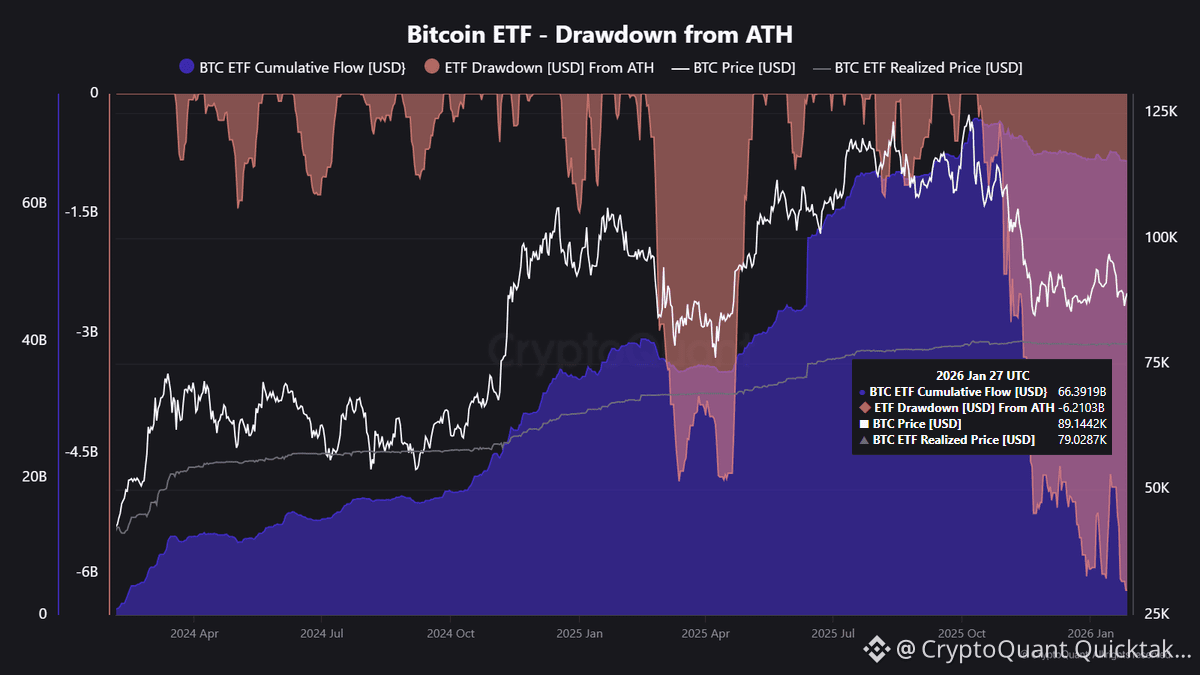

📊 CryptoQuant chart:

🔹 BTC ETF cumulative flow: +$66.4B

🔹 Drawdown from ATH: -$62.1K

🔹 BTC ETF realized price (cost basis): ~$75K

🔹 BTC spot: ~$89K

🧠 What it means:

• 2024-2025 = steady ETF accumulation.

• Price rose with inflows. The relationship is clear.

• After the ATH, inflows stopped building while price kept bleeding. Demand cooled.

⚠️ The real risk:

Lose ~$75K (ETF cost basis), and a big chunk of ETF buyers turn underwater. That’s where selling pressure can snowball.

🧭 Levels I’m watching:

🟢 Support: ~$75K

🔴 Resistance: ~$100K

📌 Takeaway: Above ~75K = ugly correction. Below ~75K = bear risk jumps.

Written by IT Tech