Friends, today let's talk about $ROSE (Oasis Network). This coin has been very strong today, skyrocketing 22.47% to $0.02198. Can it continue to rise? Let's break it down from three dimensions: technical analysis, on-chain data, and fundamentals.

Macroeconomic background: Privacy AI has become a new trend.

In 2026, there is a clear trend in the crypto market — institutions are starting to pay attention to 'Privacy AI'. As AI technology explodes, data privacy issues are becoming increasingly important. $ROSE is right at this point.

Its ROFL mainnet launched last July, focusing on 'trustless AWS', allowing AI to run on the blockchain while protecting privacy. More importantly, traditional giants like Franklin Templeton are piloting projects on Oasis. This indicates that institutions are beginning to take privacy blockchain seriously.

In-depth interpretation of technical indicators

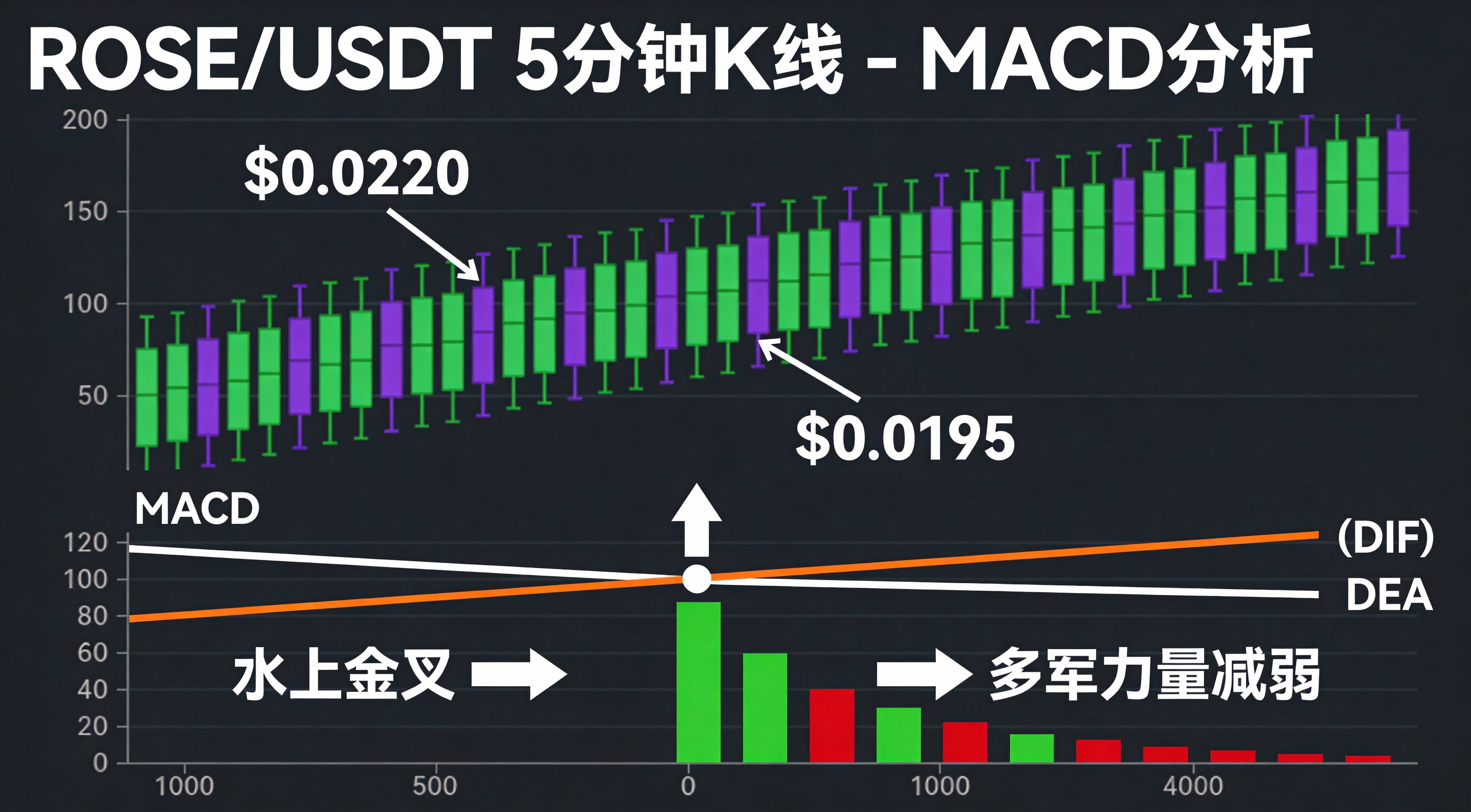

MACD analysis: golden cross is clear but caution is needed

Looking at the 5-minute K-line, the MACD fast line is above the slow line, a typical golden cross pattern. The histogram is positive but shows signs of shortening, indicating that the bulls' strength is starting to weaken.

Fortunately, MACD is still above the zero axis, considered a "water golden cross", relatively safe. The key is to observe: if the price continues to rise but the MACD histogram shortens, a top divergence may occur.

RSI analysis: healthy rising range

Current RSI (14) is at 62.39, not exceeding the overbought line of 70, and clearly above 50, in a neutral to bullish state.

Looking from multiple cycles:

4-hour RSI: 58, just rebounded

Daily RSI: 62.39, healthy rising range

Weekly RSI: 54, medium to long-term trend has just started

This kind of resonance often indicates that the rise has sustainability.

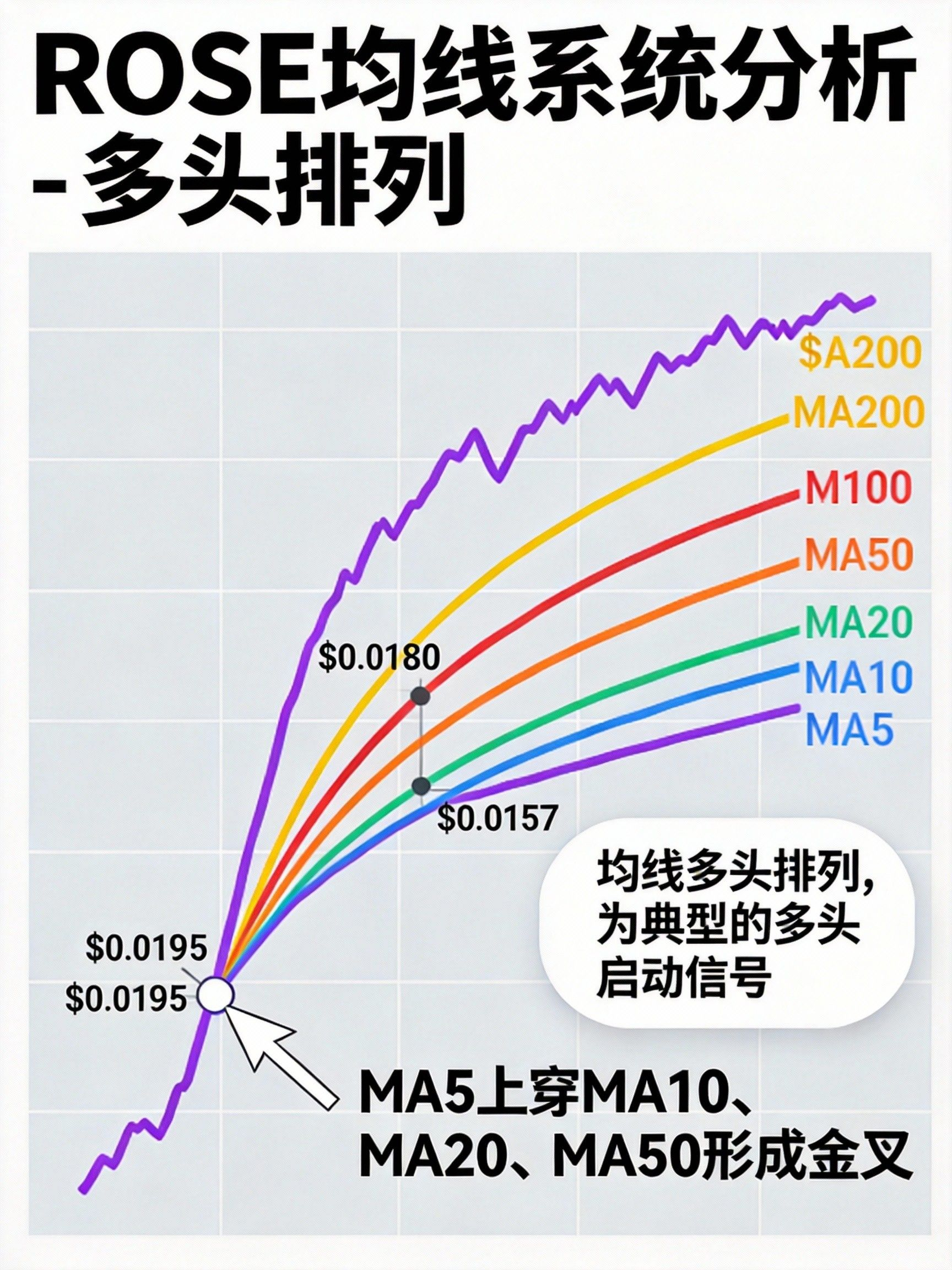

Moving average system: strong support in bullish arrangement

Moving averages show a perfect bullish arrangement:

MA5: $0.0198 (short-term support)

MA10: $0.0185 (medium-term support)

MA20: $0.0169 (important defensive line)

MA50: $0.0151 (strong support area)

MA5 crosses above MA10, MA20, MA50, which is a typical bullish startup signal.

Key price levels:

Support: $0.0195 (previous resistance turns to support), $0.0180, $0.0157

Resistance: $0.0220 (psychological barrier), $0.0250, $0.0300

On-chain data verification

$ROSE The number of holding addresses has reached 338,500, an increase of 9% compared to last month. The top 10 accounts account for 49.45%, relatively healthy distribution, not purely controlled by large holders.

24-hour trading volume $95.07 million, with a 22% increase, the volume-price relationship is healthy, and there is no issue of rising without volume.

Social media sentiment

Discussion on Twitter #PrivacyAI , #OasisNetwork has clearly increased. Community sentiment is overall positive, focusing on the progress of ROFL mainnet landing. But be cautious of the risks of excessive euphoria on social media.

Operational strategy and risk management

Batch building strategy

First buying point: $0.0195-0.0200 (resistance turns to support)

Second buying point: $0.0180-0.0185 (near MA10)

Stop-loss level: below $0.0157

Take profit in steps

First take profit: near $0.0250

Second take profit: $0.0300-0.0350

Third take profit: above $0.0390

Position management: no more than 5%

Important reminder: $ROSE Market cap is only 128 million, poor liquidity, extremely volatile (today's fluctuation 41.69%). Rapid rises are followed by sharp declines; positions must be controlled within 5% to ensure overall fund safety.

Risk warning

Market sentiment: overall crypto market 65% of coins are down, which may drag down $ROSE

Competitive pressure: intense competition in the privacy blockchain track

Liquidity: large buy and sell impacts for niche coins

Regulation: AI privacy policies are still being improved

Summary

$ROSE's rise today has the support of technical, on-chain data, and fundamentals. MACD golden cross, RSI healthy, moving averages in bullish arrangement, increasing holding addresses, high AI narrative heat—these factors create a certain resonance.

But operations must be rational: batch building without chasing highs, strict stop-loss, taking profits in steps, keeping positions within 5%.

Remember: in the crypto market, staying alive is more important than making quick money. Control risks well to go further.

Follow Xiaohai for deep technical analysis in the crypto circle. Rational investment, long-termism.

Statement: This article is solely for technical analysis communication and does not constitute investment advice. Cryptocurrency is highly risky; make decisions cautiously and bear your own losses.