Both indicators are aligned. Both flashing caution.

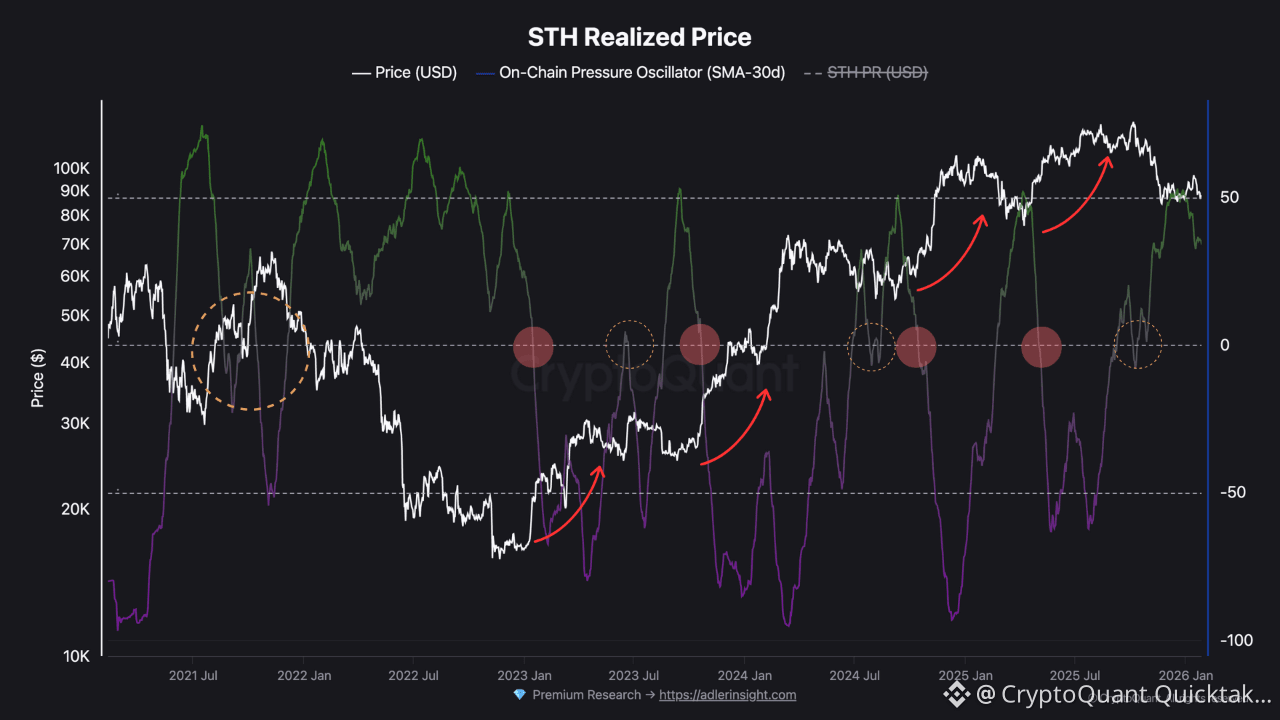

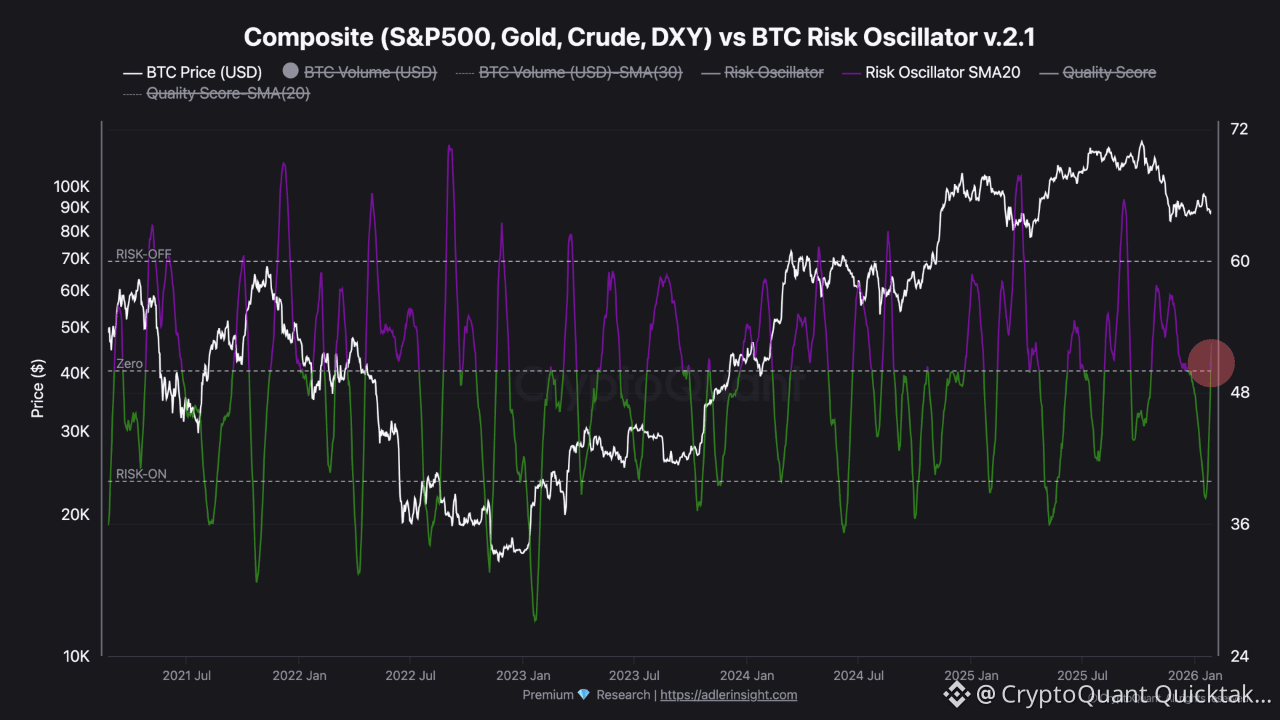

The Composite vs BTC Risk Oscillator sits at 52—firmly in risk-off territory. The On-Chain Pressure Oscillator shows elevated stress at 34+, converging with bear market levels and local bottoms.

This isn't divergence. It's confluence on the stress side.

📊 The Pattern We're Living Through

The Risk Oscillator is doing its job—the last risk-off signal came October 22nd, just before a massive drawdown. The indicator caught it accurately.

But we're back in risk-off territory again. Trends aren't persisting long enough to build sustained momentum. We get the signal, the move happens, then we return to stress before real follow-through develops.

The environment isn't allowing for conviction. Signals are accurate, but the macro backdrop keeps pulling us back into caution.

⚠️ What I'm Watching for the Shift

The Pressure Oscillator (30d SMA) sits around 34. For a proper recovery trend—not just a bounce—this needs to cross below zero. That threshold confirms selling exhaustion is real, not temporarily paused.

We're seeing significant selling pressure now, which pushed this indicator up considerably. It's converging with local bottoms and bear market levels, telling us the market is under genuine stress.

Historical context: March 2023 saw Pressure cross below zero after sustained risk-off. A 40% rally followed over three months as both indicators flipped favorable.

Right now, both are aligned on stress. Both need to flip before confirmed trend change.

💬 Why These Two Work Together

The Risk Oscillator reads macro risk appetite. The Pressure Oscillator reads on-chain selling behavior — coins moving at a loss.

When both align on stress (now): patience required.

When both align on recovery (Pressure <0, Risk flips risk-on): trend-following setups improve.

We're not there yet. Time will reward the patient.

--

Note: Trend-following signals, not mean reversion. Different approach for different phases.

Written by RugaResearch