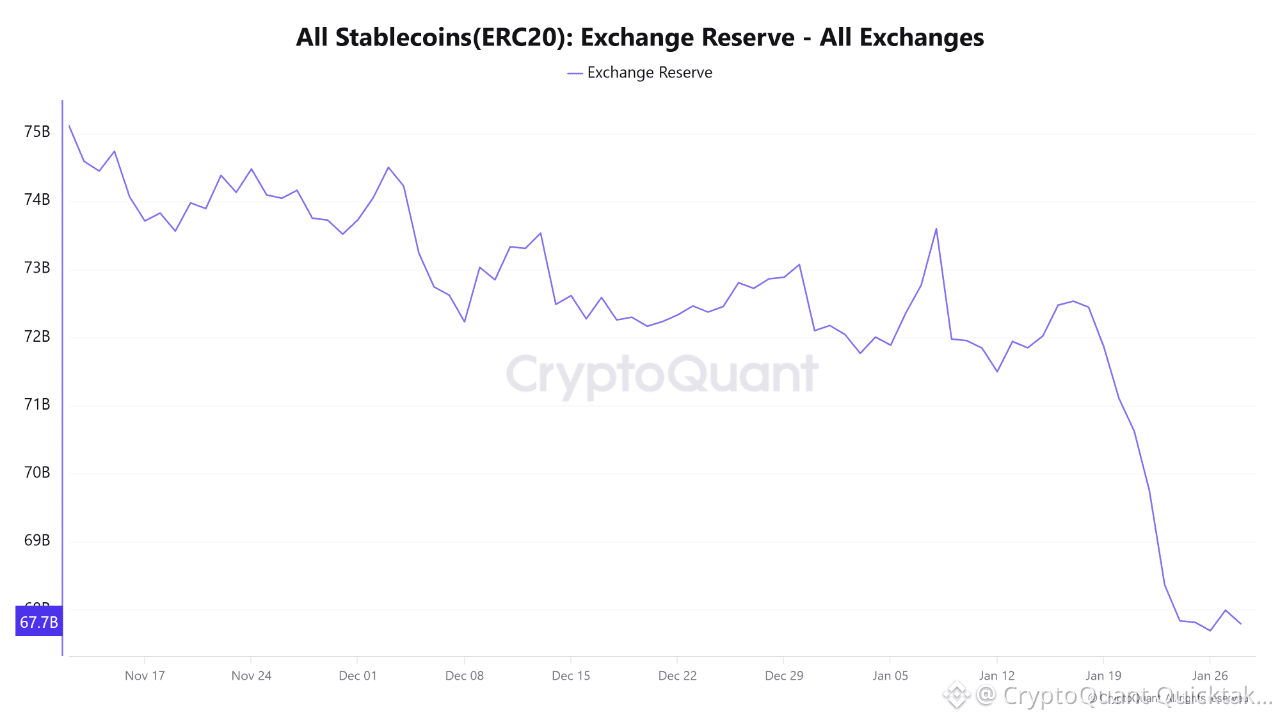

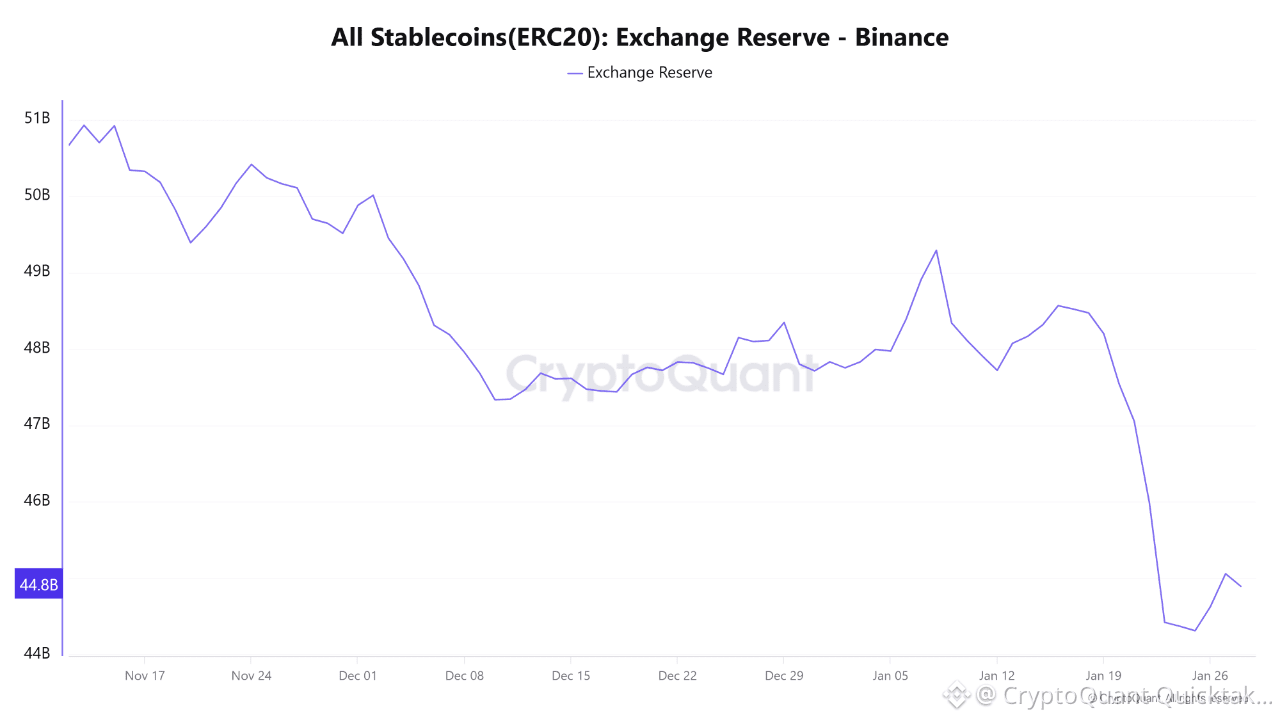

On-chain data indicates a simultaneous decline in ERC20 stablecoin and Bitcoin exchange reserves between January 18 and January 24.

All Stablecoins (ERC20): Exchange Reserve – All Exchanges decreased from $72.5B to $67.8B.

At the exchange level, All Stablecoins (ERC20): Exchange Reserve – Binance also dropped significantly from $48.5B to $44.4B.

Under normal conditions, concurrent outflows of stablecoins and Bitcoin from exchanges suggest reduced short-term sell pressure and improving supply dynamics. However, the current macro backdrop points to an alternative interpretation.

During the same period, precious metals experienced historic rallies, with gold reaching a new all-time high of $5,280 and silver surging to a record $114. Rising geopolitical tensions, including the risk of military conflict between the U.S. and Iran, have reinforced a global risk-off environment, driving capital toward traditional safe-haven assets.

Within this context, part of the stablecoin outflows—particularly from a major exchange like Binance—may reflect capital rotation from crypto markets into gold and silver, rather than immediate reinvestment into crypto spot markets.

Therefore, while declining exchange reserves remain structurally supportive for crypto, confirmation of a bullish scenario requires additional validation from spot trading volumes, cross-market capital flows, and global risk sentiment indicators.

Written by CryptoOnchain