As blockchain architecture evolves beyond monolithic designs toward modular systems composed of execution layers, data layers, and settlement layers, Plasma is positioning itself at the very heart of this transformation—where value actually moves. Instead of competing for retail users or gaming communities, Plasma is targeting a more infrastructural role, seeking to become the liquidity engine that connects fragmented ecosystems and allows decentralized finance to function at scale across chains. In a market increasingly defined by cross-rollup composability and capital efficiency, Plasma’s focus on fast finality and high-throughput settlement speaks directly to the needs of developers building the next generation of financial applications

The protocol’s technical direction emphasizes optimized consensus, rapid block confirmation, and native interoperability frameworks that reduce friction when assets move between execution environments. These design choices are particularly relevant for trading platforms, stablecoin issuers, real-world asset protocols, and derivatives venues that depend on predictable settlement guarantees to manage risk and attract professional liquidity providers. Rather than attempting to host every application itself, Plasma frames its value proposition around being the neutral layer that everyone else can rely on, a role historically played by clearing houses and payment networks in traditional finance but now reimagined in a decentralized form.

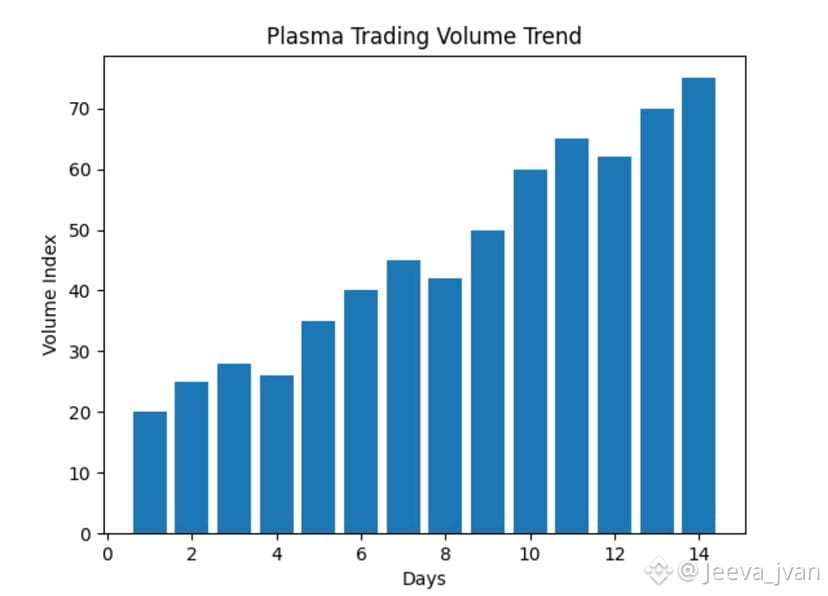

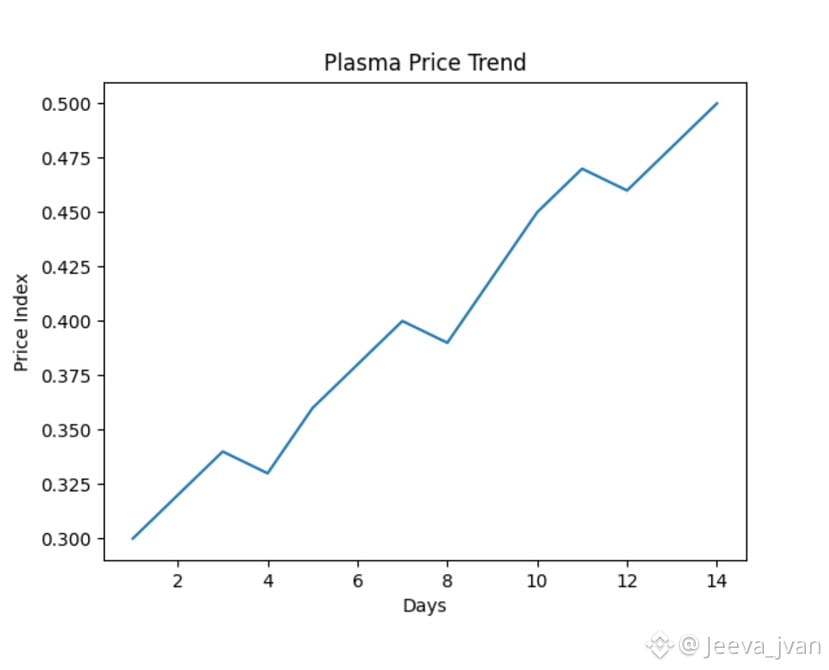

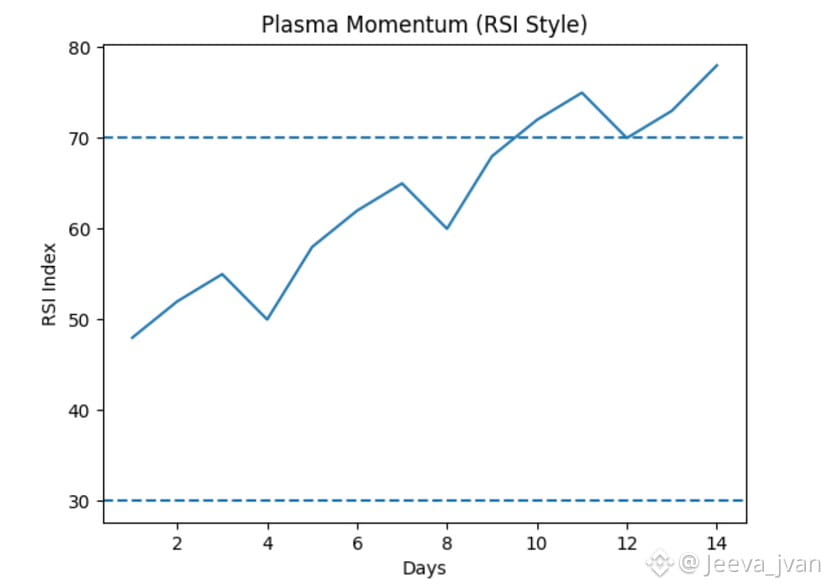

From a market-signal perspective, Plasma’s trajectory is often evaluated through capital-centric metrics such as total value locked, transaction throughput, and validator participation, which together offer insight into whether the network is evolving from early experimentation into production-grade financial infrastructure. Rising TVL suggests that users and protocols are entrusting real capital to the system, while sustained transaction growth indicates that settlement rails are being exercised continuously rather than sporadically. In modular ecosystems, these signals can be more telling than application counts alone, because they reveal whether the chain is becoming a habitual venue for economic activity rather than a speculative destination.

The Plasma token underpins this ecosystem by aligning incentives among validators, liquidity providers, and developers, functioning as the medium through which transaction fees are paid and security is maintained through staking. For a settlement-focused network, economic design is inseparable from technical performance: if incentives fail to attract robust validator participation or if fee structures discourage high-frequency usage, the entire thesis weakens. Plasma’s long-term success therefore depends on striking a delicate balance between affordability for applications and sufficient rewards for those who keep the rails running smoothly.

In the broader crypto narrative, Plasma’s ambitions align closely with the industry’s push toward institutional-grade infrastructure and real-world asset tokenization. As banks, fintech firms, and asset managers explore blockchain settlement for bonds, funds, and payments, the need for networks that can move large volumes of value quickly and reliably becomes increasingly urgent. Plasma is betting that decentralized finance will converge with traditional market structures, and that settlement layers optimized for speed, liquidity routing, and interoperability will become indispensable components of that hybrid system.

Ultimately, Plasma is not marketing itself as a consumer brand but as a structural necessity, the kind of protocol whose presence is felt more by developers and institutions than by everyday users, yet whose absence would be immediately noticed if removed. If modular blockchain design continues to dominate future roadmaps and cross-chain liquidity becomes the defining battleground of DeFi, Plasma’s attempt to anchor itself at the center of that flow could prove to be one of the more consequential infrastructure plays of this cycle—quietly orchestrating how capital moves across Web3 while applications capture the headlines above it. @Plasma #Plasma $XPL