While most blockchain projects are still discussing how to "integrate AI," Vanar has already undergone a deeper identity reconstruction—transforming from an "AI-enabled blockchain" into a "smart infrastructure natively designed for AI." This is not merely a change in marketing rhetoric, but a strategic bet on the technological architecture of the next decade.

Strategic Shift: From a Race for Speed to a Race for Intelligence

In 2026, the narrative of the blockchain industry is undergoing a fundamental shift. Vanar stated explicitly in a recent tweet: “We are entering a new era of blockchain where intelligence—not speed—is the primary driver of value. Chains that embed reasoning, explainability, and interoperability at their core will lead the future.” This statement precisely encapsulates Vanar's strategic focus: no longer pursuing mere TPS figures, but rather building blockchain infrastructure that can “think.”

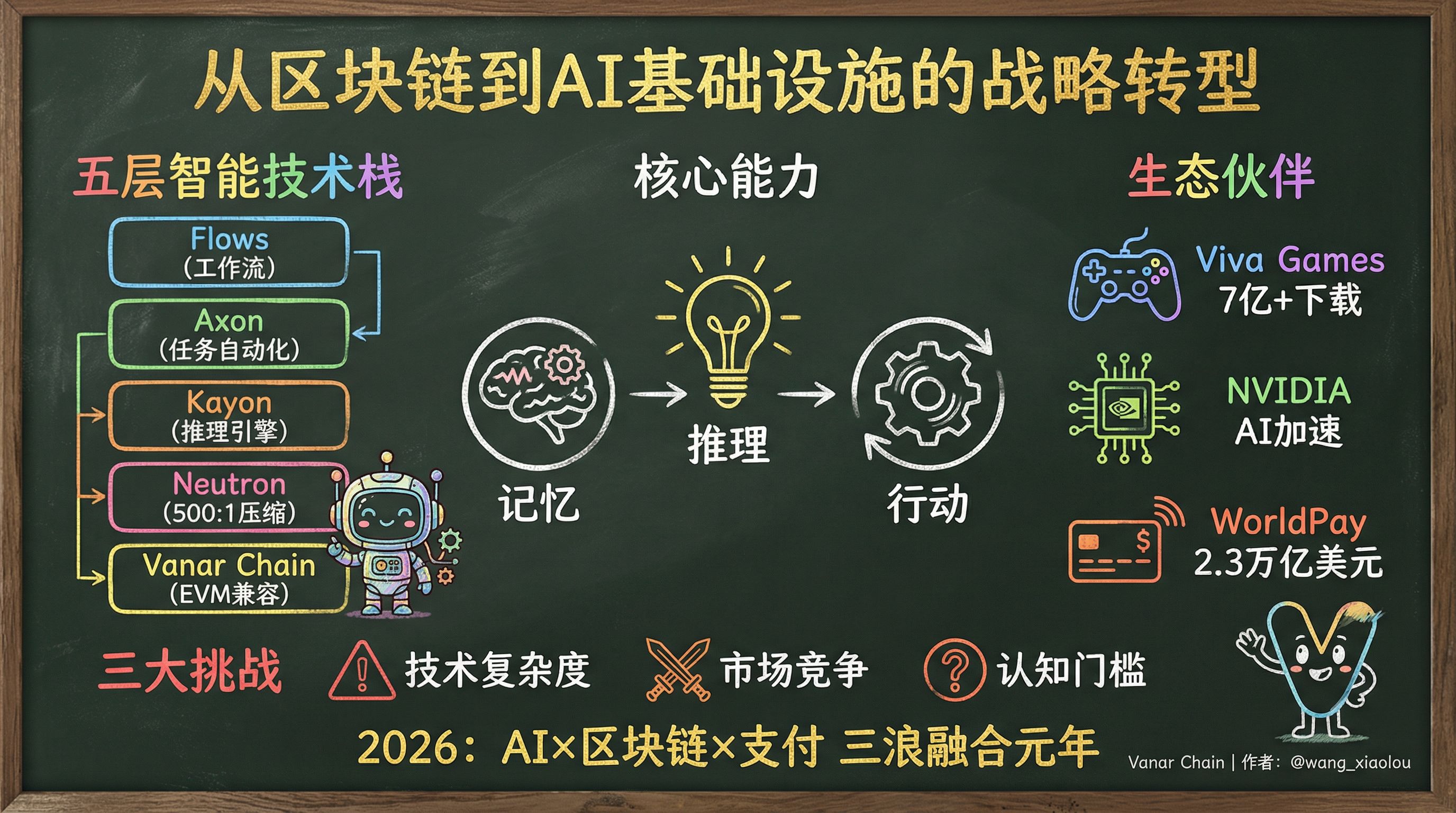

This shift is reflected in Vanar's five-layer intelligent technology stack. At the bottom is Vanar Chain itself, providing a high-throughput EVM-compatible execution environment; the second layer, Neutron, uses AI-driven semantic compression technology to compress data into "seeds" at a ratio of 500:1 and store them directly on the chain; the third layer, Kayon, serves as a decentralized inference engine, enabling smart contracts to query and understand this data; and the upper layers, Axon and Flows, are responsible for task automation and industry-specific intelligent agent workflows, respectively. This is not a simple stacking of modules, but a complete "nervous system," allowing the blockchain to evolve from a "dumb ledger" into an intelligent agent capable of remembering, reasoning, and acting.

Product iteration: From proof of concept to production readiness

Vanar's roadmap reveals a clear productization pacing. In April 2025, Neutron delivered a landmark demonstration at TOKEN2049 in Dubai—compressing a 25MB video into a torrent and reconstructing it on-chain, proving the possibility of completely eliminating IPFS and centralized storage. In August 2025, MyNeutron Personal Edition was launched, allowing users to carry AI memories across platforms such as ChatGPT, Claude, and Gemini. In the first quarter of 2026, premium AI tool subscriptions will begin requiring the use of $VANRY tokens, marking a crucial leap from technology demonstrations to a closed-loop business model.

More importantly, there are the upcoming Axon and Flows. Axon is positioned as an "intelligent, agent-ready smart contract system" that will enable contracts to have proactive reasoning capabilities; Flows is a toolset for creating automated, logic-driven on-chain workflows. The launch of these two products will complete Vanar's full-stack coverage from the "data layer" to the "application layer," making it a true operating system for the AI agent economy.

Ecosystem Integration: From Gaming and Entertainment to Financial Payments

Vanar's partner network reveals three main directions for its ecosystem expansion. In the gaming and entertainment sector, partnerships with brands such as Viva Games (700 million+ downloads), NVIDIA (providing CUDA-accelerated AI stack), Disney, and Paramount enable Vanar to reach hundreds of millions of mobile users, seamlessly integrating Web2 gamers into Web3. In the financial payments sector, integration with WorldPay (annual transaction volume of $2.3 trillion) makes Vanar a key bridge connecting traditional finance with Web3 payments, particularly in PayFi (Pays in Finance) and tokenized real-world assets (RWA) scenarios.

At the infrastructure level, the Vanar Kickstarter project has partnered with over 20 companies to provide Web3 and AI developers with one-stop support, from wallets and security to data and token listing. This "ecosystem empowerment" strategy is not simply business development collaboration, but rather building a developer network effect centered on Vanar—as more and more projects choose to build smart agent applications on Vanar, Neutron's data assets and Kayon's inference capabilities will form a moat that is difficult to replicate.

Complementarity: Symbiotic relationship with OpenAI and Anthropic

Vanar's relationship with large AI platforms is not one of competition, but rather complementarity. Companies like OpenAI and Anthropic focus on training and inference for general-purpose large language models, but they face two core pain points: first, AI "amnesia"—the context needs to be reloaded for each conversation; and second, the risk of centralized storage—user data depends on the continuous operation of company servers. Vanar's Neutron precisely solves these two problems: by compressing users' AI memories into seeds and storing them on the blockchain, it achieves cross-platform persistence and portability.

This complementarity is particularly evident in the design of MyNeutron—it supports both local storage (protecting privacy) and on-chain anchoring (ensuring permanence), and can be injected into platforms such as ChatGPT and Claude with a single click. This means that Vanar is not intended to replace these AI giants, but rather to become their "memory layer" and "payment layer," enabling AI agents to securely manage assets, execute transactions, and maintain continuous context across different platforms.

Challenges and Risks: A Triple Test of Technology, Market, and Perception

Despite its promising prospects, Vanar faces equally significant challenges. Technically, AI-native blockchains are far more complex than traditional public blockchains—Neutron's compression algorithm needs to balance efficiency, security, and verifiability, while Kayon's inference engine must maintain low latency in a decentralized environment—both are unproven technologies on a large scale. The threat of quantum computing also compels Vanar to proactively implement quantum encryption, further increasing its technological risks.

In terms of market competition, Vanar is not the only project betting on AI + blockchain. NEAR's chain abstraction, Bittensor's decentralized AI training, and Render's distributed rendering are all building moats in their respective niche areas. While Vanar's "full-stack" strategy is comprehensive, it also means fighting on multiple fronts simultaneously, and the risk of resource dispersion cannot be ignored. More importantly, the current market volatility reflects that investors' confidence in the "AI-native infrastructure" narrative has not yet been fully established—whether the success of the technology demonstration can translate into sustained growth in on-chain activity still needs time to prove.

At the level of market perception, Vanar's challenges are perhaps more fundamental. Most developers and users are still accustomed to the mindset that "blockchain is just a ledger," and it will require significant educational investment to get them to understand that "blockchain can reason." Moreover, the AI agent economy itself is still in its early stages, and a true killer application has yet to emerge. Vanar is betting on a market that may not take off until 2026-2030, which means it must maintain sufficient stamina in terms of funding, team, and community confidence.

Endgame prediction: The financial-grade underlying technology of the AI era?

Returning to the initial question: Can Vanar become the "financial-grade foundation of the AI era"? The answer depends on two key variables. First, will AI agents become as ubiquitous as smartphone apps are today? If so, then the infrastructure providing these agents with memory, reasoning, and payment capabilities will become a necessity, giving Vanar's five-layer technology stack immense strategic value. Second, can Vanar maintain synchronized growth in technological maturity, ecosystem prosperity, and market awareness? History tells us that technologies developed too early often fail due to market immaturity, while those developed too late fail because competitors have already captured market share.

Judging from its current pace, Vanar is following a path of "technology validation first, then ecosystem expansion, and finally market explosion." Neutron and Kayon have moved from concept to production, partnerships with Google Cloud, NVIDIA, and WorldPay provide enterprise-level trust endorsement, and the Kickstarter project is nurturing a developer community. If all of this can create a positive flywheel by 2026—more developers building intelligent agent applications on Vanar, more users using $VANRY because of these applications, and more data assets accumulating in Neutron—then Vanar truly has the potential to become a key infrastructure in the AI era.

But this is not a sprint, but a marathon. Before the three major technological waves of AI, blockchain, and payments truly converge, Vanar needs to prove not only the feasibility of its technology, but also the sustainability of its business model and the self-reinforcing capabilities of its ecosystem. 2026 may just be the starting point of this long race.