What keeps pulling me back to Dusk is how honest it feels about money. Not crypto money, but real money. The kind that comes with obligations, paperwork, and consequences if something goes wrong. Most blockchains still act like total transparency is some moral high ground. In practice, that’s not how finance survives. Exposure isn’t fairness. It’s risk.

Dusk seems to understand that from the start. Instead of pretending everyone is comfortable having their balances, strategies, and counterparties visible forever, it builds around a simple reality: privacy is normal in finance, but it has to coexist with rules. You don’t get one without the other.

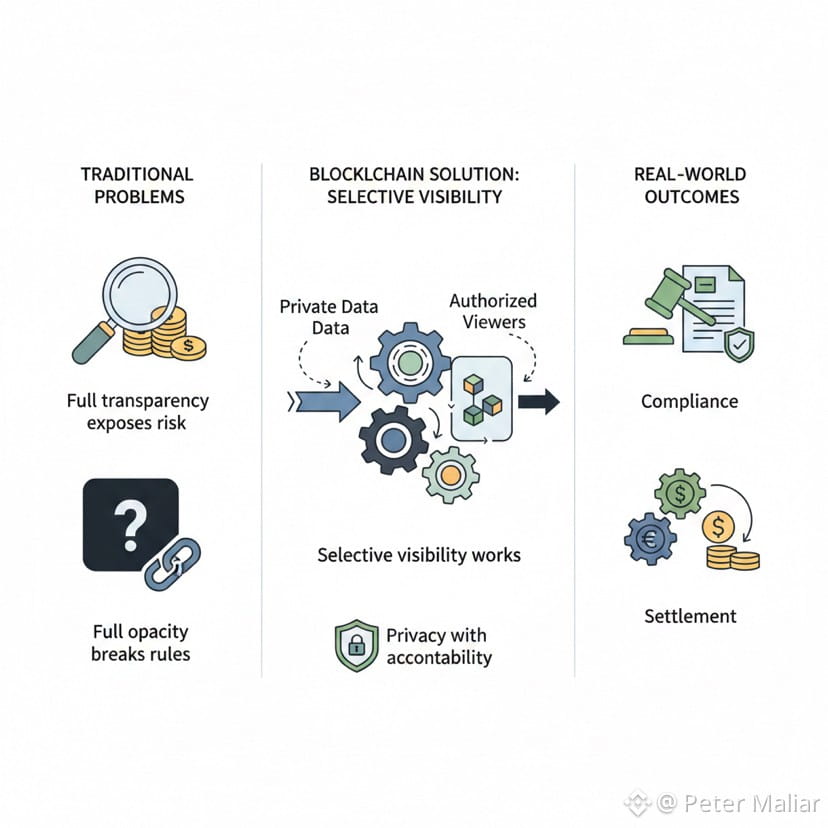

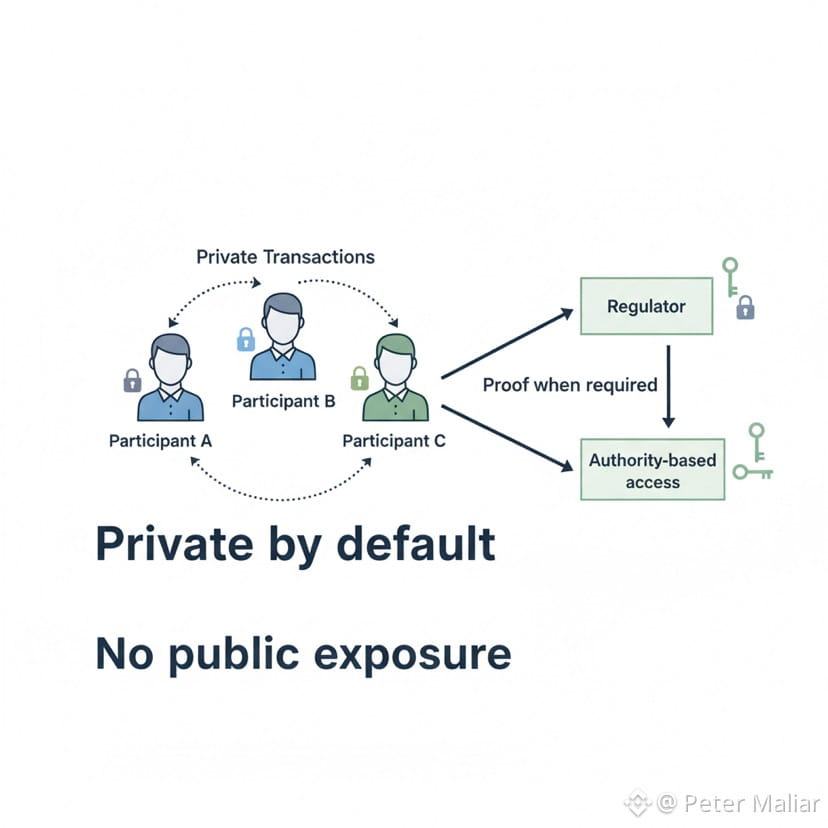

What I like is that Dusk doesn’t chase extremes. It’s not trying to make everything invisible, and it’s not turning the chain into a public surveillance feed either. Transactions can stay private for the people involved, while still producing proof when someone with authority needs answers. That’s how banks, funds, and regulated markets already work off-chain. Dusk just brings that logic on-chain.

The way the system is designed also feels deliberate. Settlement comes first. Finality matters. Execution and apps sit on top of something that’s meant to be stable, not flashy. Privacy isn’t a toggle in an app—it’s part of how value actually moves through the network.

Even the token side reflects that mindset. DUSK isn’t sold as a magic growth lever. It exists to secure the network, pay for activity, and keep validators doing their job over time. No drama, no fantasy economics.

What really seals it for me is how the team behaves when things aren’t perfect. Pausing a bridge, communicating clearly, focusing on the core protocol instead of spinning narratives—that’s infrastructure behavior, not hype behavior.

Dusk isn’t trying to be loud. It’s trying to be correct. And in finance, correctness tends to outlive excitement.