@Plasma feels like it was designed by people who got tired of pretending that “money onchain” is mostly about trading. If you spend any time close to stablecoin flows in the real world, you start to notice how different the emotional stakes are. A swap can fail and you shrug. A payroll batch that fails makes someone miss rent. A supplier payment that lands late becomes an argument you can’t unwind. Plasma starts from that pressure point and treats stablecoins as the main event, not a side effect. It says so plainly: stablecoins deserve first-class treatment at the base layer, because they behave like a public utility when people actually depend on them.

That focus changes what “performance” means. Plasma isn’t just trying to be fast in a clean lab environment. It’s trying to stay predictable when usage is spiky, when people are anxious, when the network is crowded because something happened in the world and everyone moves at once. Stablecoins are boring only until they’re the only thing that still feels stable in a chaotic market. Plasma’s goal is to keep the act of sending a dollar-like token from turning into a small gamble about fees, delays, and failed transactions. This is why the project keeps framing itself around global payments and stablecoin-native behavior rather than general-purpose experimentation.

Plasma’s stablecoin-first posture is also visible in how it talks about friction. Most chains quietly accept that users will learn a new “gas token,” keep a spare balance, and absorb the annoyance of paying for the privilege of moving value. Plasma tries to invert that default. The idea is simple: if stablecoins are meant to behave like digital cash, then a stablecoin transfer shouldn’t routinely feel like a fee negotiation or a wallet scavenger hunt. Plasma describes mechanisms aimed at making stablecoin transfers feel closer to what people expect from everyday money movement, while still keeping cost control and abuse resistance in mind.

Once you accept that premise, EVM compatibility stops being a marketing checkbox and becomes a risk-management decision. Plasma is stablecoin-focused, but it doesn’t want builders to pay an adoption tax in unfamiliar tooling, strange contract assumptions, or niche infrastructure. Plasma’s docs are explicit that its execution environment is fully EVM compatible, built on Reth, and meant to accept standard Solidity contracts without modifications, alongside the tooling developers already live in. That matters because stablecoin rails don’t succeed by being clever; they succeed by being legible to the people responsible for shipping and operating them. Familiarity is a form of safety when the cost of a mistake is measured in real balances and real trust.

Plasma also seems to understand something that’s easy to miss from the outside: stablecoin systems don’t fail only because of code. They fail because reality is messy. People send to the wrong address. Businesses reconcile late. Attackers probe the edges when incentives spike. Regulators ask questions after the fact. Under that kind of scrutiny, the “right” design is often the one that produces the fewest surprises, not the one with the most novelty. Plasma leans into that by emphasizing predictable behavior and tight scoping around the kinds of actions stablecoin users actually perform under stress.

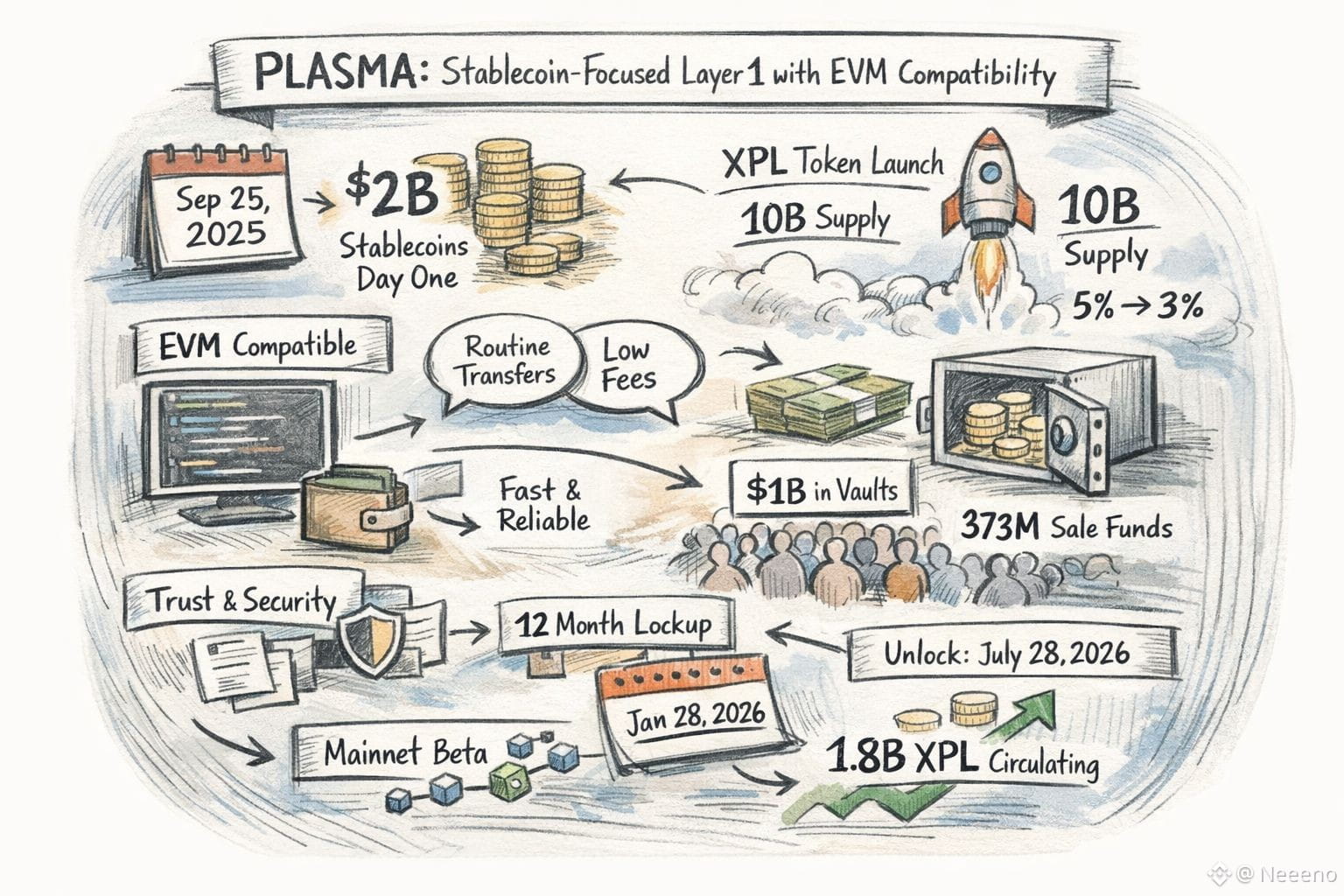

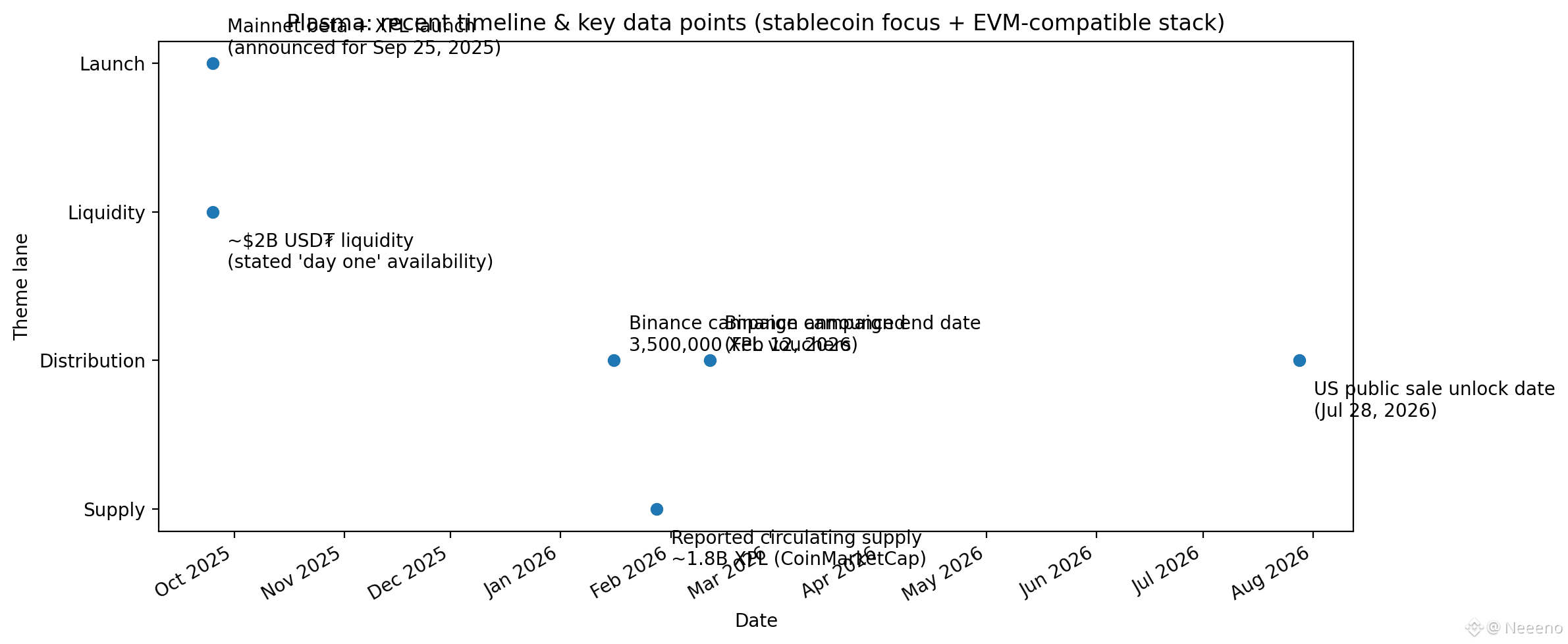

The way Plasma staged its launch also tells you what it thinks matters.With the September 25, 2025 (8:00 AM ET) mainnet beta and XPL token launch, Plasma didn’t lean on “someday” talk. It talked about stablecoins and immediate activity. Plasma said about $2 billion in stablecoins would be active from the start, and described the launch as starting in motion, not slowly building up over time. That’s a clear challenge: judge the chain by whether it can handle real payments and real liquidity, not by a hype-filled narrative.

Plasma’s community metrics from the same announcement feel like a snapshot of how financial incentives and social trust collide. Plasma said over $1 billion in stablecoin liquidity was committed to its vaults in just over 30 minutes, and that the public sale drew $373 million in commitments against a $50 million cap. Those numbers are not just “growth.” They are concentrated responsibility. When people commit that quickly, it’s rarely because they’re calmly reading documentation. It’s because they’re afraid of missing access, afraid of higher costs elsewhere, afraid the window closes. A stablecoin-focused chain has to design for that human reflex without exploiting it—because if the system later feels unfair, the memory of that first rush turns into resentment.

XPL sits right in the middle of that responsibility story. Plasma’s docs state an initial supply of 10,000,000,000 XPL at mainnet beta launch, with distribution split across a public sale (10%), ecosystem and growth (40%), team (25%), and investors (25%). Plasma also describes an inflation model for validator rewards that begins at 5% annually and steps down by 0.5% per year until reaching 3%, with fee-burning intended to counterbalance long-term dilution as usage grows. And it adds a detail that feels very “real world”: US public-sale purchasers face a 12-month lockup, with an explicit unlock date of July 28, 2026. Dates like that are where tokenomics stops being theory and becomes lived time.

You can see Plasma trying to keep XPL tied to actual network health rather than mood. If Plasma is meant to carry stablecoin payments at scale, then security and incentives can’t be purely aspirational. Plasma’s tokenomics document is candid that inflation only activates when external validators and stake delegation go live, and that locked allocations aren’t eligible for unlocked rewards. That’s a particular kind of restraint: it implies the chain wants to earn its security budget in phases, not print it immediately and hope the culture forgives the dilution later.

Even the “recent updates” around XPL hint at how Plasma thinks about distribution: not as a one-time event, but as ongoing outreach through large platforms. For example, Binance published a January 16, 2026 announcement about a Plasma campaign offering 3,500,000 XPL token voucher rewards over a defined period (through February 12, 2026). Whether you love these campaigns or distrust them, they show a practical recognition: stablecoin rails live and die by where users already are, and distribution is not a philosophical debate when you’re trying to make payments habitual.

And then there’s the reality check of circulating supply and market perception, which a stablecoin-focused chain can’t ignore even if it wants to feel “post-speculation.”As of January 28, 2026, CoinMarketCap showed about 1.8 billion XPL in circulation.A number like that changes how people judge future supply, token unlocks, and how long rewards can keep going—especially after the launch hype ends and normal work starts.

Plasma has to keep proving, day after day, that it can hold up under the quiet weight of routine payments—not just attract liquidity once.

Plasma’s deeper bet, at least from inside the way it speaks, is that stablecoins are a social contract wearing technical clothes. They only work when people believe the system will behave the same tomorrow as it did today, and when disagreements can be resolved without chaos. That’s why Plasma’s stablecoin-first choices and its EVM compatibility belong in the same sentence: one is about human expectation, the other is about minimizing unnecessary novelty. Together they create a kind of humility—an attempt to make the chain feel less like a new world users must learn, and more like an invisible surface that simply doesn’t betray them when they’re tired, rushed, or afraid.

If you zoom out, the picture becomes clearer in a handful of dates and numbers that Plasma has put on the record: mainnet beta on September 25, 2025; a stated ~$2B in stablecoins active from day one; an initial 10B XPL supply with explicit allocation splits; an inflation schedule that starts at 5% and trends toward 3% only when decentralization milestones arrive; a US public-sale unlock date of July 28, 2026; and a reported ~1.8B XPL circulating by January 28, 2026.Those aren’t just stats. They’re commitments Plasma will be held to by people who don’t want excitement—they want reliability. Quiet responsibility is deciding that invisible infrastructure deserves to be boring in the best way: consistent, legible, and stubbornly dependable. And in stablecoin land, that kind of reliability matters more than attention, because attention leaves, but payments don’t.