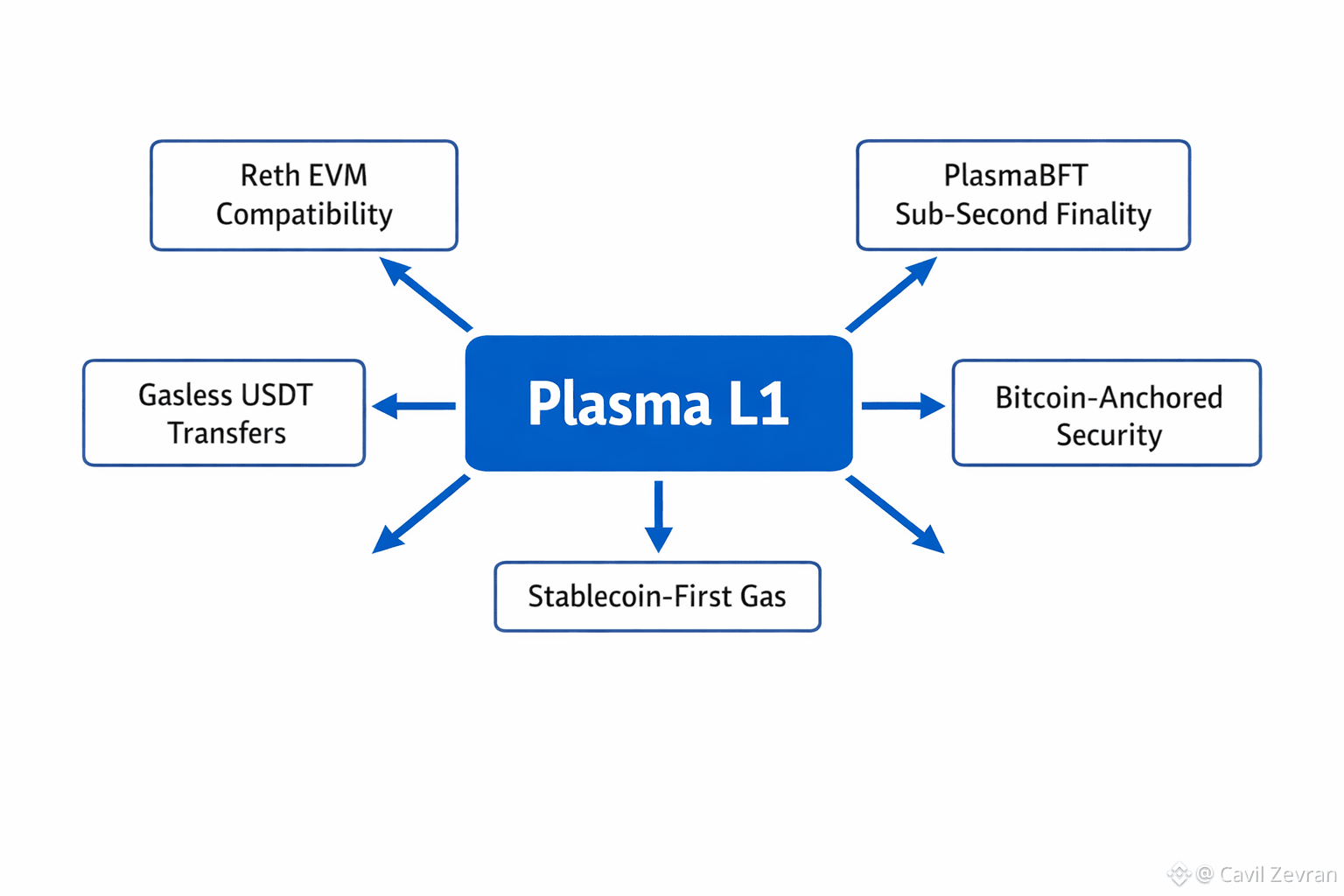

Plasma changes the game for stablecoins by building a Layer 1 blockchain focused squarely on settlement. It’s EVM compatible and delivers lightning-fast, sub-second finality, so both institutions and everyday users get speedy, reliable transactions—without the usual roadblocks.

At the heart of Plasma, you’ve got Reth powering full EVM compatibility. Developers can just drop in their Ethereum smart contracts—no tweaks needed. PlasmaBFT consensus means transactions wrap up in under a second, and block times stay under one second too. We’re talking over 1,000 transactions per second, easily.

One thing that really stands out: gasless USDT transfers. You don’t need to keep a stash of native tokens just to cover fees. Plasma flips the script by letting users pay gas fees in stablecoins themselves. This makes life way easier for stablecoin apps. USDT transfer fees are set at $20, which is pretty reasonable for big transactions, especially when you’re moving serious sums.

Security? Plasma anchors itself to Bitcoin, inheriting its decentralization and censorship resistance. This keeps the platform neutral, so there’s no single point of failure and it’s tough for outside parties to mess with it.

Plasma isn’t just about one coin. It supports more than 25 stablecoins and ranks fourth in the world by USDT balance, with $7 billion in deposits. Its infrastructure covers over 100 countries, supports more than 100 currencies, and plugs into 200+ payment methods. That’s global reach.

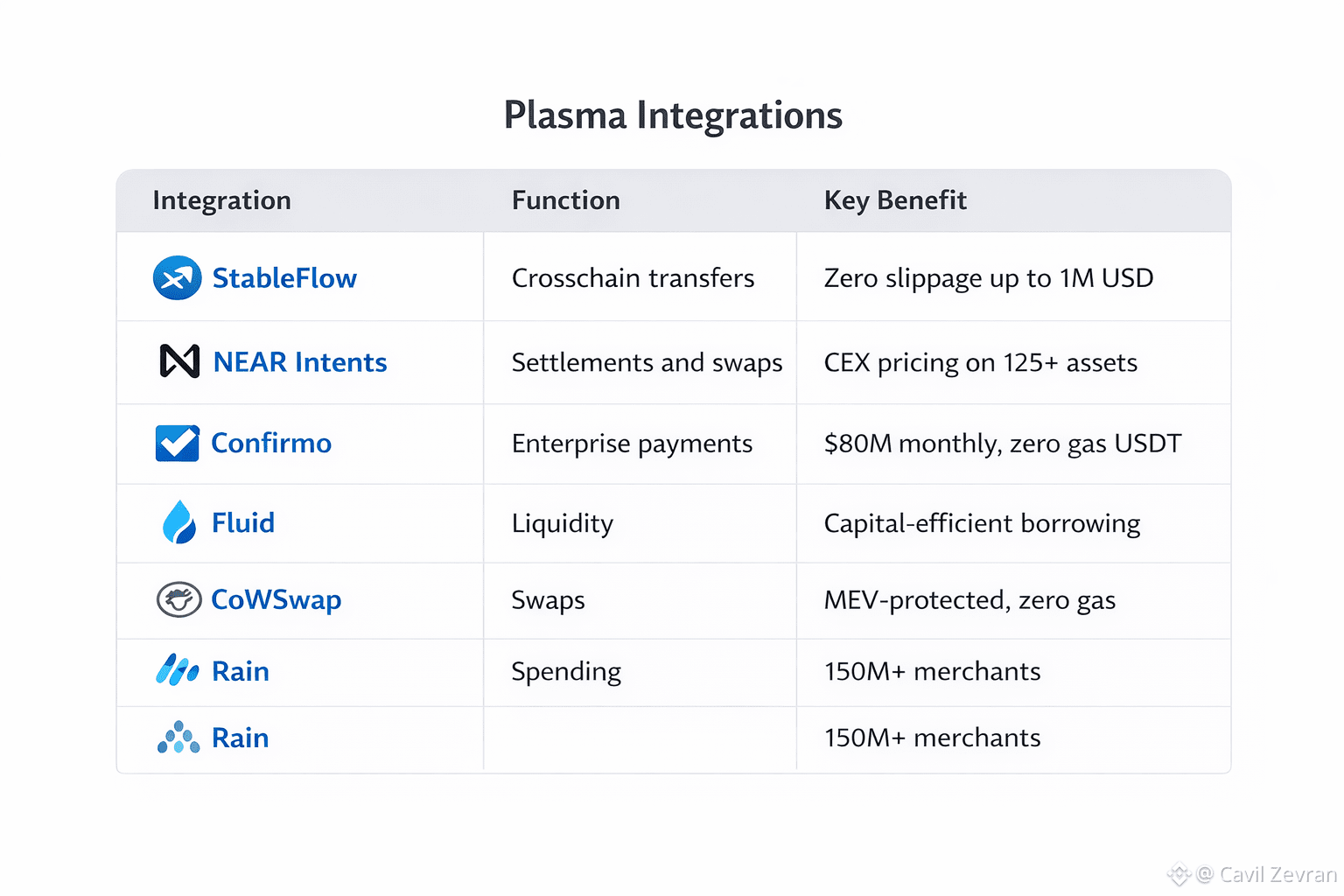

StableFlow integration lets users move huge volumes of stablecoins across chains—think up to $1 million at a time, no slippage, and minimal fees. It’s like getting centralized exchange prices but on-chain.

With NEAR Intents, builders can execute big settlements and swaps right on-chain, with access to over 125 assets at good rates. This is all handled without dragging in off-chain middlemen.

For businesses, Confirmo supports Plasma, processing more than $80 million every month for things like e-commerce, trading, forex, and payroll. Merchants can take USDT payments with zero gas fees, making stablecoins just another tool in the business toolbox.

On the DeFi side, Plasma hosts the world’s second-largest onchain lending market. In Aave V3, it leads in the ratio of stablecoins supplied to borrowed. It’s second in TVL across protocols like Aave, Fluid, Pendle, and Ethena.

The biggest syrupUSDT liquidity pool lives on Plasma too, packing $200 million. That deep liquidity lays the foundation for all kinds of stablecoin use cases.

Fluid’s launch on Plasma means payments firms, card issuers, and fintech startups get capital-efficient ways to earn, swap, and borrow. It’s designed for scale.

CoWSwap is also on Plasma, offering MEV-protected swaps without gas fees. Traders bridge and send tokens, without worrying about extraction risks.

And with Rain, users can actually spend Plasma USDT at more than 150 million merchants worldwide. Stablecoins go from digital assets to real-world money, fast.

Plasma isn’t going it alone. Heavy hitters back the project—Paolo Ardoino from Tether, Scott Bessent from the Treasury, Chris Giancarlo, former CFTC Chair, and David Sacks, known for his Crypto and AI expertise, all bring their weight. Over 100 partnerships expand the ecosystem, from liquidity providers to payment processors and DeFi projects.

So why does Plasma matter? Right now, stablecoins are scattered across blockchains, making global payments a hassle. Plasma pulls it all together, cuts costs, and gets rid of delays. Institutions get compliant, efficient rails. Regular users enjoy smooth, instant transfers, especially in places where stablecoins have really caught on.

Here’s how it looks in real life: a merchant uses Confirmo to accept USDT on Plasma. The payment lands in under a second. No gas fee comes out of the sender’s pocket. Behind the scenes, PlasmaBFT locks in finality, and Bitcoin anchoring keeps everything secure.

For finance as a whole, Plasma pushes stablecoins from speculation to real utility. Enterprises don’t need blockchain experts on staff—they just plug in and focus on their business. Plasma’s global currency support could really speed up adoption in emerging markets.

Unlike general-purpose Layer 1s, Plasma zeroes in on stablecoin features. EVM compatibility keeps things portable, but stablecoin-first gas and other tweaks set it apart. Details like tokenomics or the roadmap aren’t public yet.

And in DeFi, Plasma’s lending strength shows it’s not just another chain. High supply-to-borrow ratios mean capital gets used well, attracting more protocols and more action.

For developers, integrations like NEAR Intents simplify complex trades. Execute multisig settlements onchain, maintaining decentralization.

Security remains paramount. Bitcoin anchoring mitigates risks, promoting long-term stability.

Plasma's infrastructure supports a new financial system. By focusing on money movement, it enables instant payments globally.

Enterprise adoption grows through tools like Rain. Businesses issue cards backed by Plasma USDT, expanding crypto's reach.

Liquidity pools like syrupUSDT provide foundations for derivatives and yield products. Pendle and Ethena leverage this for advanced strategies.

CoWSwap's MEV protection safeguards users in volatile environments. Zero gas enhances accessibility.

Overall, Plasma builds payment rails for the future. Its technical stack and partnerships position it as a stablecoin hub.

As stablecoin volumes rise, Plasma's optimizations become critical. Institutions require sub-second confirmations for high-frequency operations.

Retail in high-adoption areas gains from broad currency support. Over 200 payment methods integrate seamlessly.

Plasma's neutrality appeals to regulators. Backing from figures like Giancarlo underscores compliance focus.

Plasma delivers stablecoin infrastructure that works. It solves settlement challenges, fostering innovation in payments and finance.

Bottom line: Plasma solves real-world headaches. Crosschain transfers with StableFlow mean no slippage, even for big sums, rivaling centralized exchanges for reliability. That draws in volume from traditional finance.