Plasma is not just another Layer 1 blockchain it represents a new paradigm in how digital money moves, settles, and gets adopted at real scale. While most blockchains in the world have evolved around speculation and decentralized finance (DeFi) experimentation, Plasma starts with a fundamental question that has been neglected for far too long: What would a blockchain look like if it were built from day one to serve stablecoins and payments as its core purpose? That question drives every technical choice, every protocol feature, and every design priority within Plasma. At a moment when stablecoins are already the backbone of digital value transfer globally, Plasma’s approach feels not just timely but essential.

To understand Plasma, you must first appreciate the problem space it inhabits. Stablecoins — digital assets whose value is pegged to a fiat currency like the US dollar have become the de facto medium of exchange in cryptocurrency markets. They power cross‑border remittances, serve as settlement rails for trading, support merchant payments, and act as liquidity vectors in decentralized finance. In many emerging economies, stablecoins function as a digital equivalent of cash. Despite this massive real‑world usage, the networks that carry these coins have not been optimized for stablecoin movement itself. Most blockchains were designed either for general computation (e.g., Ethereum) or for simple value transfer (e.g., Bitcoin), and neither of these fundamentals translates into a frictionless, predictable, stablecoin settlement experience. Plasma changes that narrative by building a network with stablecoin prioritization baked into its core protocol.

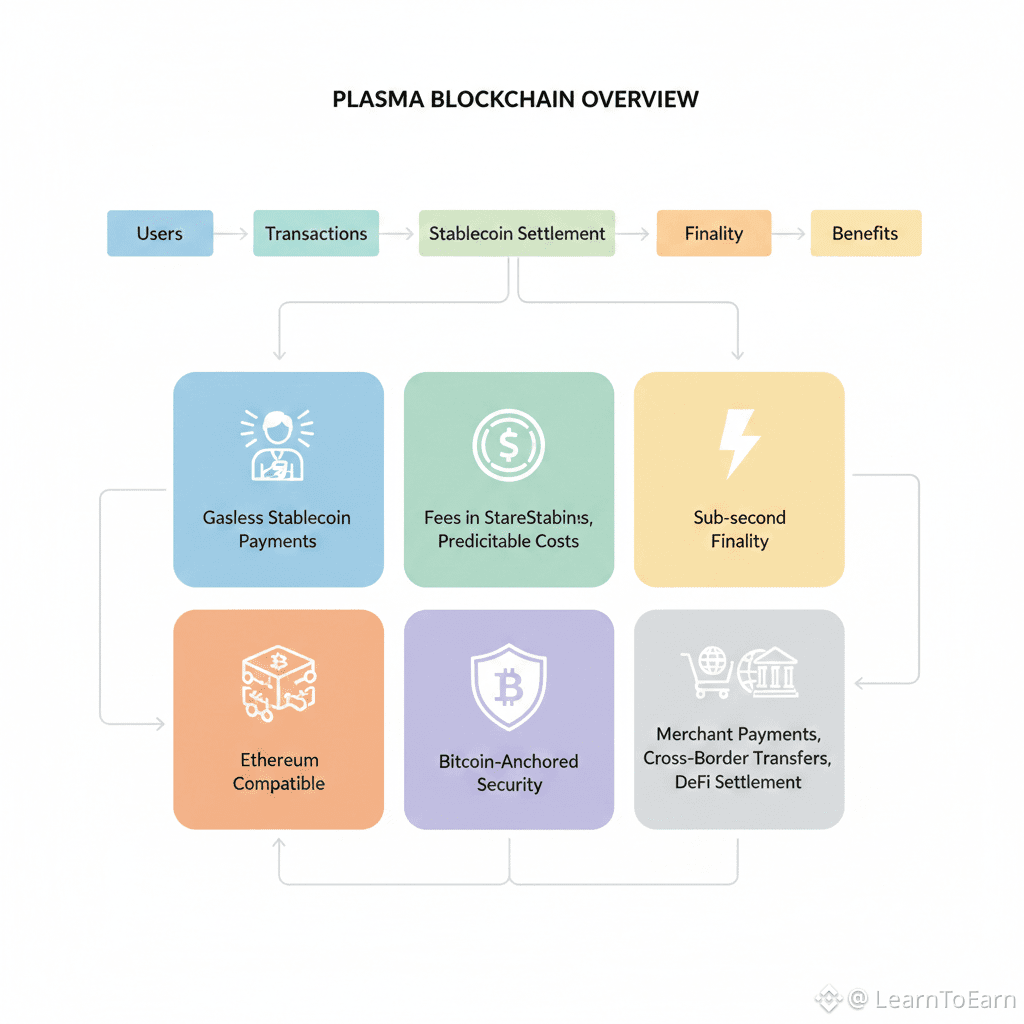

The essence of Plasma’s vision rests on three pillars: user‑centric experience, stablecoin native economics, and secure decentralized settlement. Let’s start with the user experience, because that’s where the biggest and most immediate difference becomes apparent.

On most blockchains, users must hold a native token and pay transaction fees in that token. This creates a cognitive and economic burden that simply does not exist in traditional payment systems — you never go to a cafe, get your coffee, and then realize you need another token just to complete the payment. Yet that is exactly the friction we tolerate in Web3 today. Plasma eliminates this friction through what may sound like a simple innovation but in practice is transformational: gasless stablecoin transactions facilitated by a protocol‑level paymaster.

This paymaster mechanism stands between users and the blockchain’s execution layer, sponsoring gas costs for stablecoin transfers so users do not need to own or manage any native token to send USDT or other supported stablecoins. From the perspective of everyday users, this changes everything. You can send digital dollars, complete merchant payments, or transact peer‑to‑peer without ever worrying about gas. It transforms the experience from something that feels like crypto technology into something that feels like digital cash — fast, predictable, and straightforward.

But sponsoring gas is only part of the story. Plasma’s stablecoin‑first gas model goes further by enabling fees themselves to be paid in stablecoins instead of a volatile native token. This is a profound departure from existing blockchain economics. On Ethereum, for instance, users constantly grapple with fee spikes, fee prediction tools, and the mental overhead of estimating gas in gwei. On Plasma, the fee is stable, predictable, and aligned with what users and businesses actually care about: the real cost in dollars, not the intangible cost in an abstract token. This alignment between economic meaning and user expectations may seem subtle at first, but it is critical for building a payments network that can be understood and adopted by mainstream users and enterprises alike.

Speed matters just as much as simplicity. In legacy settlement networks or permissioned blockchains, finality can take seconds or minutes — too slow for point‑of‑sale interactions or rapid settlement needs. Plasma solves this through the use of PlasmaBFT, a consensus mechanism engineered for sub‑second finality. This is not a marketing slogan; it means that when a transaction is submitted on Plasma, the network confirms and finalizes that transaction in fractions of a second. For merchants and institutions, finality — not just near‑final probabilistic confirmation — is what enables financial certainty. Whether you are a business accepting stablecoin payments at checkout or a bank settling cross‑border flows, sub‑second finality is the difference between trust and uncertainty.

While Plasma offers the convenience and speed of a payments network, it does not compromise on general programmability. This is where its full EVM compatibility via Reth comes into play. Developers familiar with Ethereum tooling — from Solidity to Hardhat to MetaMask — can build on Plasma without retooling their entire stack. The Reth integration ensures that smart contracts, wallets, and DeFi primitives developed for Ethereum can be deployed with minimal friction. Yet Plasma does not simply clone Ethereum; it optimizes the experience for stablecoin settlement. It unshackles developers from the constraints of gas‑first economics and gives them a platform where stablecoin operations are first‑class primitives.

Security is often the tension point in Layer 1 design: achieving decentralization, censorship resistance, and neutrality while still delivering high performance is difficult. Plasma navigates this tension through Bitcoin‑anchored security, a design choice that elevates its resistance to censorship and enhances neutrality. By anchoring data commitments or checkpoints into Bitcoin’s proof‑of‑work chain, Plasma gains a form of external attestation and immutability that is hard to revise or censor. This does not mean Plasma becomes a Bitcoin sidechain; rather, it means that its settlement logic benefits from Bitcoin’s unrivaled security model. In a world where blockchain networks are increasingly scrutinized for governance capture and regulatory pressure, anchoring security to Bitcoin bolsters Plasma’s posture as a settlement layer that is resistant to undue influence and interference.

Now let’s zoom out and look at why Plasma’s stablecoin focus is so strategically important. The global financial system moves trillions of dollars every day. Traditional rails like SWIFT, ACH, or correspondent banking networks are slow, expensive, and siloed. Stablecoins — particularly those pegged to major fiat currencies — offer a digital alternative that is borderless, programmable, and near‑instant. Many financial institutions understand this potential and are experimenting with tokenized deposits and digital cash equivalents. However, the rails they experiment on are often not optimized for real settlement use: there are too many points of friction, too much fee volatility, or too much uncertainty in execution speed and confirmation.

Plasma’s value proposition is clear: a blockchain where stablecoins are native, gas is abstracted, fees are predictable, and settlement is nearly instantaneous. There is a profound difference between supporting stablecoins as an afterthought and building a chain explicitly for stablecoin settlement. In the former scenario, the network’s incentives, economics, and design priorities still revolve around something else — often speculation or general smart contract execution. In the latter scenario — Plasma’s scenario — everything revolves around payment utility. This focus yields efficiency and simplicity that legacy blockchains struggle to match.

From a user’s perspective, Plasma feels like the first blockchain that truly understands what money is supposed to do. Most people outside the crypto space care about move money, not manage tokens. They want assured settlement, transparent pricing, and zero surprises at the point of transfer. Plasma gives them that. The paymaster abstraction and stablecoin fee model ensure users never second‑guess what costs they will incur. The sub‑second finality ensures recipients, whether individuals or businesses, can act on the funds immediately. The EVM compatibility ensures developers can innovate without friction. And the Bitcoin‑anchored security ensures the network’s settlement history is robust and censorship resistant.

One of the most exciting implications of Plasma’s architecture is what it enables for global retail adoption. In many parts of the world, stablecoins are already used daily — not as speculative assets but as digital cash equivalents. From remittances to local commerce, stablecoin adoption has outpaced traditional crypto narratives. Yet the experience is still rough: slow confirmations, unpredictable fees, wallet fragmentation, and exchange dependencies create unnecessary friction. Plasma’s design directly addresses these pain points. Imagine an ecosystem where an international shopper can pay a local vendor in USDT, the payment arrives in less than a second, there are no additional gas fees to manage, and the cost of that settlement is predictable. That is a world in which digital money feels like digital money, not like a technical experiment.

Institutional players also benefit profoundly. For banks, payment processors, and financial platforms, the ability to settle in stablecoins with predictable cost and rapid finality transforms reconciliation processes, liquidity management, and cross‑border flows. Traditional systems require complex liquidity corridors and pre‑funding arrangements. Plasma’s stablecoin settlement rails simplify liquidity flows by ensuring that transfers settle quickly and without surprise costs. This means institutions can reduce the cost of capital tied up in corridors and speed up settlement cycles — two perennial pain points in global finance. When institutional players can rely on a settlement layer that speaks their language — dollars, speed, predictability — adoption accelerates beyond the fringes of crypto.

It’s worth acknowledging that Plasma’s approach is not merely a technological choice but a strategic economic alignment. The use of gasless transactions and stablecoin fees aligns the network’s incentives with users rather than token speculators. In many blockchains, native tokens derive value partly from network activity — transactions, smart contract execution, and speculation. Plasma’s design de‑emphasizes native token speculation in favor of real economic activity expressed through stablecoin movement. This re‑alignment shifts value capture from token trading dynamics to utility creation. In other words, Plasma’s value accrues to users and applications that actually use the network for settlement, not just to traders betting on volatility.

As a result, the network’s growth story becomes a narrative of real usage rather than price action. A merchant adopting Plasma rails to accept stablecoin payments is a different kind of milestone than a sudden token price surge. Similarly, a remittance provider integrating Plasma for faster settlement is a different kind of success story than a brief uptick in active wallets. Plasma’s metrics for success should be adoption of stablecoin flows, not token price appreciation.

To be clear, Plasma does have a native token — as most Layer 1 blockchains do — but its role is not to be the medium of exchange for users. Instead, the token’s economic role centers on network security, incentivizing validators, and supporting governance. Users who are simply sending stablecoin money should never need to touch native tokens. This separation between transactional utility and network economics is subtle but powerful. It means the blockchain’s success is measured in stablecoins moved and settled, not in native token speculation.

Another crucial dimension of Plasma’s design is its extensibility for future financial primitives. Because it is EVM compatible, developers can build advanced smart contracts that layer on top of its settlement foundations. Think programmable invoices, automated recurring settlements, tokenized assets that settle in stablecoins, or decentralized exchanges optimized for settlement efficiency. Plasma’s network becomes not just a payments rail but a platform on which next‑generation financial applications can be built without sacrificing the simplicity of stablecoin transfers. This combination — programmable money with predictable settlement economics — is fertile ground for innovation.

Some might ask: why not just use existing optimized rollups or payment channels? The key difference is that Plasma is a native Layer 1, not a secondary layer dependent on another chain for security or settlement. This gives it autonomy and reduces reliance on external consensus layers. While rollups improve scalability, they still inherit constraints and economic models from their base layers. Plasma defines its own base layer where settlement is native, predictable, and stablecoin‑first. This autonomy allows Plasma to innovate at the protocol level in ways that aren’t possible on settlement layers designed for general smart contract execution.

Looking forward, the implications of Plasma’s architecture extend beyond payments into broader financial integration. Consider cross‑chain settlements, where assets on one network need to be settled on another. With Plasma as a settlement hub focused on stablecoins, cross‑chain messaging becomes more about value transfer than token juggling. Because stablecoins serve as a common denominator across networks, Plasma could function as a settlement anchor in a multi‑chain financial ecosystem. In effect, it becomes a bridge — not a speculative bridge — but a value settlement bridge where dollars move securely, predictably, and fast.

In conclusion, Plasma represents a purposeful rethink of blockchain design. It shifts the epicenter from token economics and speculative narratives to a stablecoin‑native settlement experience that feels intuitive, efficient, and aligned with real economic use cases. Its paymaster model abstracts gas, making transactions feel like digital cash transfers. Its stablecoin fee model aligns cost with predictability. Its sub‑second finality ensures certainty. Its EVM compatibility invites innovation. And its Bitcoin‑anchored security strengthens neutrality and censorship resistance. Together, these features position Plasma not just as another Layer 1, but as a foundational layer for digital money infrastructure.

When I think about Plasma, I see a blockchain that finally asks the right question: How do real people and institutions actually want to use money on‑chain? It’s a question that has been overlooked for too long. Plasma doesn’t just answer that question it builds the rails that make that answer matter.

Plasma is not just another blockchain in the crowded landscape of Layer 1 networks. It is a purpose‑built blockchain designed for stablecoin settlement, and at the heart of its utility is a feature that may sound simple but is transformational in practice: zero‑fee transfers for everyday users. At first glance, removing transaction fees may seem like a sugar‑coating tactic or marketing buzz. But when you understand how fees have historically functioned in blockchain ecosystems — and how they create friction, confusion, and barriers to adoption — you begin to see why Plasma’s zero‑fee transfers are far more than a feature; they are a catalyst for real‑world stablecoin adoption and everyday use.

To appreciate the significance of zero‑fee transfers, it helps to start with a familiar comparison. When people use digital services like PayPal, Venmo, or their bank’s mobile app, they rarely think about “transaction costs.” They expect transfers to work — quickly, simply, without hidden friction. That expectation is baked into everyday financial behavior. If blockchain‑based money is to move beyond niches of trading desks, yield farms, and speculative markets into genuine day‑to‑day use, it must meet people where they live: in an experience that feels intuitive, predictable, and free of barriers. Plasma’s zero‑fee transfer model answers that need.

Blockchain transaction fees, often referred to as “gas,” have been one of the most persistent sources of pain for users. On networks like Bitcoin and Ethereum, fees fluctuate wildly with network demand. Sometimes they are negligible, and other times they spike to levels that make small transfers uneconomical. For a user sending $10 worth of stablecoins, paying a $5 or $10 fee is not just inconvenient — it’s unacceptable. In traditional digital money systems, sending $10 doesn’t suddenly cost an extra $2 or $3 because the network is busy. That kind of unpredictability prevents everyday users from trusting blockchain‑based money for routine transactions. Plasma’s approach — where zero‑fee transfers remove that friction entirely — is a fundamental user experience breakthrough.

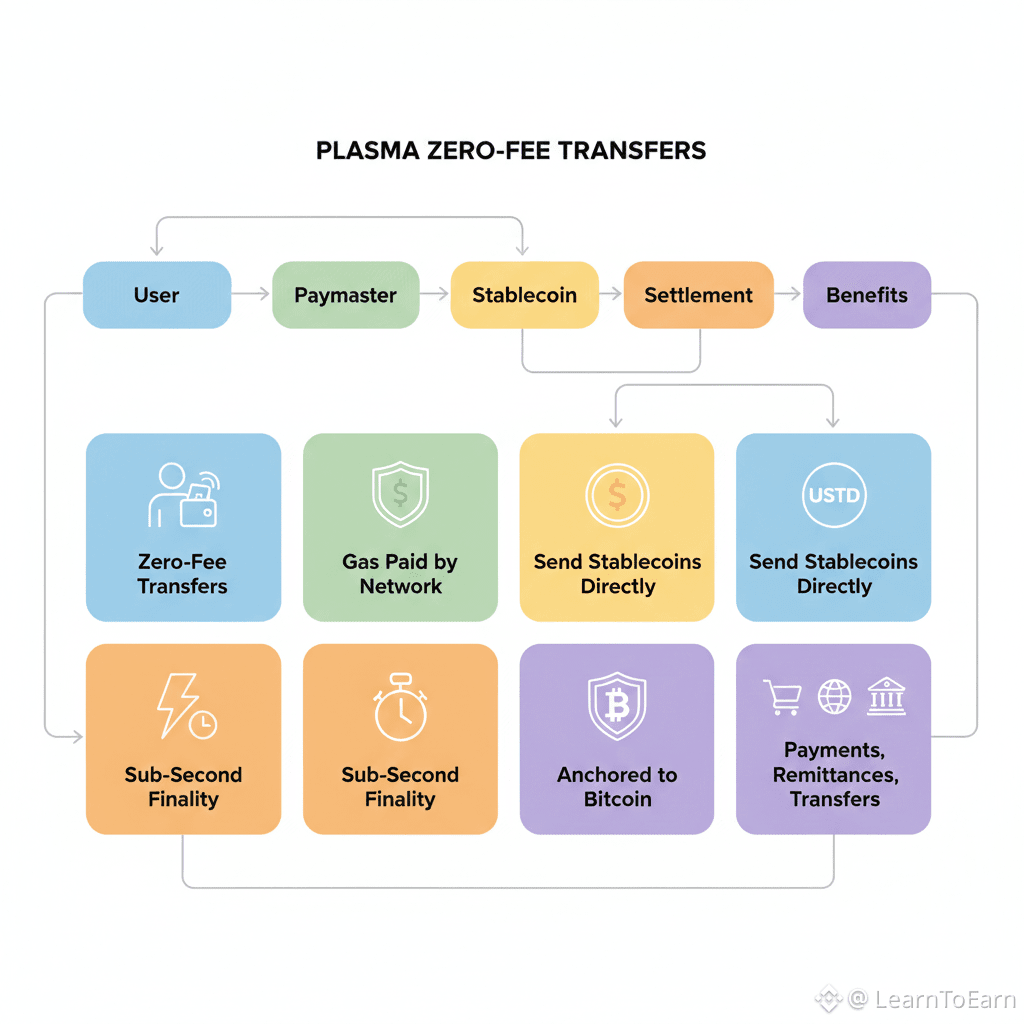

Zero‑fee transfers on Plasma are not a gimmick; they are the result of a deliberate protocol design that separates transaction execution costs from user experience. The key innovation behind this is Plasma’s protocol paymaster system. In most blockchains, users must hold the native token to pay fees. That requirement introduces two layers of complexity: users must understand and acquire a token they otherwise do not need for value transfer, and they must manage fee balances separate from the asset they want to send. Plasma eliminates both pain points. The network’s protocol paymaster sponsors gas costs for transfers of supported stablecoins, meaning users can send USDT and similar assets without paying or even holding any native token. The result is what users intuitively expect: put money in, send money out, no fee headaches.

To everyday users, zero‑fee transfers feel like digital wallets in Web2: seamless, familiar, and predictable. Imagine a user in a high‑adoption market who wants to send stablecoins to a friend, pay a merchant, or settle a small invoice. With Plasma, they simply open their wallet, enter an amount, and hit send. They do not need to worry about whether gas prices have spiked or if they have enough native tokens to complete the transaction. For users who are not familiar with blockchain mechanics — and for most people outside the crypto space — this simplicity is essential. The less users have to think about “crypto stuff,” the more they can focus on the actual value they are transferring.

Zero‑fee transfers also have a profound effect on financial inclusion. In regions where traditional banking infrastructure is expensive, slow, or inaccessible, stablecoins have already emerged as an alternative form of digital money. People use them for remittances, local commerce, savings, and cross‑border payments. Yet the underlying experience on most networks still suffers from volatility in fees, delays in settlement, and cognitive barriers related to gas management. Plasma’s model removes one of the biggest barriers: transaction cost friction. When moving money costs nothing — at least in user terms — adoption accelerates. People start to treat stablecoins not as speculative assets but as everyday money. Sending money becomes as simple as sending a text message.

From a behavioral standpoint, zero‑fee transfer experiences also reduce mental transaction cost. In psychology and behavioral economics, we understand that even small frictions deter usage. A $1 fee on a $5 transfer may be affordable, but the mental overhead of thinking about fees — “Is this the right time? Should I wait? Is the fee too high?” — creates hesitation. Beginners, in particular, get stuck trying to time the best moment to send, or they become comfortable only when fees are low, which undermines the reliability of the network as a payments layer. By eliminating that friction, Plasma shifts stablecoin transfers toward a mental default of “just send”, which is exactly the behavior you want in everyday financial activity.

Of course, zero‑fee transfers raise a natural question: who pays the cost of executing the transactions? Plasma does not eliminate costs at the protocol level; rather, it absorbs them in a way that abstracts them from the user. The network’s paymaster system underwrites transaction fees on behalf of users during stablecoin transfers. This model draws a clear distinction between user experience and network economics. While users see zero fees, the network still has mechanisms to reward validators, support security, and sustain long‑term operation. The native token and validator incentives remain essential, but they do not interfere with everyday usage. In simple terms: users get simplicity; the network gets security. That separation is critical to building a system that is both usable and robust.

The technology that enables zero‑fee transfers also contributes to predictable settlement and performance. Plasma leverages a consensus mechanism known as PlasmaBFT, which delivers sub‑second finality. In payments and settlement use cases, finality matters immensely. Traditional blockchains often rely on probabilistic confirmations — meaning a transaction is considered more secure only after multiple block confirmations. For simple transfers, that can mean waiting minutes or even longer. Sub‑second finality ensures recipients see incoming funds almost instantly and with confidence that the transfer is irreversible. When zero‑fee transfers combine with instant settlement, the experience begins to resemble central payment systems like Visa or bank transfers — but with the added benefits of decentralization, programmability, and global reach.

Zero‑fee transfers also extend Plasma’s appeal beyond individual users to businesses and merchants. For a shop accepting stablecoin payments, unpredictable fees and complex transaction processes are significant barriers. Merchants do not want to explain gas fees to customers. They do not want a checkout process that involves waiting or multiple confirmation steps. Plasma’s model where a customer sends USDT with no fees and the merchant receives it with certainty and speed fits seamlessly into real‑world commerce. Imagine buying a coffee with stablecoins in a city where Plasma rails are supported. You tap, send, and the merchant’s register updates instantly — no gas wallet, no confirmation delays, no fee surprises. That experience is indistinguishable from scanning a QR code with a credit card — except that the underlying settlement is decentralized, transparent, and global.

The impact of zero‑fee transfers on remittances — one of the most practical uses of stablecoins today — cannot be understated. Remittances are the lifeblood of many economies, and traditional remittance infrastructure often imposes high fees, slow processing times, and geographic limitations. Stablecoins already offer a new alternative, but the cost of on‑chain fees has prevented widespread adoption for smaller transfers. With @Plasma , sending remittances becomes comparable to sending a message: the cost is effectively zero to the user, and funds settle quickly. When combined with inexpensive on‑ and off‑ramps, Plasma could significantly reduce the friction and cost of sending money across borders, empowering families and communities with faster, cheaper access to funds.

Zero‑fee transfers also bring clarity to the developer experience. Developers building applications on Plasma do not need to educate users about gas or build complicated abstractions to manage fee balances. Instead, they can design apps around the assumption that stablecoin transfers will work without friction. That assumption changes the way applications are built. Wallet developers can design straightforward transfer screens without commodity gas UI. Commerce app developers can integrate stablecoin payments without auxiliary tutorial layers. Financial apps, remittance interfaces, and savings platforms can focus on core utility rather than explaining blockchain mechanics. This developer confidence accelerates innovation and broadens the range of practical decentralized applications built on top of Plasma’s stablecoin rails.

A key reason Plasma can offer zero‑fee transfers is because it is engineered with stablecoin settlement in mind from the ground up. Most blockchains treat stablecoins as just another token among many, subject to the standard fee mechanics of the network. That generalist approach works for speculative trading or smart contract experimentation, but it creates unnecessary barriers for payments. Plasma takes the opposite approach: stablecoins are native to the experience, and the protocol prioritizes stablecoin settlement as a primary use case. This philosophical shift — focusing on a specific practical need rather than treating everything as a general purpose sandbox — streamlines the entire network for the users and businesses that want to send, receive, and settle money.

Even with zero‑fee transfers, Plasma’s security and decentralization are not compromised. The network anchors its security model to Bitcoin, the most secure blockchain in the world, which enhances censorship resistance and network neutrality. By anchoring checkpoints or settlement proofs into Bitcoin’s proof‑of‑work chain, Plasma benefits from the immutability and resilience of Bitcoin while maintaining its own high‑performance consensus. This combination — zero‑fee transfer experience with robust security anchoring — makes Plasma not only usable but trustworthy for real financial activity.

Another significant dimension of zero‑fee transfers is its psychological impact. Users evaluate financial systems not just on cost, but on perceived ease and confidence. When fees disappear from the user’s mental model, transactions feel less risky, less technical, and less intimidating. People start treating the network like money, not like an experiment. That shift in perception is crucial for mainstream adoption. Users do not think: “Is the gas price too high?” Instead they think: “How quickly can I send this, and can I trust it will arrive?” Plasma’s design answers that question affirmatively.

Critically, zero‑fee transfers do not mean Plasma is free to operate or that validators are working for nothing. The network’s economic layer ensures validators and infrastructure providers are compensated, but in a way that does not burden everyday users. Fees at the protocol level may be managed, pooled, or subsidized through ecosystem incentives, validator rewards, or network‑wide economic design. What users experience is simplicity; what the network manages is sustainability. This separation between user experience and economic sustainability is a profound architectural choice because it aligns incentives: users get a frictionless experience, and the network maintains healthy economic incentives for long‑term operation.

In the broader evolution of blockchain technology, zero‑fee transfers represent a milestone in user experience design. Early blockchains were revolutionary for decentralization and censorship resistance, but they often prioritized those goals at the expense of usability. Plasma demonstrates that innovation can and should go hand in hand with usability. When a blockchain removes an artifact like transaction fees from the user experience, it closes the gap between traditional digital money and decentralized digital money. It makes blockchain technology feel less like a specialized domain and more like a natural evolution of money itself.

In conclusion, #Plasma ’s zero‑fee transfers reduce friction in everyday financial activity in a way that few blockchain innovations have accomplished. By eliminating the need for users to manage fees, holding native tokens, or predict gas costs, Plasma simplifies stablecoin transfers to their pure essence: move money, fast, reliably, and without hidden cost. This model resonates with fundamental user expectations about how money should work. It supports financial inclusion by lowering barriers to entry. It empowers developers to build without unnecessary cognitive load. It offers merchants and remitters a practical, cost‑effective settlement rail. And it does all this while maintaining a robust security posture anchored to Bitcoin.

Plasma’s zero‑fee transfer mechanism is not merely a feature — it is a bridge to real‑world adoption, a step toward the day when stablecoins are not just digital assets traded on exchanges, but everyday money used by billions of people around the world. $XPL

$XPL