In early 2026, Dusk Network crossed a major milestone, transitioning from years of development into a fully operational Layer-1 blockchain with a live mainnet that focuses on privacy, compliance, and real-world assets (RWAs) rather than speculative narratives. After six years of iterative engineering, the mainnet launch marked the moment Dusk went from concept to production, and its strategy since has been quietly purposeful — shipping features and integrations that strengthen its position as regulated financial infrastructure.

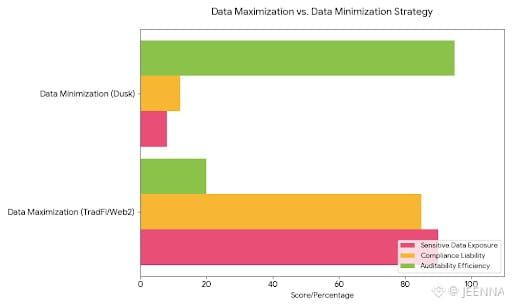

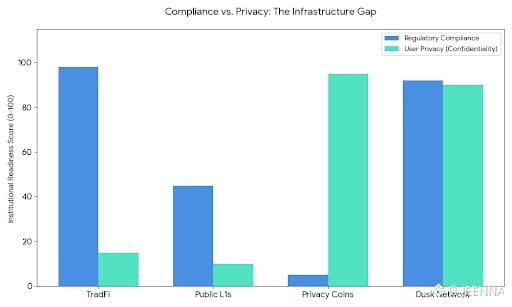

At its core, Dusk is a blockchain designed to power confidential smart contracts and regulated financial instruments. It blends zero-knowledge cryptography with compliance primitives that meet institutional requirements, enabling sensitive transaction data to stay private while still allowing selective auditability for authorized parties. This model directly addresses the longstanding conflict between privacy and regulatory compliance — a tension that has constrained adoption of pure privacy coins and permissionless networks in regulated environments.

The network’s most significant recent technical achievement has been the launch of DuskEVM, an Ethereum Virtual Machine–compatible execution layer that went live in January 2026. By supporting Solidity and familiar developer tooling, DuskEVM dramatically lowers friction for existing Web3 teams to build on Dusk while leveraging its privacy and compliance features. This compatibility is not a cosmetic upgrade — it creates a bridge between existing smart contracts and a chain that embeds privacy and regulatory friendliness at the protocol layer.

Dusk’s ecosystem narrative is anchored in regulatory cooperation and real-world asset tokenization. Strategic partnerships with regulated entities such as NPEX — a Dutch exchange with MTF licensing — and compliance-aligned stablecoin issuers illustrate a deliberate push to bring traditional financial instruments on-chain in a compliant way. Planned deployments like the NPEX dApp are expected to enable trading and settlement of tokenized securities, including equities and bonds, directly on Dusk’s EVM environment, potentially unlocking hundreds of millions in institutional capital.

In parallel, Dusk is integrating developer infrastructure like Chainlink oracles and cross-chain messaging protocols, which will be critical for secure price feeds, interoperability, and composability with other chains. These technical building blocks are essential for supporting complex onchain financial products that require real-time data and multichain liquidity flows.

Market dynamics in early 2026 reflect growing investor interest. After breaking a long downtrend, the DUSK token experienced significant price momentum, with trading volume and open interest expanding as traders rotate into privacy and compliance-focused assets. While volatility remains high — a natural feature of early adoption phases — this market activity underscores heightened attention to Dusk’s unique value proposition relative to other privacy tokens that lack compliance tooling.

Despite the positive momentum, analysts note that short-term technical corrections and liquidation risks may surface as the broader market digests recent rallies. These risks are typical during periods of rapid price expansion and do not necessarily diminish the underlying fundamental developments — but they do highlight the importance of risk management for participants engaging with nascent infrastructure tokens.

Looking ahead, Dusk’s roadmap prioritizes regulated finance integration and broader ecosystem utility. Key milestones include the rollout of Citadel identity solutions that balance privacy with compliance workflows, further development of cross-chain bridges enabling secure asset transfers, and expansion of tooling tailored to institutional users operating within regulatory frameworks such as the EU’s MiCA and DLT Pilot Regime.

In sum, Dusk Network has shifted from ambition to execution — shipping core infrastructure that aligns cryptographic privacy with financial compliance and real-world utility. This shift sets Dusk apart in the crowded blockchain landscape because it speaks directly to the demands of regulated finance rather than catering solely to speculative use cases. If adoption continues among institutions and developers building real-world financial applications, Dusk’s 2026 narrative may be defined less by token price movements and more by tangible deployment of compliant blockchain services in global markets.