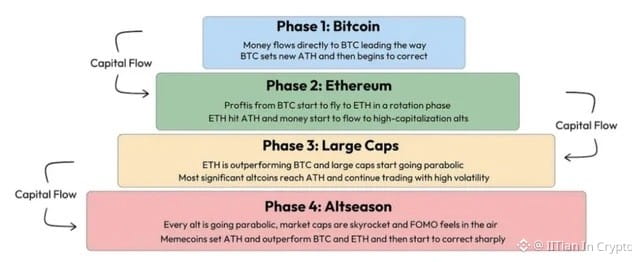

In previous crypto cycles, the "Waterfall Model" was the law of the land: first Bitcoin (BTC) pumped, then profits trickled down into Ethereum (ETH), and finally, the "Altseason" began. But as we move through January 2026, that old playbook is being rewritten.

For the first time, we are seeing simultaneous growth. Large-cap altcoins like Solana (SOL), BNB, and various AI-tokens are running side-by-side with Bitcoin. Why is this happening, and what does it mean for your portfolio? Let’s break down the structural shifts making this cycle unique.

📈 1. Fresh Capital Over "Profit Rotation"

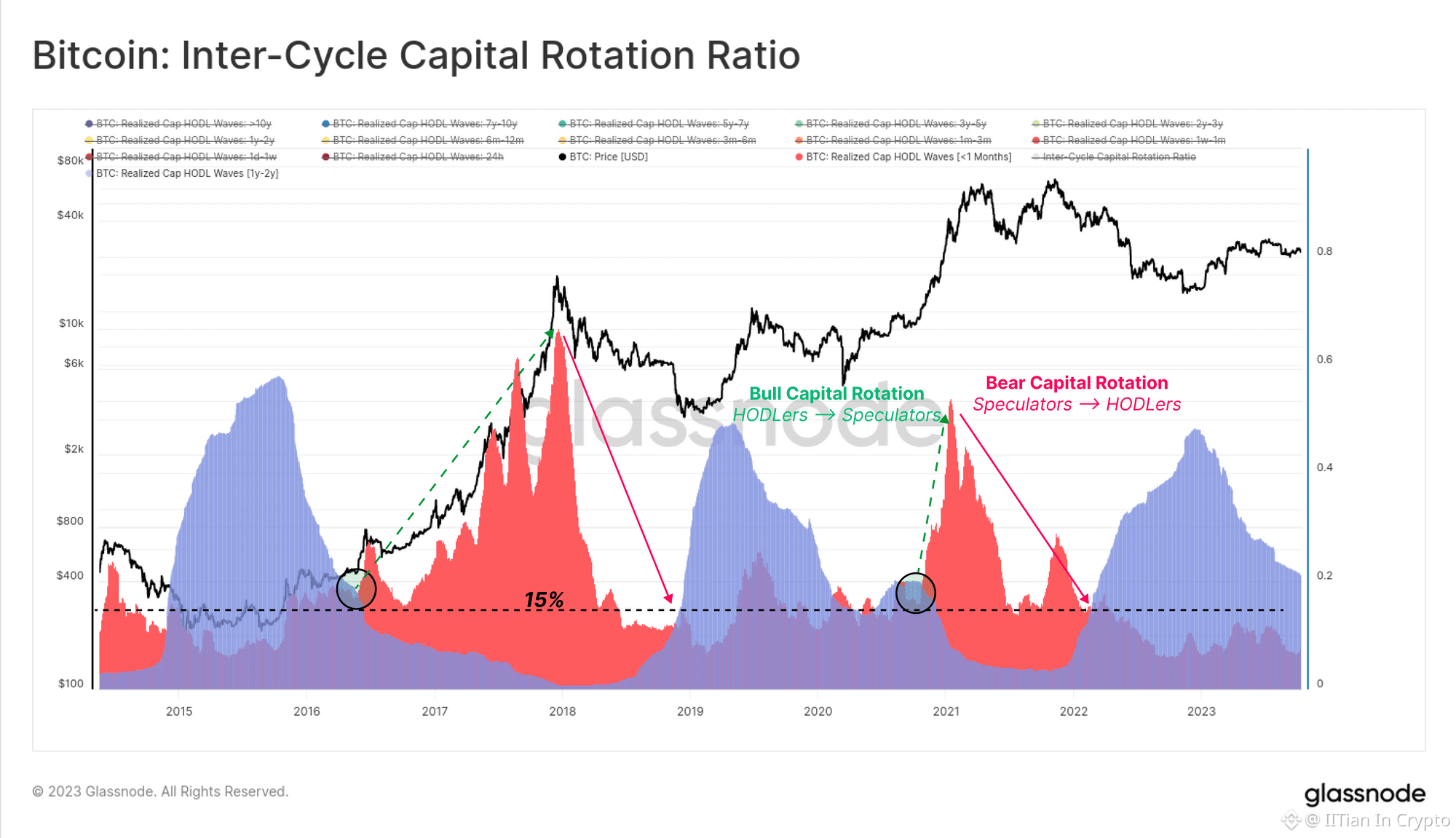

In 2017 and 2021, liquidity was a zero-sum game. To buy an altcoin, traders usually had to sell their Bitcoin, creating a "see-saw" effect.

Then: Limited capital meant Bitcoin had to "pause" for Altcoins to breathe.

Now: The market is awash with fresh institutional capital. With the success of spot ETFs for Bitcoin, Ethereum, and now Solana, massive pools of money are entering multiple "entry points" at once. Investors aren't just "flipping" BTC profits anymore; they are deploying new cash into a diversified basket of assets from Day 1.

🛡️ 2. Higher Investor Confidence & Market Breadth

The "fear factor" that once kept altcoins pinned down until Bitcoin stabilized has significantly faded.

Regulatory Clarity: Frameworks like the MiCA in Europe and the CLARITY Act in the U.S. have provided a safer environment for institutions.

Utility over Hype: This cycle isn't just driven by "memecoin fever." We are seeing massive growth in Real-World Assets (RWA), AI-integrated protocols, and Decentralized Physical Infrastructure (DePIN). When assets have real-world usage and revenue, they are less dependent on Bitcoin’s daily price action to find buyers.

🏹 3. Global Liquidity & The "Risk-On" Floor

Macroeconomics is playing a massive role. With global central banks shifting toward a more accommodative stance in early 2026, the "hurdle rate" for traditional investments has increased, pushing liquidity into the entire crypto ecosystem.

Diversification: Sophisticated traders now view the Top 20 altcoins not as "leveraged Bitcoin bets," but as distinct technology plays. This leads to Market Breadth, where a wide variety of sectors thrive simultaneously, signaling a much healthier and more mature financial ecosystem.

🧭 How to Navigate This "Simultaneous" Rally

Because capital is spreading more evenly, your entry strategy should be more balanced than in the past.

Step-by-Step: Positioning Yourself for Broad Market Growth

Start Your Journey: Don't wait for a "rotation" that might already be happening. Set up your account and be ready. 👉 Sign Up for Binance Here!

Monitor the Entire Market: Use the price pages to see which sectors (AI, Layer 2, DeFi) are leading the charge alongside BTC. 👉 Track Real-Time Altcoin Prices

Use Binance Convert for Diversification: If you want to move some USDT into a basket of BTC, ETH, and BNB quickly, this is the tool.

Select your source (e.g., USDT).

Choose your destination (e.g., SOL or BNB).

Click Preview Conversion and hit Convert for an instant, fee-free swap!

🏗️ Diversification Strategy: Focus on Gold & Silver Until Altseason Peak

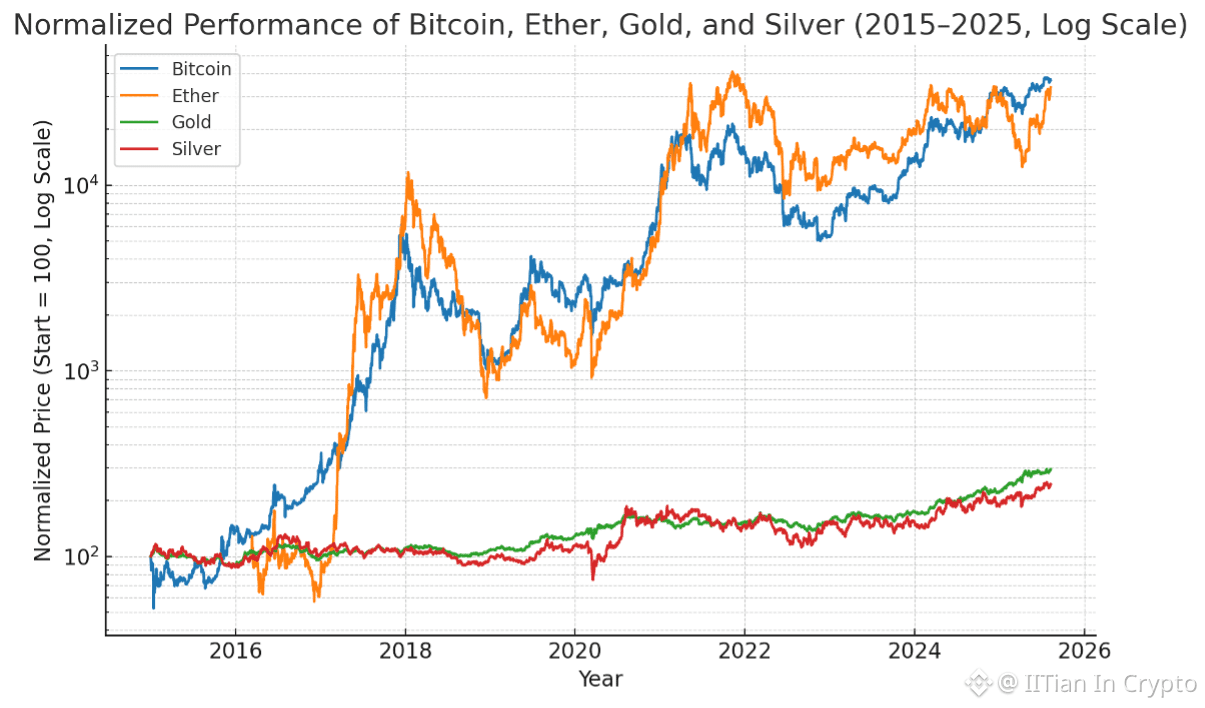

While the simultaneous rally is exciting, the truly "explosive" Altseason—where small-caps 10x in a week—is still warming up. In the meantime, smart money is rotating into Precious Metals to hedge against early-year volatility.

The Flight to Safety: In January 2026, Gold has surged past $5,000 and Silver has shown even more explosive growth, tripling from its 2025 lows.

Hard Asset Hedge: As Bitcoin consolidates near $100K, holding tokenized Gold or trading Silver perps allows you to stay in "Hard Assets" while waiting for the perfect Altcoin entry signal.

✅ Final Thoughts

The "wait-your-turn" era for altcoins is ending. We are entering a phase of Integrated Market Growth, where quality projects across various sectors are being rewarded at the same time as the "Digital Gold."

While this suggests a more sustainable bull run, it also requires more research. Focus on projects with strong fundamentals, clear utility, and consistent on-chain activity.

Quick Links for Your Strategy:

Join Binance: https://www.generallink.top/en-IN/join?ref=E174GSF2

Market Data: https://www.generallink.top/en-IN/price

Instant Swap: https://www.generallink.top/en-IN/convert/USDT/BTC