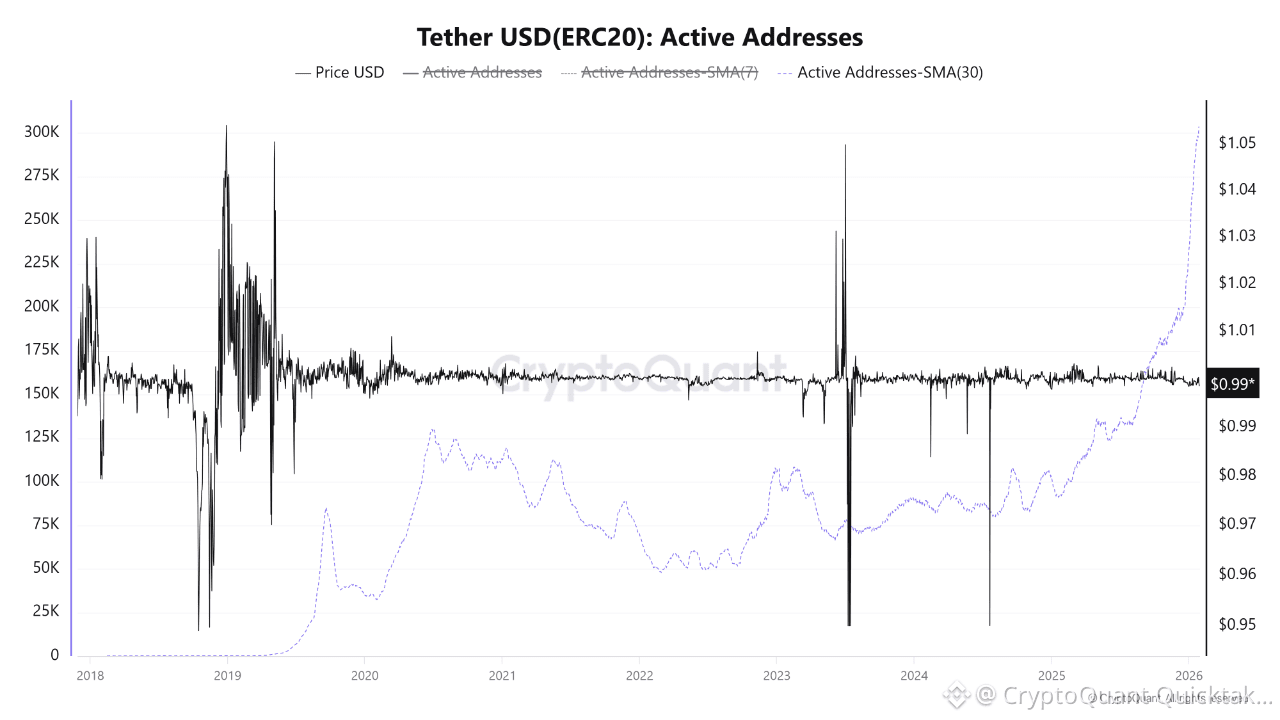

Recent data from CryptoQuant reveals a fascinating divergence. While the 30-day Simple Moving Average (SMA) of Tether (ERC20) active addresses has gone parabolic, touching a record 300,000, Bitcoin failed to breach the critical $92k resistance and faced a pullback.

The key insight lies in combining this metric with the observed stablecoin outflows from exchanges. A surge in active addresses coupled with exchange outflows is typically not a signal of immediate buying pressure on Centralized Exchanges (CEXs). Instead, it points toward a capital rotation into DeFi protocols or Self-Custody wallets.

This behavior suggests that following Bitcoin’s correction, investors are not cashing out into fiat (leaving the market completely). Rather, they are choosing to hold liquidity in Tether and move it on-chain. The spike in network activity is likely driven by users seeking yield (farming) during market chopping or executing swaps on Decentralized Exchanges (DEXs). Liquidity hasn’t left the ecosystem; it is accumulating in the underlying layers of the Ethereum network, potentially waiting for the next clear trend to deploy.

Written by CryptoOnchain