The FOMC announced on January 28, 2026 (U.S. time) that policy rates would be held at 3.75%, reinforcing a wait-and-see stance near neutral. Economic activity remains solid, the labor market shows signs of stabilization, and inflation is still somewhat elevated. The message was clear: there is no urgency to ease policy.

While FOMC decisions consistently attract attention in crypto markets, historical data shows that these meetings rarely define Bitcoin’s medium-term direction. Instead, they tend to function as positioning reset points.

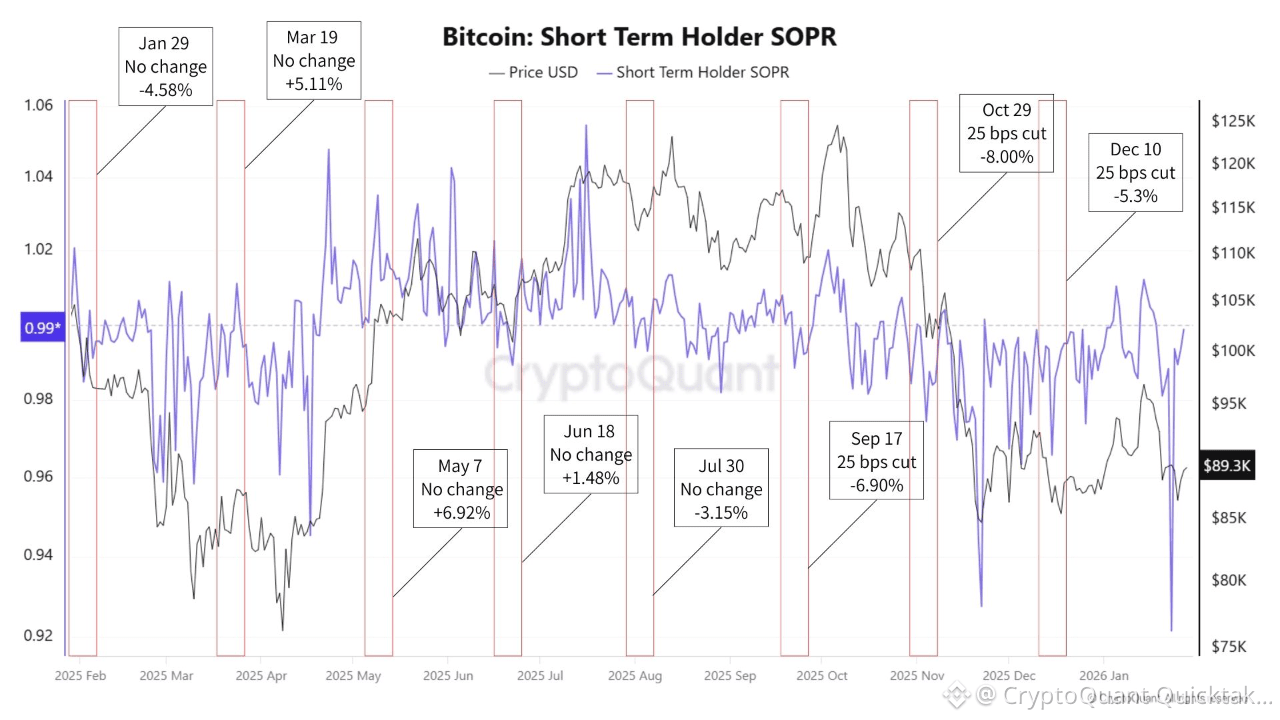

Looking at FOMC meetings in 2025, Bitcoin’s 7-day performance after each decision was inconsistent. Rate-hold meetings produced mixed but relatively mild moves, while rate cuts in September, October, and December were followed by declines of roughly 6–8%. This suggests that outcomes were driven less by policy itself and more by market conditions going into the event.

Ahead of FOMC meetings, leverage and open interest often build as expectations become widely shared. Volatility compresses and liquidity thins, creating an appearance of stability. However, once the event passes and no new bullish catalyst emerges, markets shift into adjustment mode. Particularly during rate-cut cycles, easing expectations are frequently priced in beforehand, turning the decision into a trigger for profit-taking and position unwinds.

On-chain and derivatives data consistently show that post-FOMC moves are characterized by higher volume, wider spreads, and faster price swings. This reflects structural cleanup rather than a change in long-term trend.

The key takeaway is that FOMC meetings do not decide Bitcoin’s direction. They expose how crowded positioning has become and accelerate its resolution. Over the next 30 days, the critical signals will come not from policy rhetoric, but from whether leverage, selling pressure, and liquidity conditions normalize after the event.

Written by XWIN Research Japan