Hey everyone, here comes another article, still that familiar flavor—let's talk about @Plasma

This project has kept me awake at night recently. To be honest, I've been paying attention to Plasma since the end of last year. At first, I just found its positioning as a 'stablecoin payment L1' quite interesting, but the deeper I dug, the more I got hooked.

It's not a short-term FOMO impulse, but rather seeing it gradually push the word 'practicality' to its limits, making me unable to resist wanting to hoard more $XPL.

First, let me mention the most explosive thing recently: Plasma has directly integrated with NEAR Intents. This is not just a simple bridge, but it pulls cross-chain liquidity up to CEX levels.

Users can now seamlessly exchange over 125 types of assets from more than 25 mainstream chains into Plasma's native token XPL, or directly deposit and withdraw USDT0.

In the past, large stablecoin cross-chain transactions were often plagued by high slippage and gas fees. Now, developers can get nearly the same quotes as centralized exchanges using on-chain.

Slippage is so low it's negligible, and fees are absurdly low. This means Plasma is quietly transforming itself into a 'settlement layer'—not a vague L1, but a settlement highway specifically optimized for stablecoins and real payments.

Zooming out a bit, the USDT0 ecosystem is blooming all over the place. Real payment platforms like Oobit and Crypto.com already support Plasma's native USDT₮, meaning you can now use dollars on Plasma to swipe cards and make payments, rather than just circling in DeFi pools.

Confirmo Pay's integration is even more aggressive; they were already handling over $80 million in corporate transactions (e-commerce, foreign exchange, payroll settlements) every month, and now they are accepting Plasma's USDT₮ with zero gas fees.

Traditional merchants are starting to find it truly appealing: lower costs, faster transactions, and no bank intermediaries taking a cut. This is the real 'on-chain dollar' landing, not just a PPT narrative.

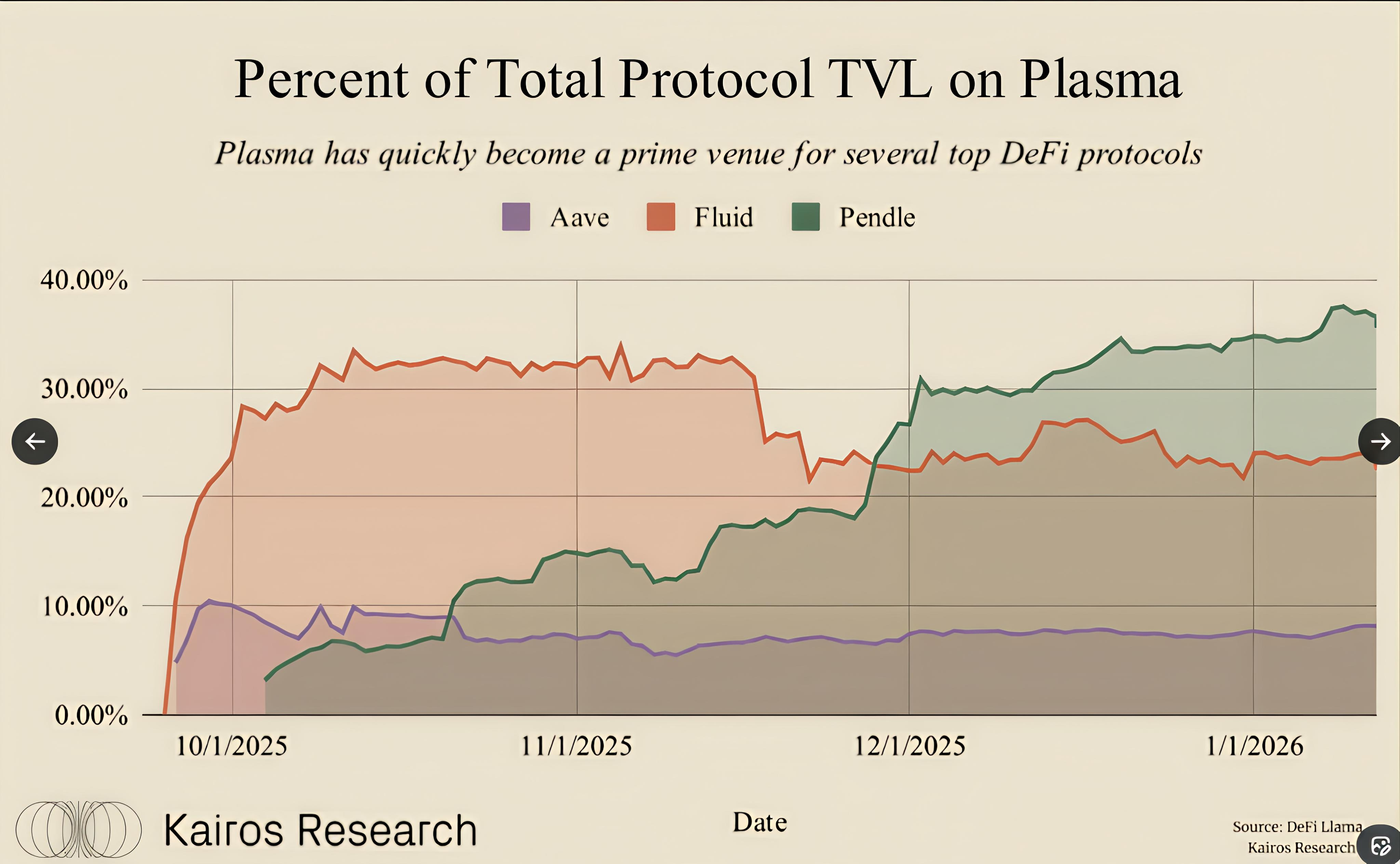

DeFi is even more exaggerated on this side. The capacity of Ethena's sUSDe PT on Aave Plasma instances is simply like riding a rocket.

From a cap of hundreds of millions a few months ago, it has exploded to a total cap of 1.2 billion now! An increase of 240 million + 400 million is not just an atmosphere test, nor is it market makers brushing volume, but real institutional demand pushing it.

Aave and Ethena daring to pull capacity this high shows they see that Plasma's credit layer and liquidity depth can genuinely accommodate large funds.

Institutions entering are not just playing around; they genuinely want to use Plasma as infrastructure. Plus, the Plasma One wallet app truly makes me unable to go back after using it.

With an annualized yield of over 10%, up to 4% cash back, swipe freely with Visa/Mastercard in over 150 countries, get a virtual card in minutes, and free instant USDT transfers... these features combined bring an on-chain dollar lifestyle of 'earning while spending' directly to users.

No banks, no borders; global payments are as simple as sending a WeChat message. This is not just another DeFi tool, but a real application that changes everyday payment habits.

Looking at these points together, Plasma is actually doing something very intense: it's not trying to create a universal L1 to compete with Ethereum or Solana on TPS, but focusing on a 'highway specifically for stablecoins.'

Cross-chain depth (NEAR Intents), stablecoin track (USDT0 launched across all platforms), institutional DeFi demand (Ethena + Aave's explosive capacity), real-world payment implementation (Confirmo, Oobit, Crypto.com, Plasma One), all conditions are fully met at once.

I increasingly feel that in the 2026 stablecoin narrative, Plasma might be the most underrated one. It's not about hype, nor blind optimism; I just feel that every step it's taking is stubbornly moving toward 'real adoption,' while the market hasn't fully reacted yet.

$XPL, as a governance + incentive + fee capture token, is slowly gaining momentum in value with the growth of TVL, daily trading volume, and partner ecosystems.

Of course, there are still risks: unlocking pressure, sideways fluctuations, and increased competition. But compared to those purely speculative projects, every update from Plasma is delivering real use cases, which makes me willing to be a bit more patient and wait for it to take off. What about you?

For those who have already swiped cards on Plasma One, come to the comments to share your real experience—what's the yield like? Is the cashback satisfying? For those using StableFlow/NEAR Intents across chains, share how low the fees are? Or if you're still watching from the sidelines, share your concerns, and let's discuss whether this 'stablecoin stealth dark horse' is worth going all in.

Charge ahead, see the truth in 2026!