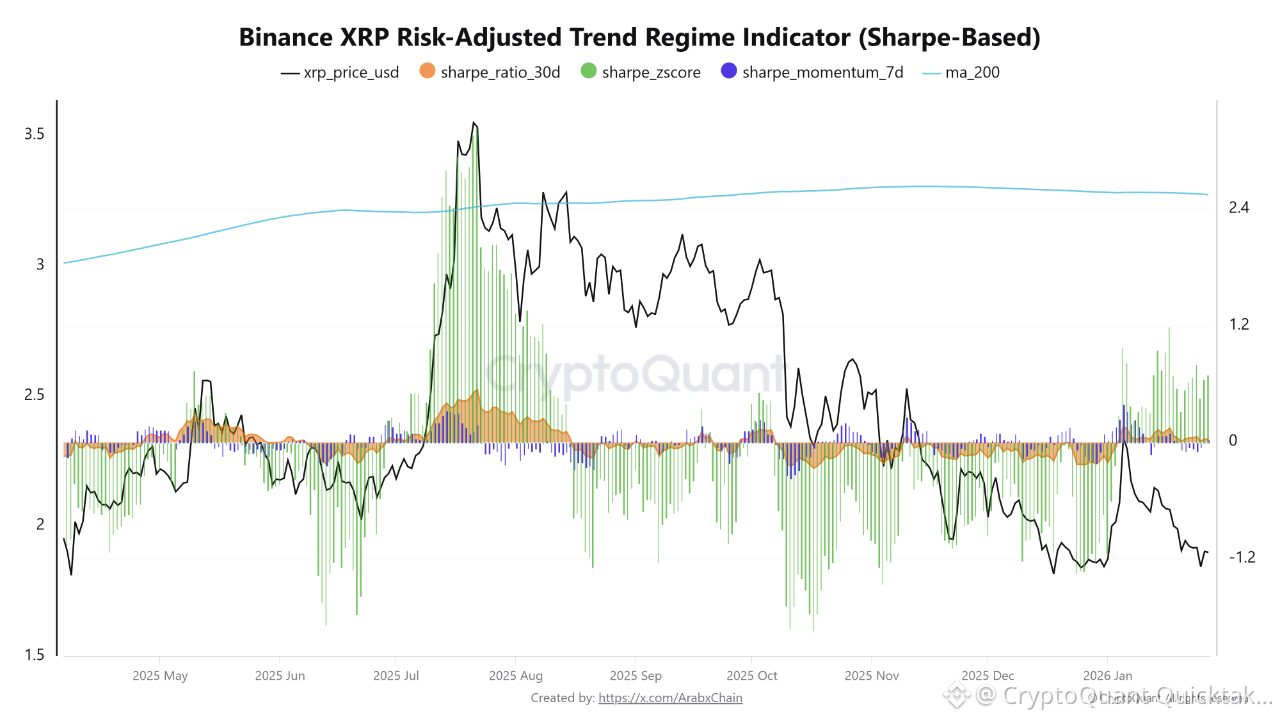

XRP data on Binance indicates a delicate state of cautious equilibrium in the market, with current values reflecting a combination of long-term structural weakness and limited short-term recovery attempts. According to the latest data, XRP is trading at around 1.89, while the 200-day moving average stands near 2.54, meaning the price remains approximately 25% below this average. This discrepancy clearly indicates that the overall long-term trend has not yet transitioned into a sustained uptrend, and that the market is still operating within a corrective range rather than a structural one.

From a risk-adjusted return perspective, the 30-day Sharpe Ratio registers a low value of 0.034, a reading very close to zero. This suggests that the return achieved over the past month offers minimal compensation for the level of risk assumed, reflecting a trading environment characterized by consolidation and a lack of clear directional conviction. Such readings typically emerge during rebalancing phases, when traders’ impulsiveness declines and the market becomes increasingly sensitive to changes in liquidity conditions.

Conversely, the Sharpe Z-Score shows a positive reading of approximately 0.70, indicating a relative improvement in return quality compared to the recent historical average. However, this level still falls short of the statistically significant threshold associated with strong trend formation. This implies that the market has partially recovered from prior pressures but has not yet entered a phase of clear risk-adjusted outperformance.

Meanwhile, the 7-day Sharpe Momentum, at around 0.03, reflects weak positive momentum in the short term. Although this indicator remains above zero, its modest level suggests that the current price behavior is more consistent with gradual consolidation or base-building, rather than a strong or impulsive price advance.

Written by Arab Chain