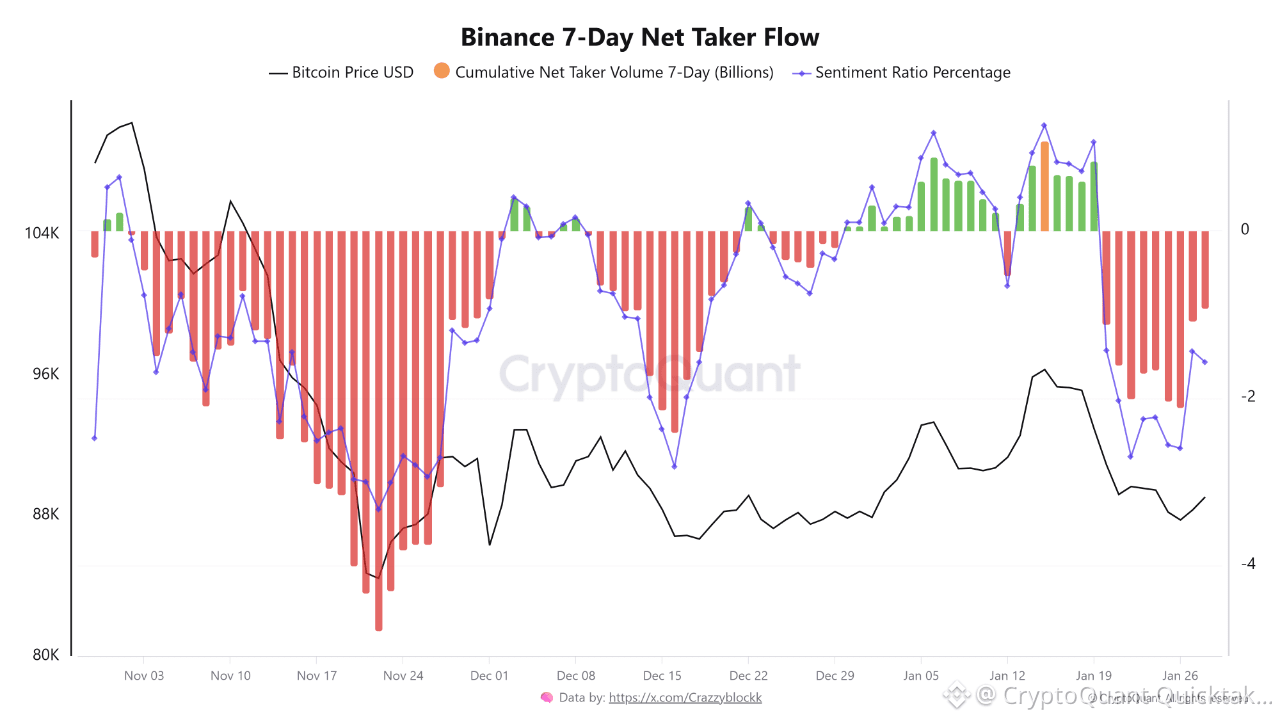

Bitcoin taker flow on Binance suggests that recent price stability is not being driven by strong buying pressure. This metric tracks market orders and helps identify whether buyers or sellers are actively crossing the spread and setting short-term direction.

The latest data shows Binance’s 7-day net taker flow is still only slightly positive. Buyers are present, but their advantage over sellers remains small, keeping sentiment in the slight buying pressure zone. This tells us that participation exists, yet conviction is weak. The market is moving, but not with force.

Today’s reading reinforces this view. Net taker volume remains positive, but it is small compared to total volume. Buyers are willing to step in, though they are not chasing price aggressively. This behavior is very different from early bull-market phases, where strong and persistent taker buying absorbs sell pressure and pushes price higher with momentum.

From a market structure perspective, this reflects balance rather than strength. Sellers are no longer dominating the order book, but buyers are also not committing enough capital to take control. In past cycles, sustained bullish moves on Binance only emerged once 7-day taker flow expanded meaningfully and conviction increased, neither of which has happened yet.

For now, Binance taker flow points to stability without strength, suggesting the market is consolidating and waiting for stronger liquidity and more decisive participation before the next clear move.

Written by Crazzyblockk