📈 Why $RIVER

Has Been Rising Recently

1. Massive Speculative Demand

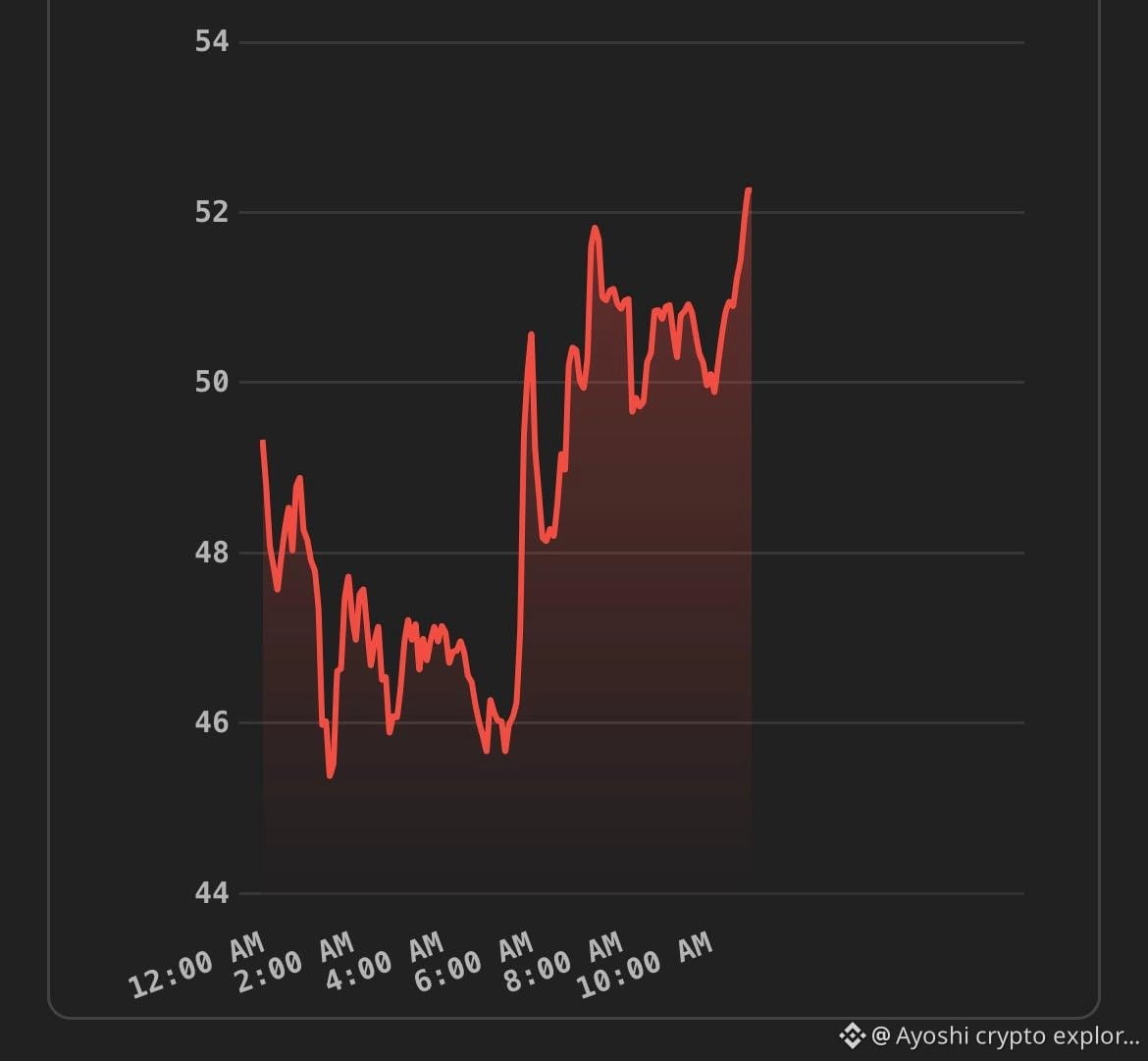

RIVER has been one of the top-performing altcoins in 2026, surging hundreds of percent year-to-date as traders piled into it amid broader crypto market moves.

This type of momentum attracts more traders — leading to short squeezes, heavy derivatives activity, and fast price moves.

2. High Trading Volume and Listings

New exchange listings (e.g., the South Korean exchange Coinone and others) have generated significant volume spikes and broader access for traders.

Listing news alone often causes price increases even before the token trades on a major exchange.

3. Institutional Backing & Big Names

Well-known figures and funds like Arthur Hayes’ Maelstrom Fund and investment from Justin Sun (TRON ecosystem) boosted confidence and visibility.

4. Innovative Tech Narrative

RIVER’s project vision — a chain-abstraction stablecoin system (satUSD) spanning ecosystems like TRON, Sui, etc. — gives traders a narrative beyond purely speculative hype.

This can drive accumulation from DeFi or “real project” believers.

🪙 What Binance Has to Do with It (“Binance Squad” Effect)

When you mention “Binance squad,” most retail traders mean factors related to Binance’s influence on price action even without a full spot listing:

📌 1. Binance Perpetual Futures Listings

RIVER is listed on Binance’s perpetual futures market. This alone massively increases trading and speculator exposure, especially leverage trading, which can inflate prices.

Futures markets often create big short squeezes and forced liquidations during rallies.

Heavy derivatives activity can push price up quickly even without organic spot demand.

📌 2. Speculation Around Future Binance Listings

Rumors or expectations of a spot listing on Binance or deeper support tend to drive retail traders to buy before official news — this is a well-observed pattern in crypto markets.

People often chase tokens expecting “buy the rumor, sell the news.”

📌 3. Binance-Driven Volume & Visibility

Even without a full listing, support related to Binance Futures or Binance-adjacent markets can:

increase liquidity,

attract global traders,

create more market depth — all of which can push prices up.

That’s what many traders loosely call the “Binance effect.”

⚠️ Risks to Keep in Mind

Some contrasting data suggests caution:

❗ Heavy leverage & negative funding rates — futures trading volumes far outweigh spot, meaning much of the price move is speculative and fragile.

❗ Highly concentrated token supply — a large portion of RIVER tokens resides in a few wallets, which can amplify volatility.

❗ Rapid unlock schedules + airdrop conversions — sudden token unlocks can add selling pressure.

🧠 Summary

Driver Impact on Price

Exchange listings (Coinone, HTX, futures) 🔺 Big

Attention from big investors (Hayes, Sun) 🔺 Medium–High

Binance Futures/trading ecosystem 🔺 High — speculative

Tech narrative (satUSD) 🔺 Medium – long-term

Tokenomics unlocks/whales 🔻 Risk factor

Bottom line: RIVER’s rise so far has been fueled by speculative trading, exchange access (including Binance Futures), high-profile support, and hype around future deeper listings and DeFi utility. But the same dynamics also make it very volatile and risky in the short term.