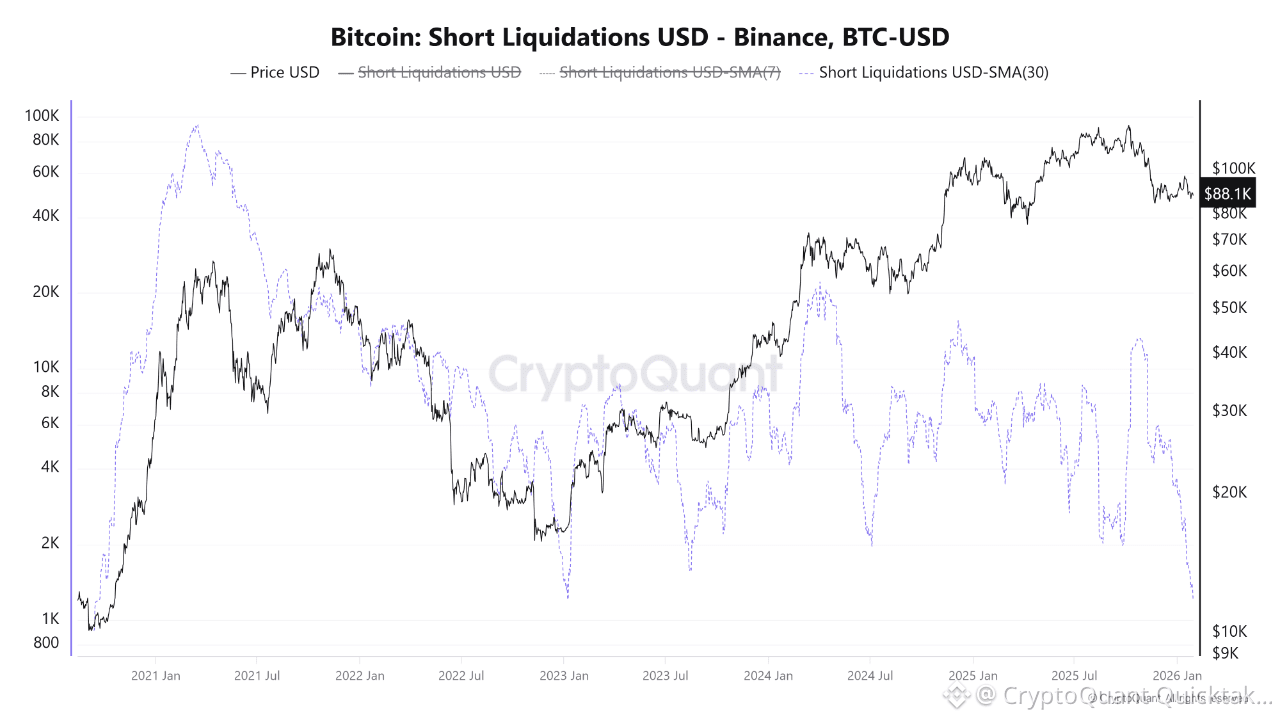

CryptoQuant data reveals that the 30-day Simple Moving Average (SMA-30) of Bitcoin short liquidations on Binance has plummeted to ~$1,200, a low not seen since September 2020.

This dramatic drop in liquidation volume occurs in a critical context: Bitcoin has undergone a severe correction from its All-Time High of ~$128,000 down to the current $88,000 range.

When short liquidations vanish following a $40,000 price decline, it signals two key market dynamics:

Bearish Dominance: Short sellers have ridden the trend down with virtually no resistance. The lack of liquidations implies there have been no significant relief rallies to squeeze out the bears, allowing them to hold or close positions profitably without force.

Market Leverage Reset: The speculative froth has been washed out. Reaching the lows of September 2020 suggests the market has entered a state of exhaustion.

This is the “silence after the storm.” The absence of short liquidations means there is currently no fuel for a “Short Squeeze.” For Bitcoin to reverse this downtrend and reclaim higher levels, it can no longer rely on cascading liquidations; it requires genuine, organic spot demand to rebuild momentum.

Written by CryptoOnchain