Technology investors focusing on artificial intelligence concentrate their portfolios on Nasdaq 100 stocks, without considering alternatives on other exchanges. Oracle, IBM, and Snowflake are trading on the New York Stock Exchange and offer compelling growth narratives given the current valuations.

Sven O’Lundell, Portfolio Analyst & Manager at Blockvestor Capital, examines why stock listings create artificial constraints that lead institutional portfolios to overlook legitimate infrastructure investments.

The blind spot of exchange locations

The rules for index composition create unintended consequences for portfolio diversification. The Nasdaq 100 tracks the largest non-financial companies listed on the Nasdaq exchange. This geographical restriction excludes high-quality technology companies that have opted for NYSE listing.

Investors tracking QQQ and similar index funds are missing exposure to significant developers of artificial intelligence infrastructures. These companies build fundamental technologies that support the AI boom but remain invisible to index-focused allocators. This oversight creates opportunities for active managers willing to look beyond automatic inclusion criteria.

The recent market developments clearly show this dynamic pattern. Technology stocks rebounded sharply after a weakness in mid-November, which followed strong quarterly numbers from major companies.

Alphabet and Apple reached new all-time highs while avoiding the strongest selling pressure in November. However, several NYSE-listed technology companies with similar growth profiles are trading at significant discounts.

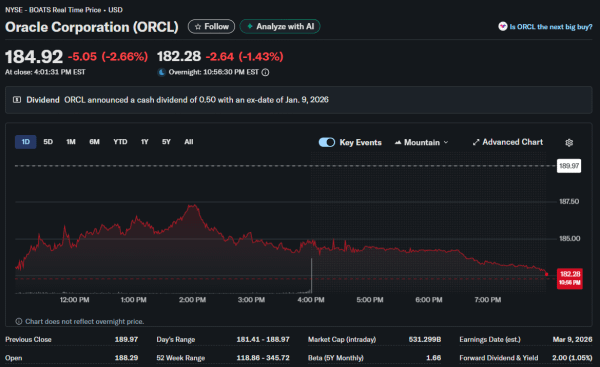

Oracle's infrastructure bet at a 40% discount

Oracle shares fell 40% from their highs as skepticism about spending on artificial intelligence investments grew. The $561 billion database and cloud infrastructure company faces questions regarding aggressive spending on data centers. CEO Larry Ellison invested significant resources in building AI-optimized data centers.

These expenditures raise concerns among investors worried about return timelines and competitive positioning. Hyperscale cloud providers like Amazon and Microsoft have larger capital bases for infrastructure investments. Oracle's push in this area requires the company to sell its specialized AI infrastructures as advantageous and justify premium pricing.

The valuation reduction creates entry opportunities for investors who believe that infrastructure demand will exceed current expectations. Oracle's database business generates stable cash flows that support infrastructure building. The company is not fully reliant on the growth of AI revenues to justify current valuations, unlike pure startups.

The market gains in technology stocks almost completely bypassed Oracle. While broader indices rose after the correction in November, Oracle continued its decline. This divergence suggests that the stock is falling due to company-specific concerns and not because of market sentiment. Resolving these issues through successful execution could lead to a significant revaluation.

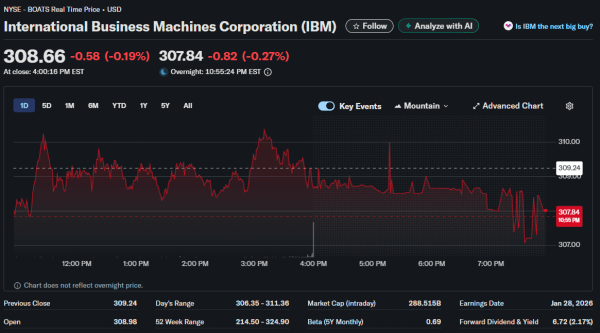

IBM's quantum computing as a wild card

International Business Machines trades at 24.8 times the expected earnings, which seems reasonable given the company's $285 billion technology portfolio. IBM has reinvented itself after years of stagnant growth by focusing on quantum computing and enterprise AI automation. These emerging technologies position the storied company for relevance in the next generation of computing technology.

Quantum computing remains speculative, but it represents a potential breakthrough technology. IBM has partnered with leading research institutions and companies to advance practical applications. Commercial viability remains uncertain, but early leadership positions could be extremely valuable.

Enterprise AI automation offers a more immediate revenue opportunity. Large enterprises need assistance in integrating artificial intelligence into existing IT infrastructures and business processes. IBM's decades-long corporate relationships provide sales advantages that younger competitors lack. The company can sell AI services into its already established customer base.

Stocks trading above $300 appear expensive when compared to the valuations of growth companies. IBM offers quantum optionality plus stable corporate revenues at earnings-related multiples significantly below those of software peers. The combination offers asymmetric return potential if either quantum or enterprise AI exceeds expectations.

Snowflake's growth acceleration opportunities

Snowflake is the youngest company among the three mentioned here with a market capitalization of under $85 billion. The cloud data platform enables companies to analyze information across multiple cloud environments. This architecture is perfectly suited for AI workloads that require access to diverse data sources.

Stocks fell about 9% in November, which aligned with the broader weakness of the technology sector. The decline creates potential entry opportunities ahead of the December results. Management had previously forecasted that revenue growth would accelerate to over 30% as new products gain more acceptance and demand grows.

The development of agentic AI could prove particularly beneficial for Snowflake's business model. These autonomous AI systems require constant data access and analysis to operate effectively. Snowflake's platform architecture addresses exactly these use cases at scale in enterprise environments.

Valuation discrepancies create entry points

Oracle's 40% drop from its highs seems exaggerated compared to long-term infrastructure trends. IBM's earnings multiple appears moderate given the quantum potential and enterprise AI positioning. Snowflake's weakness in November offers access before the growth potential becomes apparent.

These valuation discrepancies exist in part because index funds cannot buy these stocks due to their exchange listings, no matter how compelling the business models are. Passive capital flows bypass NYSE-listed technology companies, creating artificial selling pressure and valuation reductions.

Correcting these inefficiencies requires active capital allocation and a willingness to deviate from benchmark weights. Investors comfortable with exchange-independent technology portfolios can seize growth opportunities at discounts to index members.

The post NYSE technology giants offer growth without Nasdaq premium appeared first on Visionary Financial.