Dusk feels less like a product and more like a response to a quiet ache that has lived inside finance for a long time. An ache born from knowing that trust has always been fragile, that privacy has always been expensive, and that the systems meant to protect people often ask them to expose themselves in order to participate. When Dusk was founded in 2018, it wasn’t answering the loudest question in blockchain. It was answering the most uncomfortable one: why does participating in modern finance still feel like surrendering pieces of yourself?

There is something deeply human about wanting to be seen only when it matters. In traditional finance, privacy was enforced by walls—institutions, paperwork, closed doors. In blockchain, those walls were torn down in the name of transparency, but what replaced them often felt cold and unforgiving. Every transaction visible. Every balance traceable. Every action immortalized. Dusk emerged from the realization that transparency without compassion becomes exposure, and exposure without consent becomes fear.

At its heart, Dusk is about dignity. About letting value move without forcing identities to bleed into the open. About letting institutions comply with the law without broadcasting their vulnerabilities to the world. It recognizes that behind every transaction is a human decision—someone protecting a strategy, safeguarding a livelihood, or simply wanting their financial life to remain their own. Dusk does not shame that instinct. It designs around it.

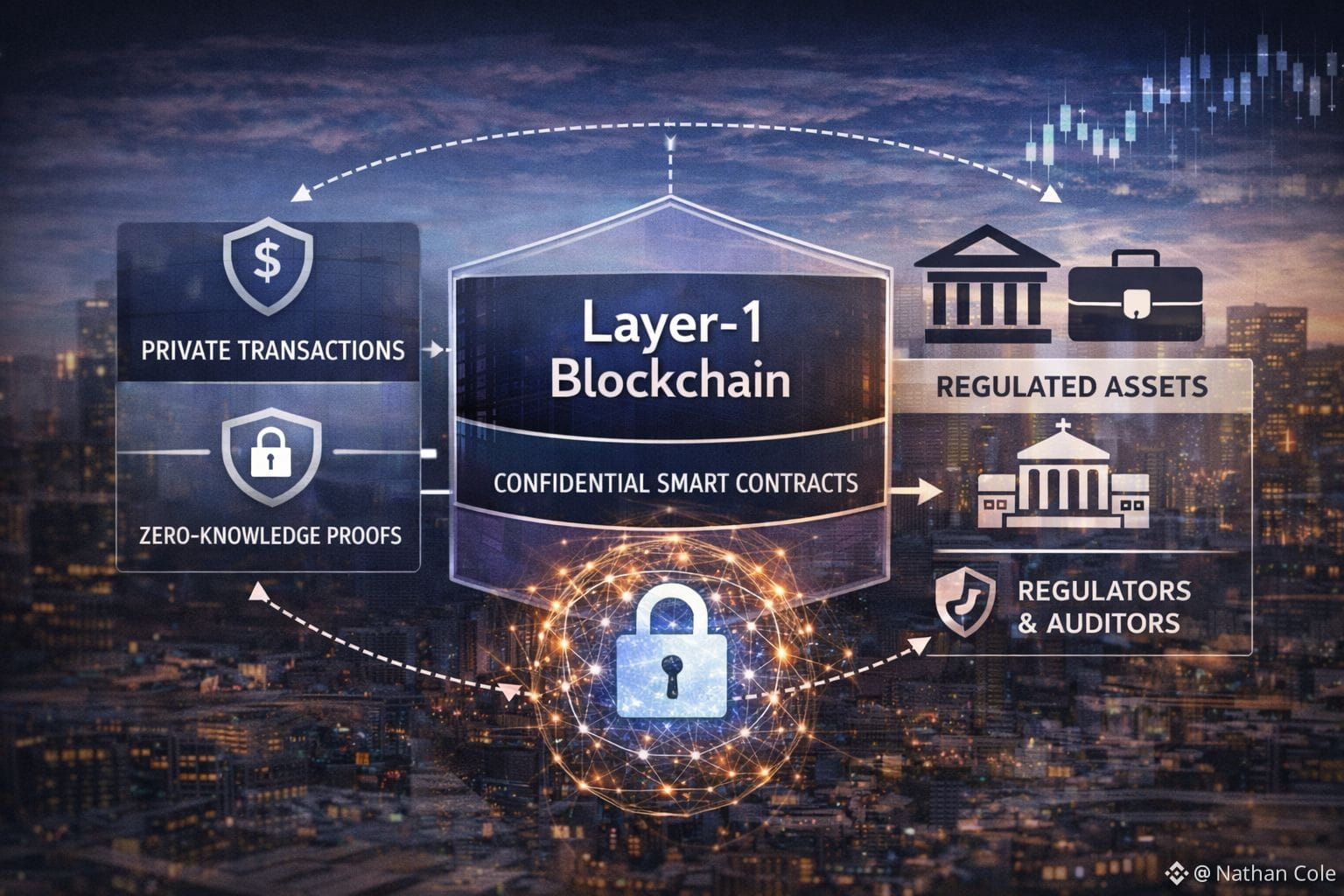

The technology is powerful, but what it protects is fragile. Confidential smart contracts, zero-knowledge proofs, modular architecture—these are not just technical choices, they are emotional ones. They are acknowledgments that privacy is not about hiding wrongdoing, but about preserving agency. With Dusk, you can prove you are compliant without revealing your entire story. You can participate without being exposed. You can exist on a public ledger without being stripped bare by it.

There is a quiet relief in that idea. Relief for institutions that operate under relentless scrutiny, knowing that one leak or one misinterpreted transaction can trigger panic or punishment. Relief for issuers who want to innovate but cannot afford regulatory missteps. Relief for a future where financial systems do not demand vulnerability as the price of entry. Dusk does not promise freedom from rules—it promises freedom within them.

Its modular design mirrors the way humans actually live. We don’t reveal everything to everyone. We share different truths in different contexts. Dusk allows finance to behave the same way. Some transactions can be public. Others can remain private. Some information can be disclosed selectively, when it is needed, to those who are authorized. This is not secrecy—it is consent, encoded.

The DUSK token itself plays a supporting role, not a starring one. It secures the network, fuels transactions, and aligns participants, but it does not demand attention. It is infrastructure, not spectacle. And there is something calming in that restraint. In a world obsessed with volatility and hype, Dusk quietly insists that stability is an achievement, not a flaw.

What makes Dusk emotionally resonant is not what it claims to disrupt, but what it tries to protect. It protects the ability to transact without fear. It protects institutions from unnecessary exposure. It protects regulators from blind spots by offering provable auditability instead of opaque trust. And most importantly, it protects the idea that technology can be firm without being cruel.

There are risks, of course. Complexity always carries weight. Cryptography demands humility. Adoption takes time. But Dusk does not rush these realities away with optimism. It treats them with patience, as if understanding that systems built to handle money must also be built to handle consequences. That patience is rare. And it is felt.

When you imagine the real-world impact, it becomes personal. Faster settlement means fewer sleepless nights for risk managers. Confidential issuance means smaller players can enter markets without being crushed by exposure. Tokenized assets with built-in compliance mean innovation no longer has to live in legal gray zones. These are not abstract improvements. They touch pensions, municipalities, families, and futures.

Dusk does not feel like a rebellion. It feels like reconciliation. A moment where technology stops trying to overpower reality and instead listens to it. It accepts that finance will always involve power, regulation, and responsibility—and asks how those forces can coexist without sacrificing humanity along the way.

The name lingers for a reason. Dusk is not darkness. It is transition. It is the moment when harsh light softens, when outlines remain but glare fades. It is when systems have a chance to breathe and rethink what they are becoming. In that space, Dusk offers something rare: not a promise of domination or escape, but a promise of balance.

If the future of finance is going to work—not just technically, but emotionally—it will need systems that understand fear as well as efficiency, privacy as well as proof, and trust as something earned, not extracted. Dusk does not shout that future into existence. It waits for it. And sometimes, the most human systems are the ones that arrive quietly, carrying less noise and more care.