The sudden continuous decline today is not just in stocks and cryptocurrencies; gold and silver are also falling, and the dollar is down. My first thought is whether institutions are exiting. If so, what is the reason for their exit? Then I thought that institutions probably don't have much cash left.

Last week, when we looked at the global fund managers' allocations, we found that cash allocation had reached a historic low of 3.2%. This indicates that the cash in fund managers' hands is insufficient to continue driving the market up. We also see a lot of data suggesting that the main buyers of ETFs should be retail investors, making retail investors the 'bag holders' for institutions, which logically makes sense.

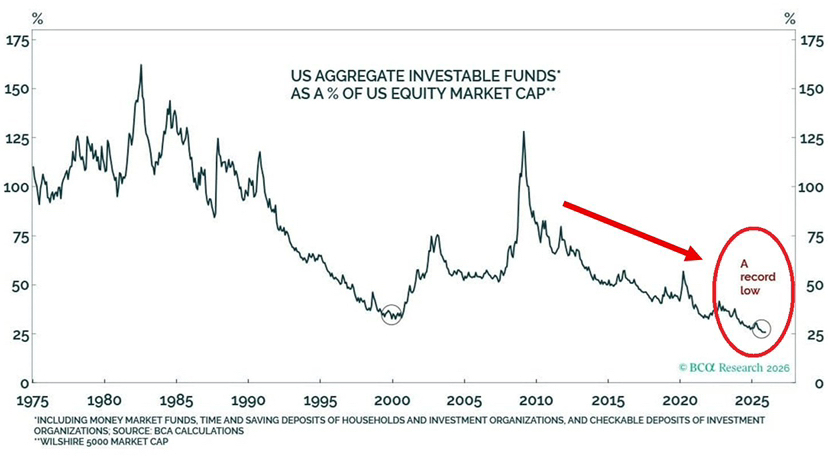

Then I saw the chart of US aggregate investable funds as a % of US equity market cap, indicating that the proportion of cash available for investment in the US relative to the total market value of US stocks has fallen to a historically low level, showing that the market is overall in a state of having very little cash, being heavily filled, and being more sensitive to new liquidity.

In simple terms, it means that everyone is almost fully invested, with no cash left to continue buying the dip.

Of course, having less cash does not mean that institutions are going bankrupt; rather, it means that the marginal capacity for incremental buying has decreased. Whenever there is even a slightly negative development, the market will switch from an uptrend driven by sentiment and inflows to a downtrend and redemption mode. When positions are heavily filled, any volatility will trigger risk budgets, margin requirements, and stop-loss lines, leading to passive reductions in positions rather than subjective exits.

The more critical point is that today's decline exhibits this characteristic, where the information brought by the earnings season has become the last straw that breaks the camel's back, not because the earnings reports are so bad, but because the market has no room for error. The earnings season essentially consists of two things: expectations and volatility. When expectations have been pushed to the extreme optimistic level, earnings don't need to be very poor; just not good enough will be perceived as negative by the market. When positions are already heavily filled, earnings don't need to trigger a disaster; as long as volatility increases, risk control models will prompt institutions to sell first.

Therefore, it is more inclined to believe that today's decline is due to the passive exit of institutions, and the earnings reports and profits have allowed many institutions to have sufficient profits. The upcoming market may increase its amplitude because of the earnings reports, especially since the rise of gold and silver has already been significant, triggering risk control measures. As a result, the first assets to be sold are often not the worst ones, but those that are easiest to sell and most liquid, including stocks, ETFs, gold, and even some mainstream cryptocurrencies.

It is precisely for this reason that I feel this decline resembles a situation where deteriorating liquidity has caused funds to switch from 'increasing positions' mode to 'survival mode'. In 'survival mode', institutions are not 'shorting and exiting', but rather 'first reducing risk exposure', with 'position structure + risk control mechanisms' at play.

So returning to the original question, 'Is it the lack of money in US institutions that caused the decline?' A more accurate statement should be that it is not the lack of money in institutions leading to the decline, but rather that the cash ratio in institutions is too low, and the market is heavily filled, causing extreme sensitivity to any volatility. Once high-volatility events like earnings season occur, the market will switch from an uptrend driven by incremental funds to a downtrend relying on passive selling.

What to look at next is also very simple: if ETF fund flows start to turn negative, redemptions continue to occur, and volatility continues to rise, then this decline will not be a matter of one or two days. Conversely, if fund flows continue to enter (retail investors continue to buy), and it is just a short-term deleveraging, then the depth created might actually be an opportunity to buy the dip.

PS: I am just playing the role of hindsight here. Last week, I did mention that fund managers might take profits and exit, but I did not know the specific timing and methods; I could only speculate on potential reasons by looking at more data.