$BTC

Bitcoin's sharp retrace to the $84,000 support level isn't a mystery—it's a confluence of three clear factors: a macro reset, a massive de-leveraging event, and a classic liquidity squeeze.

Think of it like this: Bitcoin was driving down the highway way too fast. The Fed put up a "SLOW DOWN" sign. Everyone slammed on the brakes at once, and the guy in the fancy car with no seatbelt (over-leveraged longs) went flying through the windshield.

1. The Macro Catalyst: "Higher for Longer" Hits Risk Assets

The primary trigger was the Federal Reserve signaling that interest rate cuts are off the table for now. This "higher-for-longer" stance makes yield-bearing assets more attractive and pressures speculative investments like Bitcoin. The sell-off mirrored a drop in tech stocks like the Nasdaq, reaffirming BTC's short-term correlation with risk assets.

2. The Domino Effect: $800M+ Liquidations Wipe Out Leverage

The price decline triggered a cascade of forced selling. Data shows over $800 million in leveraged crypto futures positions were liquidated in a single day, with long positions making up the majority of the losses. This created a self-reinforcing cycle: price drop → longs liquidated → more selling pressure → further price drop.

3. The Amplifier: Thin Weekend & Institutional Outflows

The move was exacerbated by two conditions:

Thin Liquidity: With fewer institutional participants active, the order books were shallow. This means modest sell pressure had an outsized impact on price.

ETF Outflows: U.S. spot Bitcoin ETFs saw significant outflows, with one report noting $1.3 billion in net outflows over a recent week, indicating a pullback by some institutional investors.

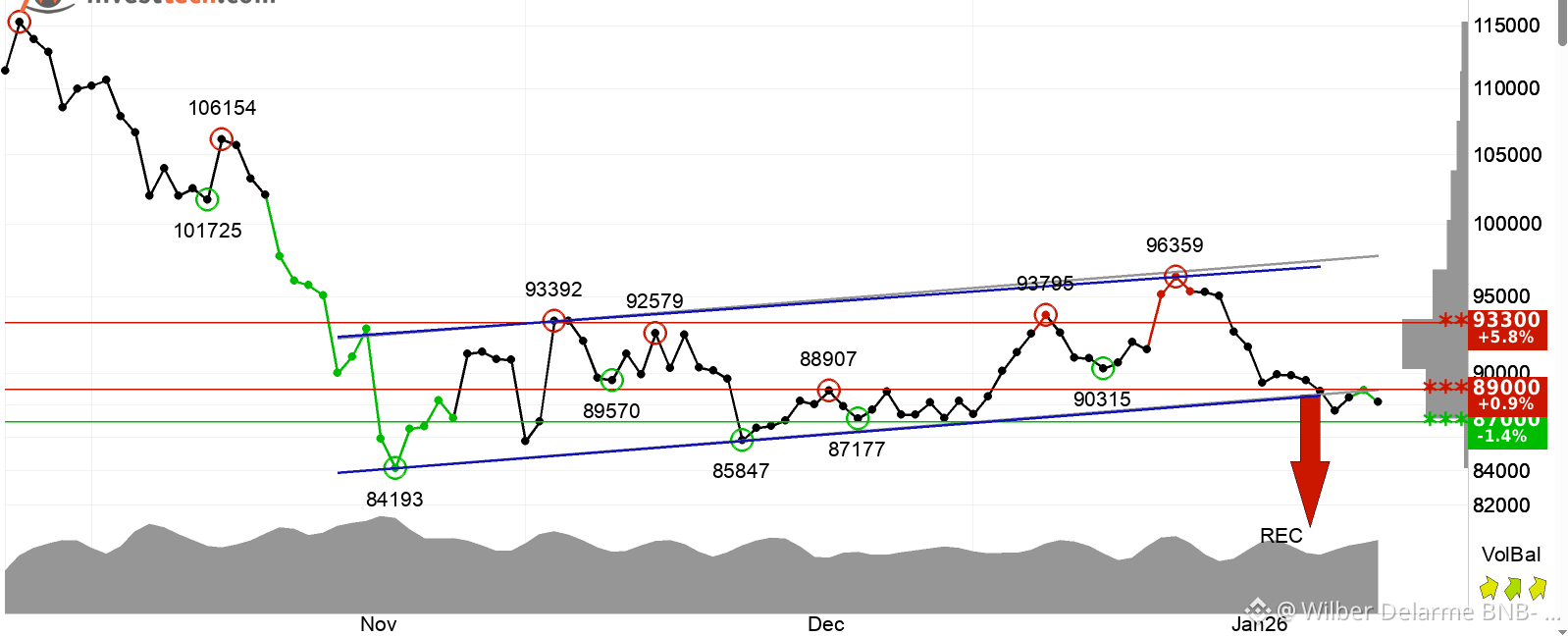

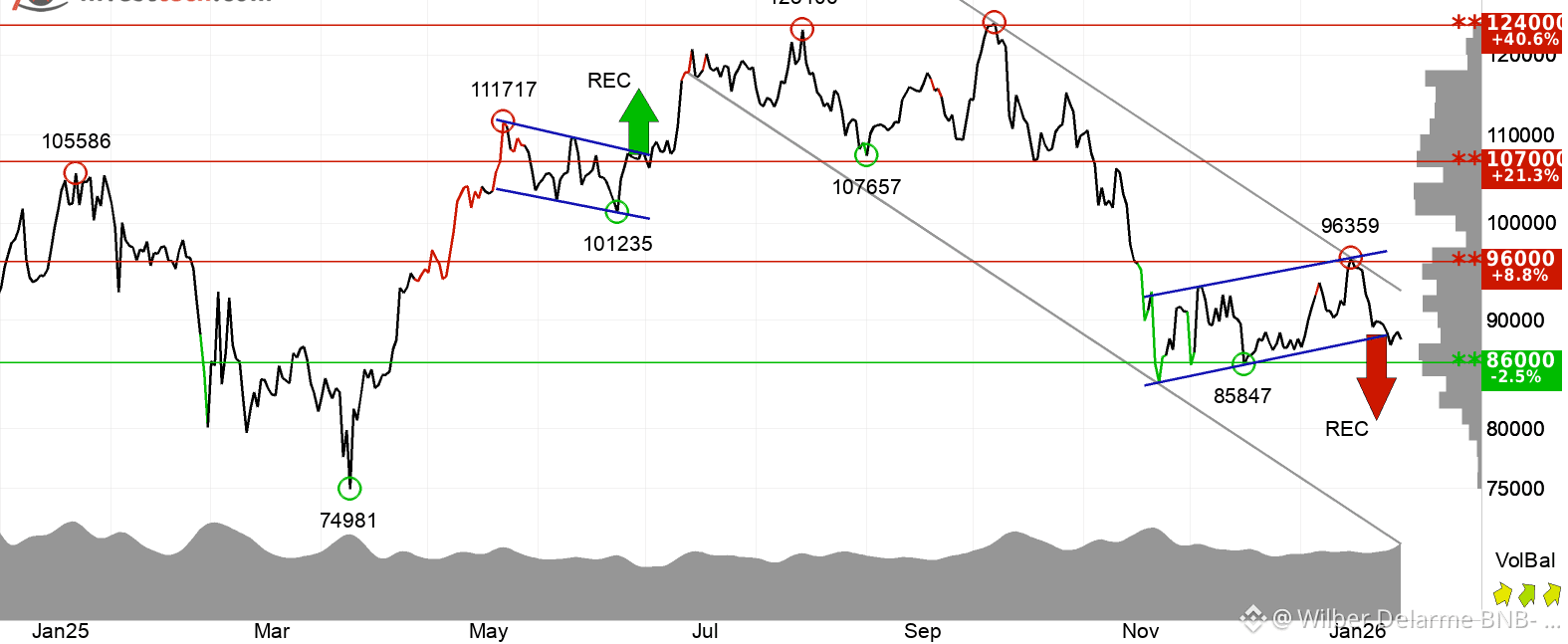

The Trader's Lens: Key Levels and the Path Forward

This is where sentiment meets structure. The $84,000 level is now the critical weekly support to watch.

Bullish Scenario: Holding above $84K could allow for a technical bounce toward resistance levels at $91,400 and then $94,000. Some on-chain metrics, like the Puell Multiple, suggest the market may be nearing a cyclical "buy zone".

Bearish Scenario: A decisive break below $84K opens the path toward $80,000, and potentially $75,000 or lower. Analysts warn that the failure of key support could renew selling pressure from long-term holders.

For Binance traders: This is a volatility playbook. The extreme fear (Fear & Greed Index recently hit 15/100) often sets the stage for the next move. Watch the $84K support and ETF flow data for the next directional cue. Trade the range, but respect the liquidity.

Is this a healthy correction or the start of a deeper bear phase?