Asian markets opened the day on shaky ground, and the tone was clear from the start: volatility is back. From crypto charts flashing red to stocks swinging between gains and losses, investors woke up to a global market trying to digest political signals from Washington and a sudden risk-off move across assets.

At the center of it all was , which took a sharp hit just as Asian trading kicked off.

Bitcoin Takes a Sudden Fall

Bitcoin dropped nearly 7%, sliding quickly after holding steady in recent sessions. For many traders, the move felt less like panic and more like a classic leverage flush.

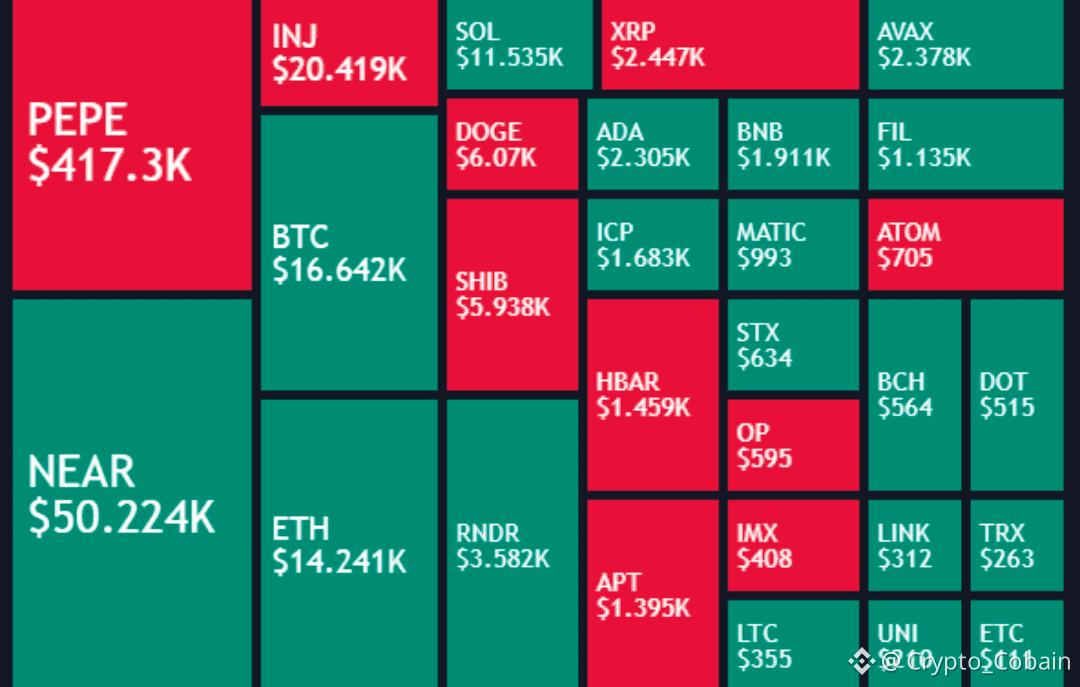

The market had become crowded with optimistic long positions. Once prices started slipping, stop losses were triggered, leverage unwound fast, and liquidations piled up. Within hours, billions of dollars’ worth of crypto positions were wiped out across exchanges.

Other major cryptocurrencies followed Bitcoin lower. The selling wasn’t selective — it was broad, mechanical, and fast. This kind of move usually signals that traders were positioned too aggressively, leaving the market vulnerable to even a small shock.

Importantly, there was no single piece of bad crypto news. This was about sentiment, positioning, and macro pressure — not fundamentals.

Asian Stocks Open Cautious and Choppy

Equity markets across Asia struggled to find direction. Some indexes opened slightly higher, others slipped, but the overall mood was defensive.

Investors were reacting to a messy mix of factors:

Weakness in U.S. tech stocks overnight

Political uncertainty in the United States

Rising bond yields and a firmer dollar

Japan’s market held relatively steady, supported by local economic data, while other regional markets traded unevenly as investors waited for clearer signals from global leaders.

The key word was hesitation. Nobody wanted to make bold bets.

Trump’s Signals Shake the Macro Picture

Market attention was firmly fixed on comments from , who signaled two major developments that immediately rippled through global markets.

1. A Possible Government Shutdown Deal

Trump indicated support for a deal that could prevent a U.S. government shutdown. That eased some short-term fear, as shutdowns tend to disrupt economic data, slow spending, and damage confidence.

Still, markets didn’t fully relax. Traders have learned that political deals can unravel quickly, so optimism remained cautious.

2. A New Federal Reserve Pick

Trump also suggested he has already chosen his nominee for the next chair of the .

That comment immediately sparked speculation about future interest-rate policy. Any hint that the Fed’s direction could change is a big deal for:

Stocks

Bonds

The U.S. dollar

Crypto market

Bond yields ticked higher, and the dollar strengthened slightly as traders adjusted expectations.

Why Crypto Felt the Pain First

Bitcoin and crypto tend to react faster and more violently than traditional markets. When uncertainty rises:

Stocks hesitate

Bonds adjust

Crypto moves immediately

Higher yields and a stronger dollar usually pressure risk assets, and crypto sits at the top of that risk ladder. Once prices slipped, forced selling did the rest.

This doesn’t mean the long-term crypto story is broken. It simply shows how sensitive the market still is to macro signals and leverage.

What This Market Move Really Says

This Asia open wasn’t about fear — it was about repositioning.

Traders are reducing risk

Leverage is being cleaned out

Markets are waiting for clarity

Bitcoin’s drop looks dramatic, but structurally it resembles a reset rather than a collapse. For equities, the lack of direction reflects uncertainty, not panic.

Everyone is watching the same things now:

U.S. political stability

The future path of interest rates

Whether global growth can hold up

The Bottom Line

Asia’s market open delivered a reminder that politics, policy, and positioning still rule global markets.

Bitcoin’s 7% drop exposed how quickly sentiment can flip when leverage is high. Stocks swung as investors weighed hope for a shutdown deal against uncertainty over the Fed’s future. And across all markets, one theme dominated: caution.

For now, traders aren’t chasing rallies — they’re waiting for confirmation.