Just now, the gold market experienced a 'once-in-a-decade' super flash crash! 💥💥

During the US trading session, spot gold surged to a historical high of over 5590 dollars/ounce, but within just 30 minutes, it plummeted nearly 450-500 dollars, with the maximum drop approaching 8-9%! Silver fared even worse, diving over 12% from a high point of 121 dollars!😫😖

This wave of operations has directly evaporated approximately 3-3.4 trillion US dollars from the global gold market (some media even say that precious metals have evaporated nearly 5-6 trillion), what does this number mean? It's equivalent to wiping out several times the total market value of the entire cryptocurrency market! It's terrifying, simply a market version of a 'nuclear explosion'!💥😅

Why is it suddenly so intense? Mainly due to profit-taking at high positions and the wave of long liquidations. Gold has surged nearly 24-30% this January alone, and many people FOMO'd into buying at highs, leveraging heavily. As a result, a wave of selling triggered a chain reaction. 💥😅

Speculative long positions on COMEX were instantly blown up, with over 220,000 liquidations worldwide! At the same time, the tech stocks in the U.S. (especially the sharp drop in Microsoft) also crashed sentiment. As soon as fears of an AI bubble arose, capital fled from 'safe-haven' gold in a frenzy. Geopolitical tensions (Iran, tariffs, etc.) initially pushed gold prices up, but once profit-taking hit, the demand for safe havens instantly turned into 'who cares'.

But don't panic; after this flash crash, gold quickly rebounded in a V-shape, closing down less than 1%. It's now hovering around $5400. Many major banks (like UBS) have directly raised their price target for 2026 to $6200, with some even projecting as high as $7200! This indicates that the mainstream view is still bullish, but the short-term bubble is too intense and needs to be washed out.

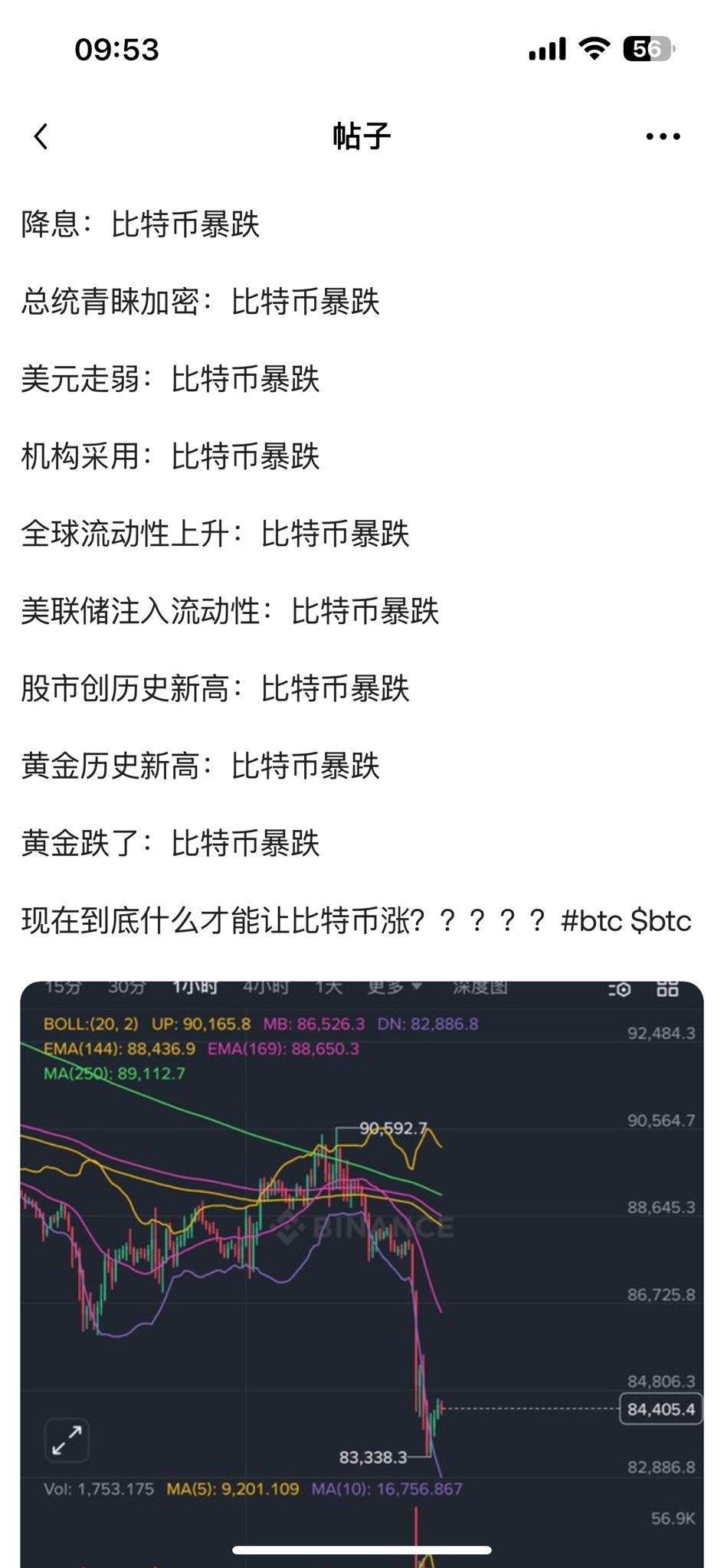

Bitcoin briefly plummeted to 81118 dollars. If gold, silver, and other precious metals crash, the risk market will definitely spiral into a breakdown. From what we see, this logic is correct: with the crash in gold and silver, no market can finish well. Bitcoin has also followed the plunge, and U.S. stocks are plummeting as well.

The cryptocurrency market and the gold market are indeed closely related. This turbulence reminds everyone: don't go all in on leverage during a bull market; cash is king! Are you continuing to buy the dip in gold, or are you waiting to see a bit more stability? Let's discuss in the comments!

#黄金暴跌 #GoldCrash #BinanceSquare #GoldPricePlunge #白银暴跌 #PreciousMetalsCrash #CryptoCrash #FinancialMarket #Gold #Crash #比特币暴跌