Recently,#apechain the style has changed a bit.

It is no longer just a 'test field for the monkey ecosystem', but is gradually upgrading to exchange-level infrastructure. Especially after the native integration of#币安 went live, the entry and exit thresholds have been significantly lowered, and the user experience has improved quite a bit. The question arises👇

Can this operation really take ApeCoin (APE) to new heights?

📊 The data is stable, but it's just not hot

First, look at the on-chain fundamentals.

Currently, the daily active addresses on ApeChain are around a little over 10,000, with a daily trading volume of over 70,000 transactions, and the TPS is even less than 1. At first glance, it seems stable, but in the public chain track, the scale is indeed relatively small.

In summary: Some people are using it, but not much, and it's not expensive.

🚀 The highlights come quickly, but the tide goes out just as fast.

At the end of 2024, when ApeChain was just launched, it was really lively 🔥

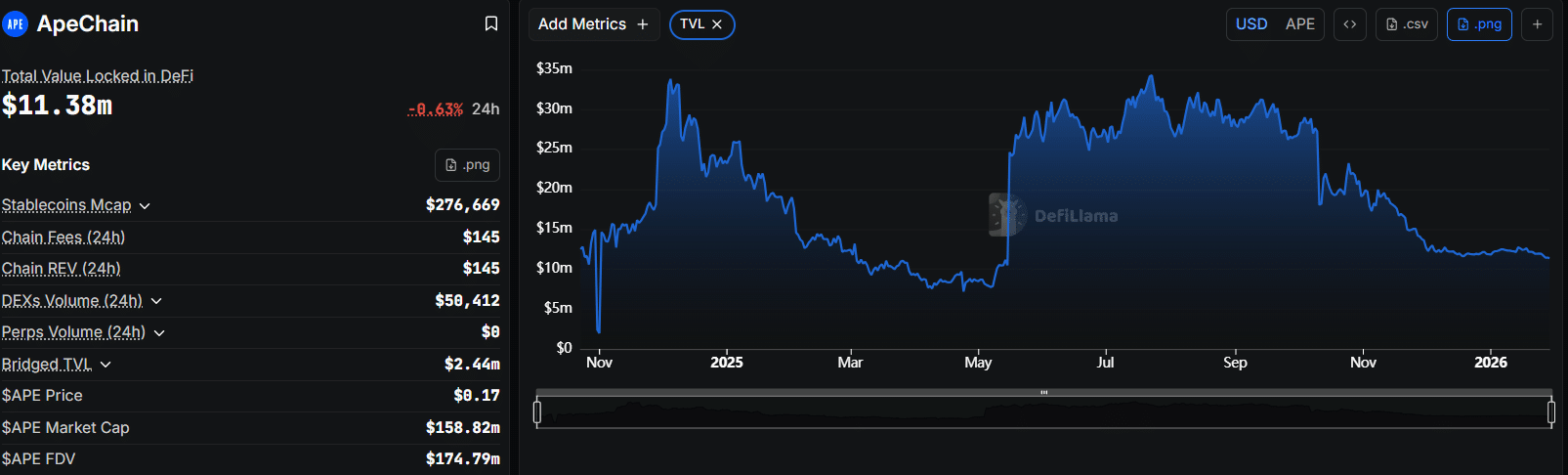

Active addresses once surged to over 50,000, with TVL approaching 34 million USD, it seemed like everything was about to take off.

But once speculative funds leave, reality sets in.

By 2025, the TVL directly shrank by over 80%, leaving only around 4-5 million USD.

DEX daily trading volume? About 50,000 USD per day, quite 'Buddhist'.

New addresses only increase by about three hundred daily, naturally growing very slowly, more like old users circling around.

⚖️ The shadow of regulation has dispersed, but the popularity hasn't returned.

The good news is, #APE is finally 'innocent'.

The SEC's investigation of Yuga Labs has ended.

The court ruled that APE and BAYC do not constitute securities.

Legal risks are considered completely lifted ✅

But the problem is: by the time regulations become clear, half of the on-chain activity has already cooled down.

Now that Binance has reappeared, it indeed gives the market a shot of adrenaline, and it also represents a recovery of institutional confidence. But—confidence ≠ usage.

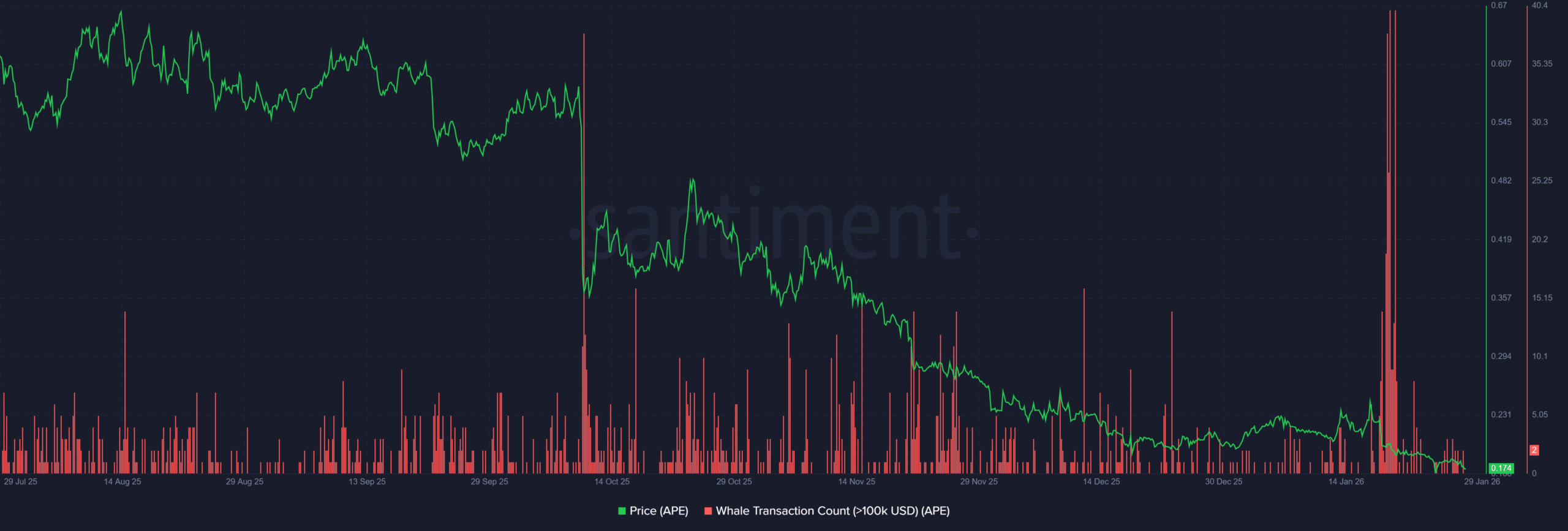

🐋 Whales are more like 'quick in and out'.

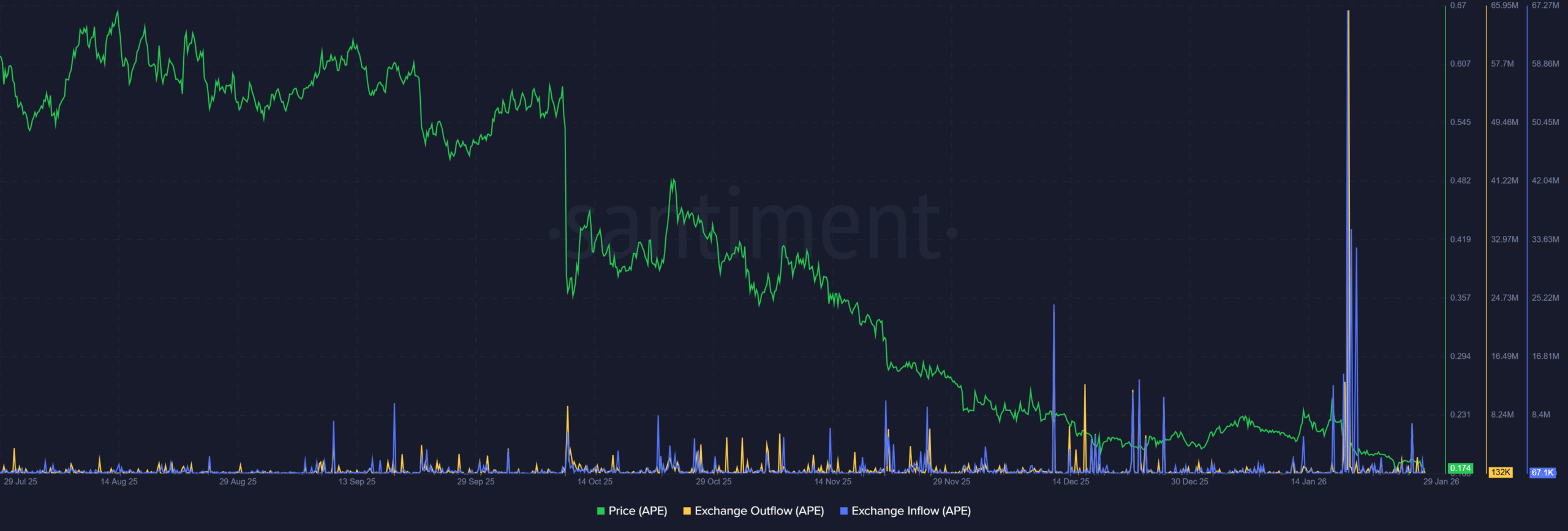

From the flow of funds, APE resembles an emotional trading asset:

In the early days of launch, funds were crazily flowing in and out of exchanges.

Prices doubled, but the big whales then exited.

The number of million-level APE wallets decreased instead of increased.

The growth of new token holders has also significantly slowed, dropping from a peak of over 50,000 to more than 10,000.

It was lively, but it didn’t leave anything behind.

🧠 The final hard truth

Binance + ApeChain indeed solved the entry and compliance issues.

But the real challenge is👇

👉 Can APE step out of the NFT circle?

👉 Is there anyone willing to use it long-term, rather than just for short-term speculation?

Current ApeChain:

Liquidity is still there.

The usage scenarios are quite limited.

Insufficient belief-based funds.

If there isn't a real 'non-NFT' application explosion, APE might still remain a niche within a niche.

The infrastructure is in place, the stage is set, now it just depends on whether there are any real actors on stage. 🎭🚀

Like, share, follow me, and let me help you capture more market opportunities while we laugh through the ups and downs of the bull and bear markets! Let's work hard together!

Can't navigate the crypto world? Don't hold on stubbornly! Xiao Yun shares real-time swing and long-term strategies, allowing you to stand on the shoulders of giants and quickly cross wealth classes. Missing out on one wave might mean missing out on hundredfold returns! Join us!