Last night, gold violently plunged, dropping from 5500 all the way down to a minimum of 5100, it really does go up and then come down just like that. However, from the current trend of gold, this pullback is clearly insufficient. If we want to continue to rise, at least a pullback starting with 4 would be healthier! Of course, don’t guess that this wave has peaked, or whether it can still go bullish later; that can't be predicted.

I can only say that this 5000 gold definitely does not have much 'cost performance'!

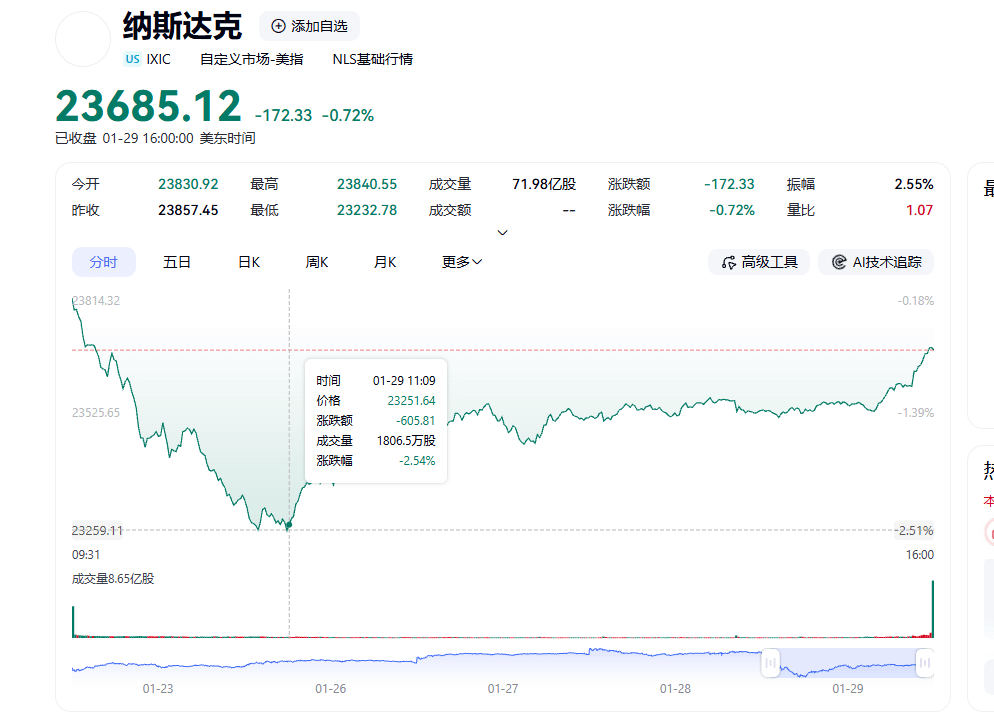

Looking at the US stock market, it opened sharply down, with the Nasdaq experiencing a maximum drop of 2.5%, but it recovered at the end, closing down 0.7%, so the resilience of the US stock market is really not bad!

However, the cryptocurrency market has performed very poorly, Bitcoin has dropped from 8.7 to a low of 8.1, a decline of 7%, and Ethereum has fallen from 2930 to 2680, a decline of 8%. Bitcoin is currently at 82700, Ethereum is at 2740, and the rebound strength is clearly not as strong as the US stock market!

But don't panic too much, next I will use a few key data points and indicators to tell you what stage the current cryptocurrency price is in!

1. Mining Costs

The current mainstream mining machines are as follows:

Antminer S21/XP, hash rate 200-270 TH/s, a commonly seen 'mid-range model' in mining farms, providing high cost performance.

Antminer S19 Pro / S19 XP, hash rate ~110–140 TH/s, a stable model from the old era.

If we calculate mining costs using S21 and XP (electricity cost at $0.05/kWh, which is very cheap at 30 cents per kWh):

Antminer S21:

Daily power consumption: 3.55 kW × 24 h = 85.2 kWh/day

Daily electricity cost: 85.2 × $0.05 = $4.26 /day

Antminer S21 XP:

Daily power consumption: 3.645 kW × 24 h = 87.48 kWh/day

Daily electricity cost: 87.48 × $0.05 = $4.37 /day

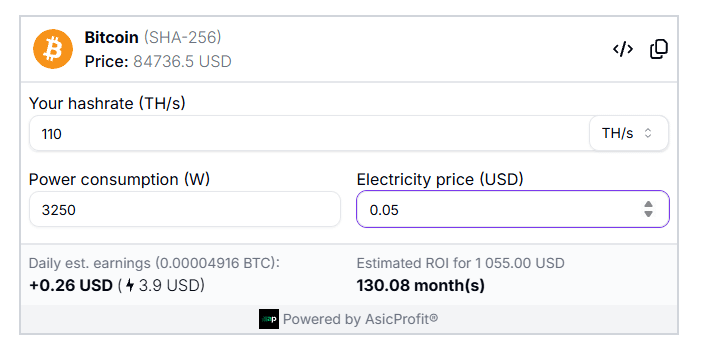

S19Pro:

Power consumption: 3250 W → Daily electricity consumption: 3.25 kW × 24 h = 78 kWh/day

Electricity cost: 78 kWh × $0.05 = $3.90 /day

BTC Output:

S21 daily output is 0.0000815 BTC, worth $6.5 (calculated at 82000), total cost is $5.3-7.1 (electricity costs account for 60%-80% of total costs), which means either the mining machine was bought at a high price or the operating costs are too high, then it is already in a loss state; only by controlling the electricity cost to be over 70% of total costs can one make a profit!

If calculated using S21 XP, daily output is ~0.00011 BTC, worth $9, total cost is $5.5-7.3, so this machine can still make money in the $82000 range.

If calculated using S19PRO, daily output is 0.000049 BTC, worth $4 (calculated at 82000), this machine is almost at the shutdown price!

I also checked the relevant average mining cost data, roughly estimated to be around 75,000 as the average mining cost! Moreover, when Bitcoin fell to over 70,000 in 2024, many news reports indicated that many machines began to shut down!

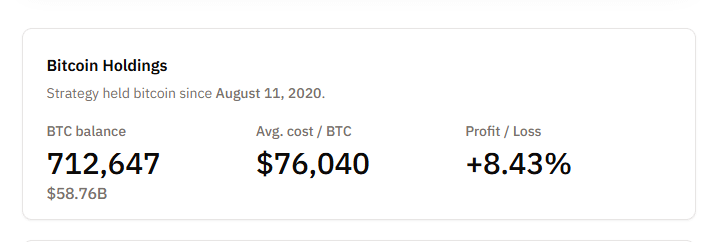

2. Microstrategy Costs

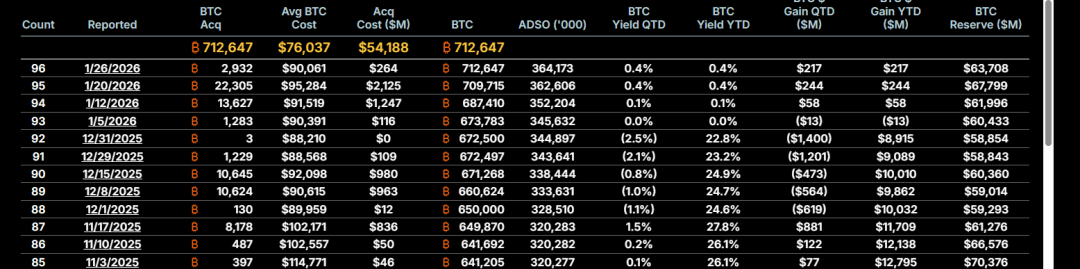

Currently, Microstrategy holds a total of 710,000 units, with an average holding cost of 76,000, and a total return rate of only +8%.

In December and January, Microstrategy increased its purchasing intensity, selling 13,627 units on January 12 and 22,305 units on January 20, so institutions are continuously buying!

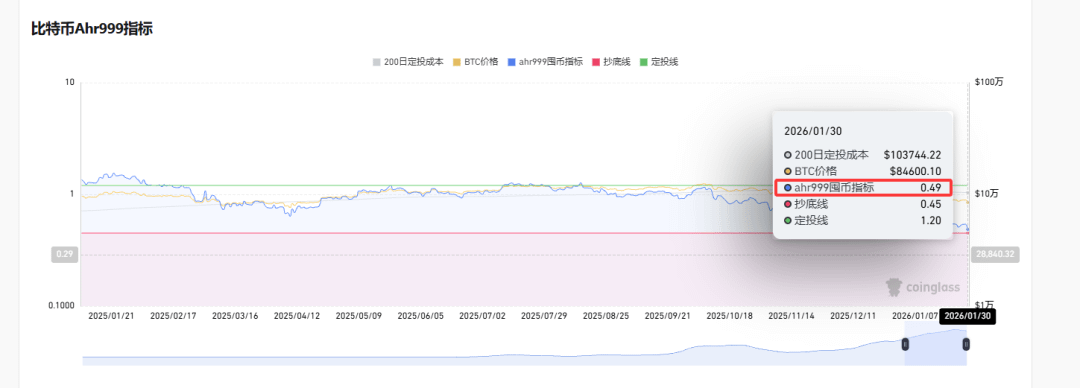

3.AHR999

The current AHR999 indicator has reached 0.49, the bottom line is 0.45, what does 0.45 mean? It is already lower than the cost of investing over 200 days, and this indicator only appeared at the bottom of the bear market in 22; it has not been lower than 0.45 in 23-25. The bottom indicator has not failed yet!

So the three key data points above already show that if the cryptocurrency price reaches 76,000, it means you are buying lower than the mining cost, lower than what listed companies are paying, and lower than what investors who have invested for 200 days have paid!

So I estimate that this bottom is roughly at this position! It won't vary too much, it is a position with very high 'cost performance'! If the cryptocurrency price falls to this range, then definitely someone will come and buy frantically!

$BTC