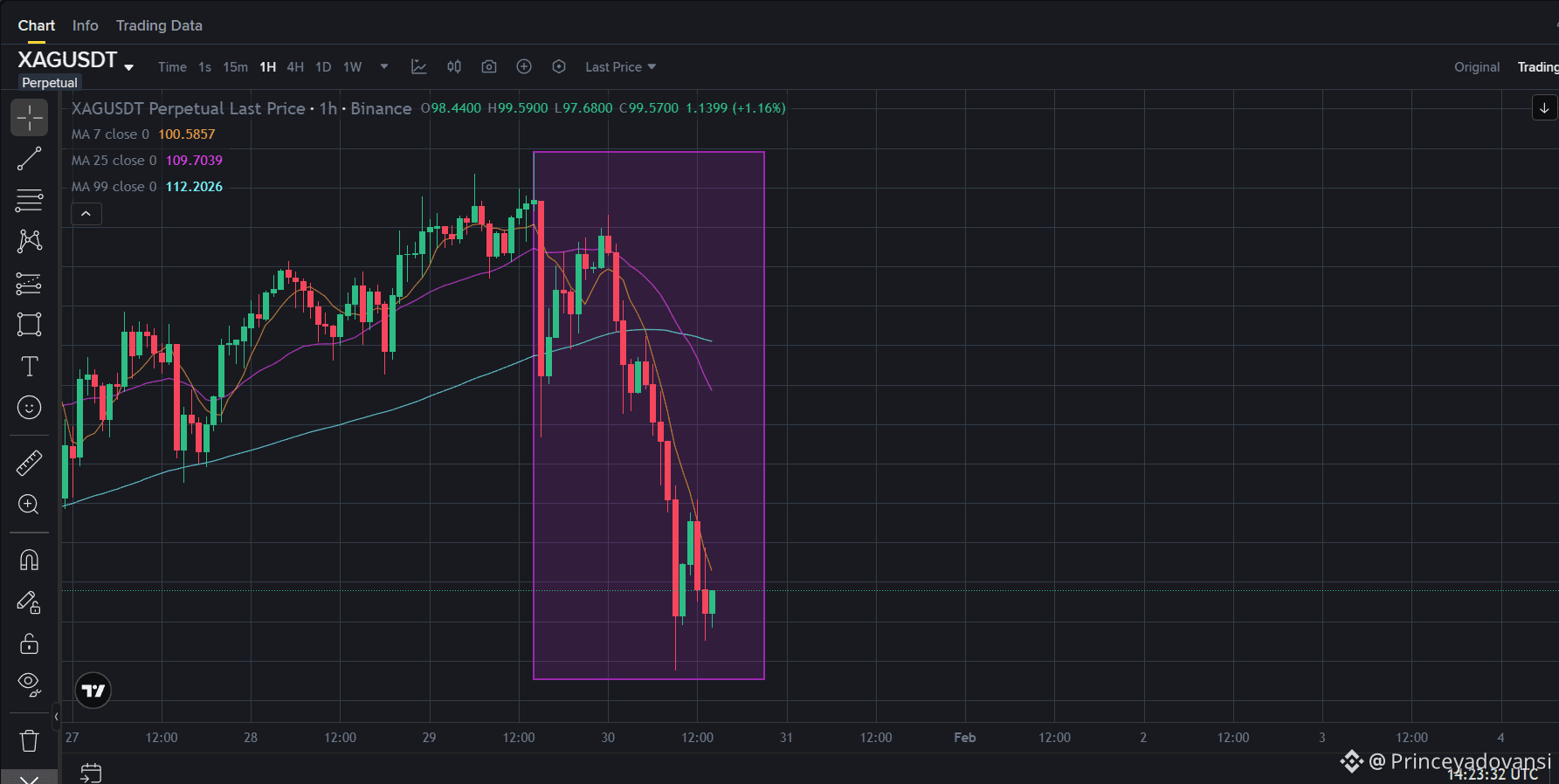

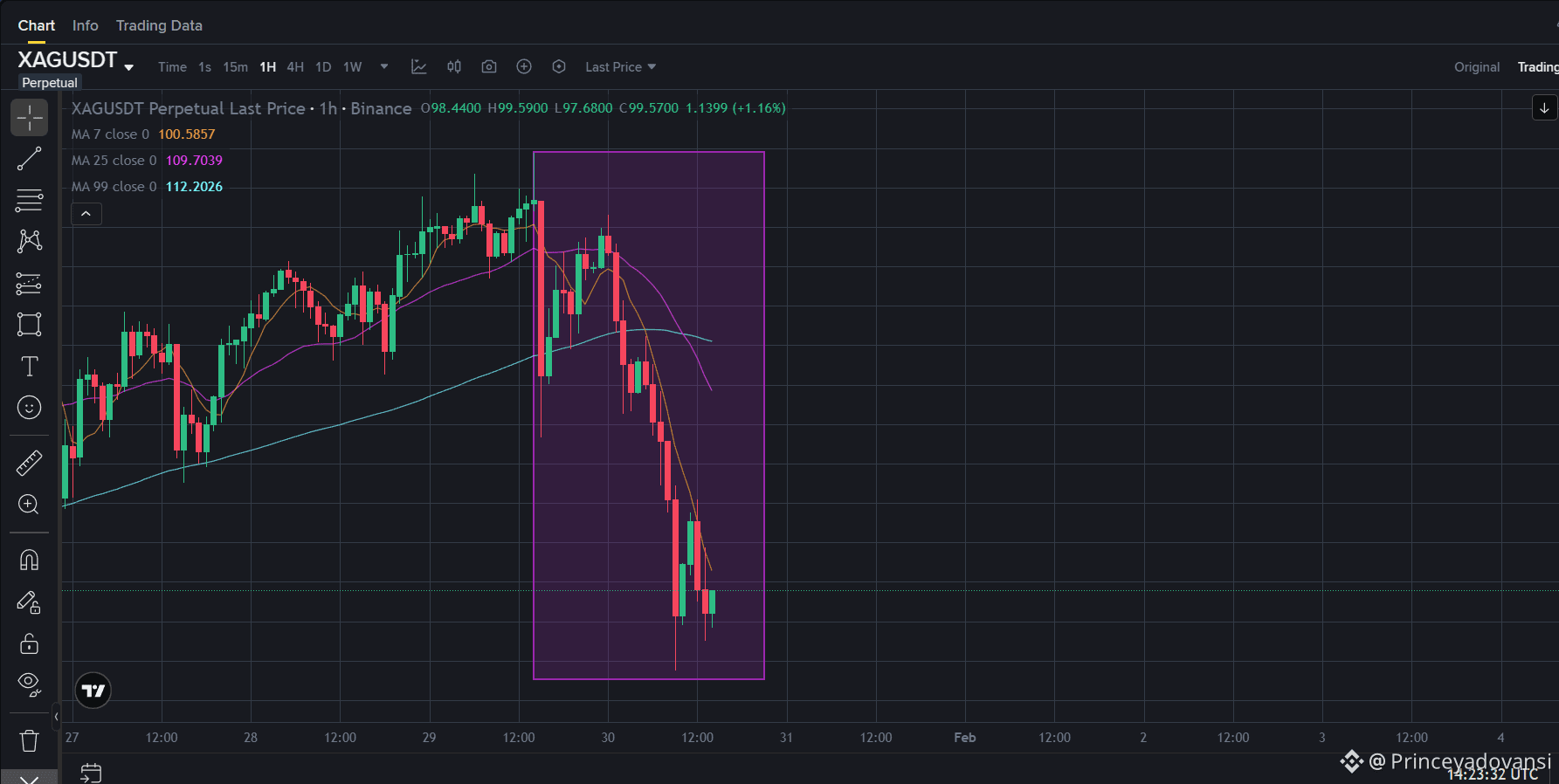

On 30 January 2026, silver prices saw a major crash, with drops of 8–15%+ in a single session after hitting record highs recently. This was one of the sharpest single-day declines in years.

Here are the key reasons behind the plunge:

🧨 1. Profit Taking After Big Rally

Silver had surged to record levels in the past weeks as investors rushed in (up 100%+ year-to-date). When prices hit extremes, many traders began selling to lock in profits, leading to a sudden drop.

💰 2. Margin Increases in Futures Markets

The Chicago Mercantile Exchange raised margin requirements for silver futures, forcing leveraged traders to either put up more collateral or reduce positions – which triggered forced selling and momentum-driven declines.

💵 3. Stronger US Dollar

A strengthening US dollar makes commodities like silver more expensive in other currencies, reducing demand and putting downward pressure on prices.

🪙 4. Reduced Safe-Haven Demand

Silver (like gold) often rallies when geopolitical risks spike. Recent positive developments in geopolitical scenarios reduced the “safe-haven” premium, leading investors back to riskier assets and away from precious metals.

📊 5. Wider Selloff in Precious Metals

Gold and other metals also fell, indicating broader commodity market correction rather than a silver-specific problem.

🔍 Short-Term Market Behavior

Silver saw extreme swings: after reaching near record peaks, prices quickly corrected.

This volatility reflects technical trading, speculative positions, and reactions to macroeconomic news, not necessarily a fundamental breakdown in silver demand.

Because silver markets are smaller and more liquid-thin than gold, they can fall faster during rapid selloffs.