CHANGE IN THE FEDERAL RESERVE AND ITS IMPACT ON CRYPTOASSETS

Subject: Strategic analysis regarding the nomination of Kevin Warsh as President of the FED.

1. Leadership Profile: Kevin Warsh

The transition from Jerome Powell to Kevin Warsh represents a paradigm shift in U.S. monetary policy. Warsh positions himself as a technical profile with a focus on promoting growth and deregulation. His management is expected to be less rigid compared to the previous one, prioritizing global economic competitiveness.

2. Axes of the Operational Tactics

Acceleration of Cuts: A more flexible interest rate policy (Dovish) is anticipated to stimulate domestic investment.

Financial Modernization: Greater openness to the integration of digital assets and distributed ledger technologies (DLT) in the traditional financial system.

Liquidity Incentive: A stance that favors the expansion of the monetary base, reducing pressure on the cost of capital.

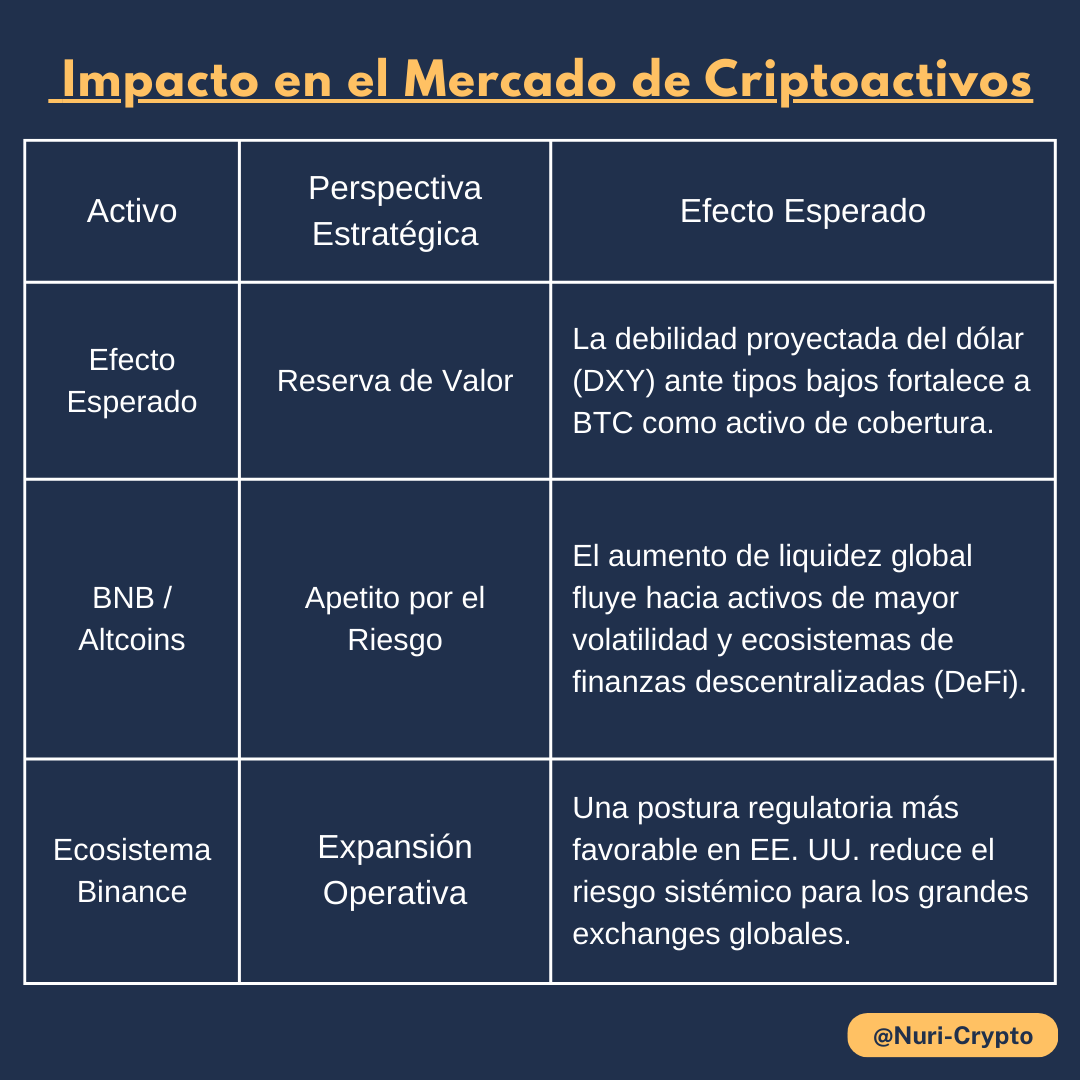

3. Impact on the Cryptocurrency Market

Analytical Conclusion

The market is in a phase of 'asset revaluation'. The arrival of Warsh acts as a bullish catalyst in the medium term. Although immediate volatility is natural after the announcement, the fundamentals indicate a high liquidity environment, which is historically the ideal scenario for a bullish market (Bull Market) in the crypto sector.

Trading Recommendation: Closely monitor support levels in BTC and transaction volume on the BNB network. The regulatory clarity that this change in leadership could bring will reduce the risk premium in Altcoins.

#Fed #BTC #BNC #WhoIsNextFedChair