🔍Key Events

Friday marked a continuation of the heavy sell-off in the crypto market that began the day before. The main driver is the intensification of macroeconomic and geopolitical risks. Investors are nervously reacting to the potential nomination of Kevin Warsh as the new head of the Federal Reserve, the strengthening of the dollar, and a general flight from risk assets around the world.

📈Key Metrics

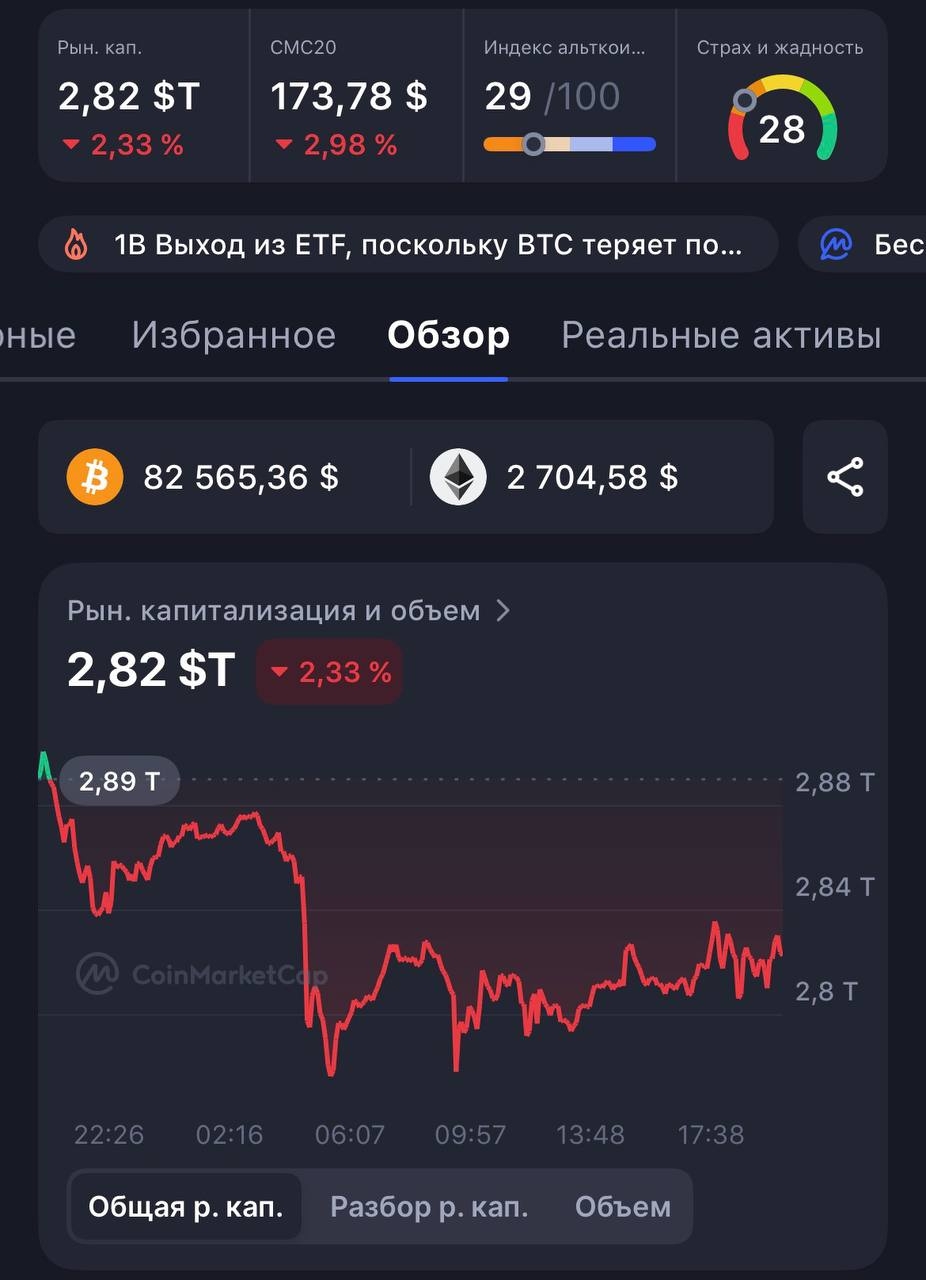

The market finished the week deep in the red zone:

• Bitcoin: fell to $82,293, losing about 5.7% in a day and reaching lows not seen since November 2025.

• Ethereum: Decreased to $2,720, losing ~6.45% in 24 hours and breaking the psychological mark of $3,000.

• Market capitalization: decreased by 4.7% in a day, losing almost $100 billion.

• Altcoins: All major altcoins, including Solana, XRP, and Dogecoin, showed similar losses following the leaders. The only notable exception in the top 100 was the Canton token, which increased by 3.35%.

🏛Unique Macroeconomic Indicators

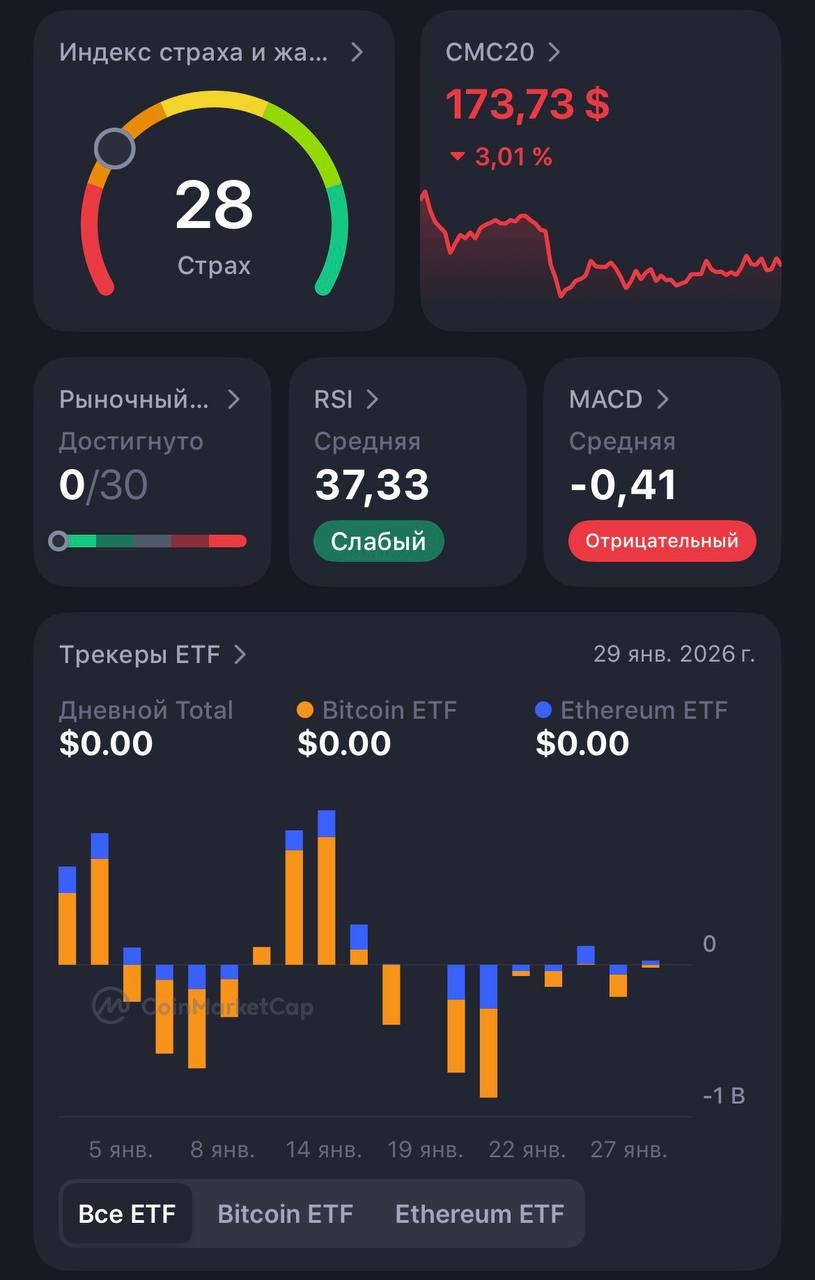

1. Massive unwinding of leverage: Positions worth ~$1.8 billion were liquidated in a day, with ~93% of them being longs. This indicates that the market was overheated and over-leveraged.

2. Institutional outflow: The third day of net outflows from American spot Bitcoin ETFs was recorded (around $818 million), depriving the market of key support.

3. Whale behavior: Major players, including Binance, have shifted to protection mode, announcing the purchase of BTC for their insurance funds, which, however, did not stop the decline.

4. Connection with raw materials: The fall of precious metals, especially silver, which dropped by ~12.7% in a day, exacerbated the overall negative dynamics in the markets for alternative assets.

💎Market Insights

Technically, Bitcoin is once again testing the critically important support zone of $80,000. If this level does not hold, analysts are considering the scenario of further decline to around $75,000. It is important to understand that the current crisis is a classic unwinding of leverage. The market is shedding excess credit risk accumulated during the rally.