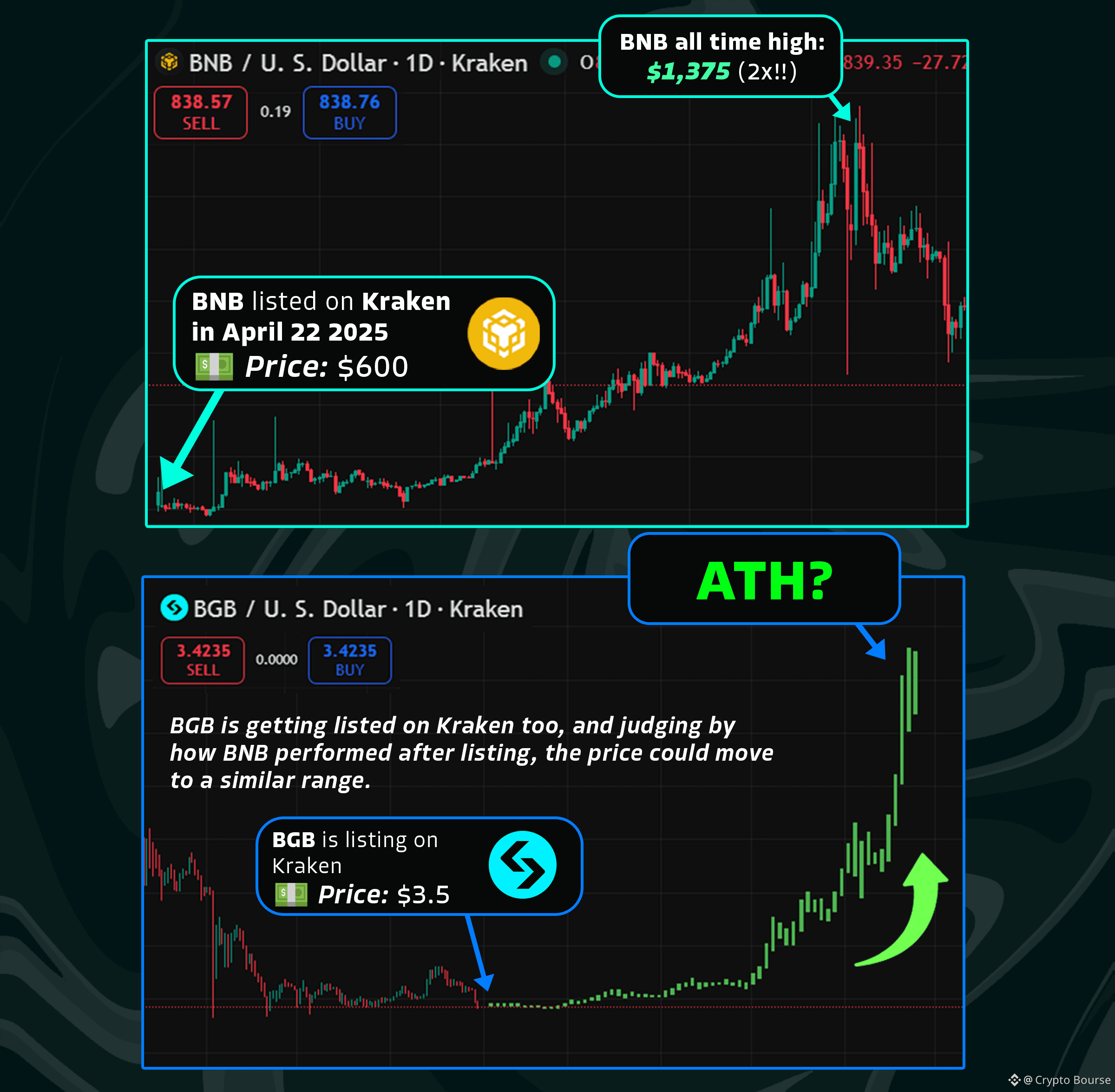

Kraken listing BGB brings back memories of when BNB was listed on Kraken in April 2025.

At the time, $BNB ’s inclusion on Kraken did not represent a price guarantee, but it marked an important moment in terms of accessibility and market visibility. Kraken, much like #binanceus , is known for its cautious approach to listings, particularly for assets made available to U.S.-oriented and compliance-sensitive users. Assets listed there usually meet higher expectations around utility, liquidity structure, and ecosystem maturity.

In that context, Kraken now listing BGB raises an interesting comparison. While BGB and BNB operate within different ecosystems, the parallel lies in how major exchange listings can broaden exposure and shift market perception, rather than immediately impacting price behavior.

From a market structure perspective, such listings often function as distribution and visibility events. They tend to expand accessibility first, while liquidity dynamics and adoption narratives evolve over time.

Rather than focusing on short-term outcomes, the more relevant question is how listings on selective platforms like Kraken contribute to long-term positioning within the broader digital asset landscape.

Do you think major exchange listings today still play a meaningful role in shaping an asset’s market perception, or has the market become largely indifferent to them?