Last December, I ambushed a project called Heima on Binance Alpha. I invested 5000 USDT, and on the launch day, it peaked at 18000 USDT, more than triple the profit, which I bragged about in the group for a month. But old Li next door wasn't so lucky—he jumped into the NYC token, the one issued by the former mayor of New York, and it dropped from 0.70 dollars all the way down to 0.10 dollars, leaving him with only 20000 from an initial 150000.

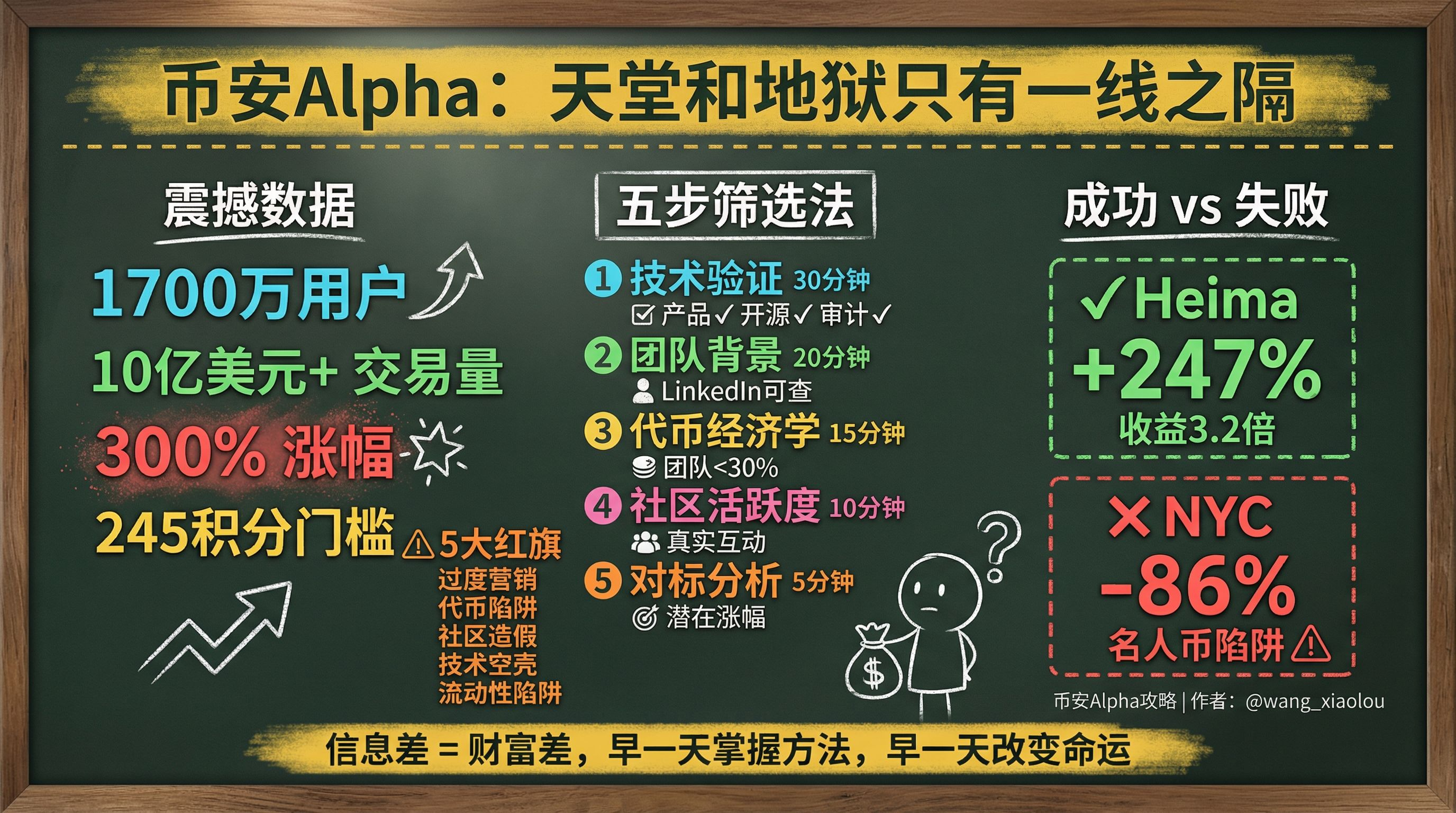

This is the harsh reality of Binance Alpha: heaven and hell are only a line apart. But if you master the right methods, Alpha is the best wealth-making opportunity in 2026. Today, I will share my complete strategy with you without reservation.

Shocking data: Just how popular is Alpha?

First, look at a few heart-pounding numbers:

17 million users: The number of users attracted after Binance Alpha 2.0 went live, equivalent to the population of a medium-sized country

$1 billion+: Cumulative trading volume, indicating this is not a trivial matter

300% increase: Average increase within 24 hours of quality projects going live (of course, there are also those that drop 90%)

782 million tokens: Total amount of rewards distributed, real money being issued

245 points threshold: The latest airdrop receipt threshold (Sport.Fun project)

More importantly, Binance Alpha has become the "Huangpu Military Academy" for early projects in 2026. The projects launched here are far more likely to be listed on Binance's spot market later than those on other platforms. What does this mean? Early participation = running ahead of the entire market.

Real cases: Success and failure are both wealth

Successful case 1: Heima - A perfect Alpha demonstration

Launch time: May 2025

Initial price: About $0.15

Highest in 24 hours: $0.52 (increase of 247%)

My operation: Received 300 tokens from airdrop, bought 1,000 at launch, sold in batches within 24 hours, total profit 3.2 times

Reasons for success:

The project has a real product (DeFi aggregator)

Team background can be verified (multiple successful project experiences)

Community activity is high (Telegram 50,000+ real users)

Token economics are reasonable (no large unlocks)

Successful case 2: DOOD - A feast for airdrop hunters

Airdrop quantity: 298 million tokens (distributed to Alpha point holders)

Launch performance: First-day trading volume $4.86 million → $35.38 million

Strategy: Immediately sell 50% of the airdrop received, hold the remaining 50% for a rise

Failure case: NYC - The trap of celebrity coins

Background: Former New York City Mayor Eric Adams issued

Initial price: $0.70

Crash price: $0.10 (drop of 86%)

Problem:

Liquidity extraction mechanism is opaque (2.43 million - 3.4 million dollars mysteriously disappeared)

Token economics are unreasonable (a large number of tokens concentrated in a few addresses)

Lack of practical applications (pure celebrity effect)

Lesson: Celebrity endorsement ≠ trustworthy project. Technology and economic model are fundamental.

Complete guide to Alpha points: From 0 to 245+

Many people ask me: "What if I don’t have Alpha points?" Don’t worry, here is the complete guide to earning points.

Method 1: Daily tasks (stable but slow)

Daily check-in: 1-3 points/day

Complete transactions: Earn points based on trading volume

Invite friends: Earn 5-10 points for each successful invitation

Participate in activities: Binance periodically holds point doubling events

Estimated time: It takes about 2-3 months to reach 0 to 245 points

Method 2: Trading surge (fast but requires capital)

On Binance spot/contract trading

The larger the trading volume, the more points earned

Tip: Choose coins with high trading fee rebates to lower costs

Estimated time: Large funds can reach the standard in 1-2 weeks

Method 3: Participate in early Alpha projects (fight to earn)

Each time an airdrop is received, 15 points are consumed

But if the project performs well, the profits from selling can be used to buy points again

Form a positive cycle

My suggestion:

Newbies: First use Method 1 to accumulate to 100 points, then combine with Method 3

Veterans: Directly Method 2 + Method 3, quickly get into the rhythm

Whales: One-time jump to 500+ points to ensure no opportunity is missed

Airdrop receipt practical action: Step-by-step guide

Taking the recent Sport.Fun (FUN) project as an example:

Step 1: Check eligibility (24 hours before launch)

Open Binance App → Wallet → Alpha points

Confirm points ≥ 245 (this project's threshold)

If not enough, hurry up and supplement (but time it well, as points have a delay in arrival)

Step 2: Claim on time (launch moment)

Project launch time: January 15, 2026, 14:00 UTC

Enter the Alpha activity page 5 minutes early

Click "Claim Airdrop" at exactly 14:00

The system will deduct 15 points and distribute 300 FUN tokens

Notes:

First come, first served! Points are enough but being slow won't get you any

Must confirm within 24 hours after receipt, otherwise deemed to be forfeited

After confirmation, the tokens will enter your spot wallet

Step 3: Decision moment (within 1 hour after receipt)

This is the most critical moment, you have three choices:

Choose A: Sell all immediately (conservative strategy)

Suitable for: Risk-averse individuals or those unfamiliar with the project

Advantages: Cashing out ensures no regrets regardless of future price fluctuations

Disadvantages: Might miss out on future gains

Choose B: Sell 50%, hold 50% (balanced strategy)

Suitable for: Most people

Advantages: Recoup costs while retaining room for appreciation

Disadvantages: If the project goes to zero, you will still lose 50%

Choose C: Hold all (aggressive strategy)

Suitable for: Those who have deeply researched the project and are confident in its long-term value

Advantages: Maximized returns

Disadvantages: Highest risk, potential to go to zero

My operation:

90% of projects choose B (sell 50% hold 50%)

10% of quality projects choose C (hold all)

Never choose A (because I will filter in advance, I won't claim if I don't have a good outlook)

Five-step screening method: How to identify 100x projects

On Alpha, new projects are launched every week. How do you find the gems among many projects? My method is:

Step 1: Technical validation (30 minutes)

Does the project have a real product? (Try it on the official website)

Is the code open source? (Check commit history on GitHub)

Is there an audit report? (CertiK, SlowMist, etc.)

Red flag: Projects without products, non-open source, and unaudited should be passed directly

Step 2: Team background investigation (20 minutes)

Can team members' LinkedIn profiles be checked?

Is there any experience with successful projects?

Is it a full-time commitment? (Part-time teams are unreliable)

Red flag: Avoid anonymous teams, inexperienced, and part-time projects

Step 3: Token economics analysis (15 minutes)

What is the total supply? (Too much can easily lead to inflation)

Is the allocation ratio reasonable? (Team share > 30% should be cautious)

Is there a large unlock? (Unlocking > 20% within 3 months after launch is dangerous)

How is liquidity? (Initial liquidity < $500,000 is easily manipulated)

Red flag: Team's share is too high, large short-term unlocks, insufficient liquidity

Fourth step: Community activity detection (10 minutes)

Telegram/Discord real user count (exclude bots)

Social media interaction rate (not follower count, but interaction count)

Community sentiment (extreme enthusiasm or lethargy is bad)

Recommended tools:

Social Blade: Detect the authenticity of social media data

Telegram Analytics: Analyze group activity levels

Fifth step: Benchmark analysis (5 minutes)

Which project does this project benchmark against? (Uniswap? Aave? Or a completely new track?)

What is the market cap of the benchmark project?

If it reaches 10% of the benchmark project's market cap, what is the price increase?

For example:

Sport.Fun benchmarks Chiliz (CHZ), market cap approximately $1 billion

If Sport.Fun reaches 10% of CHZ's market cap = $100 million

Assuming FUN's initial market cap is $10 million, potential increase = 10 times

Timeline strategy: Complete tactics before, during, and after launch

72 hours before launch: Information gathering

Join the project's official community (Telegram/Discord)

Study the white paper and economic model

Check the team's AMA (Q&A session)

Run the five-step screening method

Decide whether to participate

24 hours before launch: Ready

Confirm sufficient Alpha points

Set an alarm (5 minutes early)

Prepare trading funds (if you plan to buy when the market opens)

Develop a selling strategy (set target price and stop-loss price)

Launch moment: Quick execution

Claim the airdrop on time (be quick!)

Monitor the opening price (there is usually a sharp fluctuation for 3-5 minutes)

If planning to buy, enter after fluctuations stabilize

Execute the predetermined selling strategy (don’t be greedy)

1-3 hours after launch: Critical window

This is the period of greatest volatility

Monitor trading volume changes (volume-price coordination is healthy)

Pay attention to community sentiment (beware of large amounts of FUD)

If holding, set take profit and stop loss

24 hours to 7 days after launch: Observation period

Most airdrop hunters will sell during this period

Prices may retrace 30-50%

If the fundamentals have not changed, a retracement is an opportunity to increase holdings

If negative news appears, decisively exit

1 month after launch +: Long-term holding

Only 10% of projects are worth holding long-term

Keep track of project progress (product updates, partners)

Regularly reassess (once a month)

Set a trailing stop loss (protect profits)

Pitfall guide: These red flags should be avoided

Red flag 1: Over-marketing

Every day shout "100x" "moon" "financial freedom"

Invite a bunch of influencers to endorse

Promise unrealistic returns

Case study: NYC token is a typical example, celebrity effect + over-promotion, resulting in a crash

Red flag 2: Token economics trap

Team holds >50% of tokens

Immediately unlock a large number of tokens after launch

No lock-up mechanism

Red flag 3: Community fraud

Telegram group has 50,000 people but no one speaks

Twitter has 100,000 followers but interactions are only in the dozens

The comments are full of template replies like "great project"

Red flag 4: Technical shell

White papers plagiarizing other projects

GitHub code hasn’t been updated for months

Product Demo is obviously photoshopped

Red flag 5: Liquidity trap

Initial liquidity < $100,000

Liquidity is not locked

Developers can withdraw the pool at any time

Risk management: Preserving life is more important than making money

Capital allocation principles:

Alpha projects should occupy no more than 10-20% of total funds

No single project should exceed 5% of total funds

Always keep 50% cash on hand to seize opportunities

Stop-loss discipline:

Projects bought at launch should stop-loss at 15% below the buying price

Projects received from airdrops should stop-loss at 50% below the price when received

Projects held long-term should stop-loss at 60% below historical highs

Mindset management:

Don't FOMO (missing out is missing out, opportunities will always be there)

Don't be greedy (if you’ve made 50%, consider taking profits)

Don't engage in revenge trading (trying to recoup losses is the most dangerous)

2026 Alpha project calendar (continuously updated)

Launched (historical performance can be researched):

Sport.Fun (FUN): Sports fan token platform

RollX (ROLL): Layer 2 solution

Heima: DeFi aggregator

DOOD: Social token

Upcoming launch (focus on):

Follow Binance Alpha's official announcements

Join the Alpha Hunters community (I will share first-hand news)

Set push notifications

Interaction time: Your Alpha story

Vote: What has your experience been on Alpha?

A. Made money! Share your success stories (amount and project)

B. Lost money... Tell us what pitfalls you encountered

C. Haven't participated yet, but eager to try

D. Observing, worried about risks being too high

Comment area collection:

Share your Alpha pitfalls experience to help more people avoid them! The top 3 most liked stories will receive (Alpha pitfall complete manual) PDF, including:

50 real failure case analyses

Avoidance methods for each case

Alpha project scoring table (directly applicable)

Show-off activity:

Post your Alpha profit screenshot in the comments (sensitive information can be blurred), the top 10 selected will receive an Alpha points recharge code!

Take immediate action: Seize the biggest opportunity of 2026

Newcomers three steps:

Go to Binance App now to activate Alpha features

Start accumulating Alpha points (daily check-ins)

Join the Alpha project research group (my Telegram: @AlphaHunters2026)

Advanced users:

Establish your own Alpha project scoring system

Form a small team for division of labor research (more efficient)

Participate in early project testing (some projects will give testers extra rewards)

Toolkit download:

Follow my account and reply "Alpha Toolkit" to get:

Alpha project scoring table (Excel template)

Token economics analysis tools

Community activity detection script

My personal operation record (throughout 2025)

Final advice

Binance Alpha is the best wealth creation opportunity in 2026, but also the easiest place to lose money. Remember these points:

Never invest more than you can afford to lose

DYOR (Do Your Own Research) is a hard rule

Don’t FOMO just because others are making money

Setting stop losses is more important than setting take profits

Keep learning, the market is evolving, and you need to evolve too

In 2025, I made 500,000 on Alpha but lost 150,000 as well. This market doesn’t believe in tears, only in strength and discipline. Are you ready?

If this article helped you, please like + share + follow. I will continue to share practical Alpha experiences to help more people achieve financial freedom in 2026.

Remember: In the world of Alpha, information disparity = wealth disparity. Mastering the methods a day earlier can change your fate.

Disclaimer: This article is for educational and informational sharing only and does not constitute investment advice. Cryptocurrency investment carries high risks, especially Alpha projects. Please make decisions based on your own risk tolerance and do not invest more than you can afford to lose. Past performance does not guarantee future results.